A Fidelity analyst has cautioned that a significant increase in money supply is crucial for Bitcoin and gold to prove their worth as hedges against inflation.

Sustained Money Supply Growth

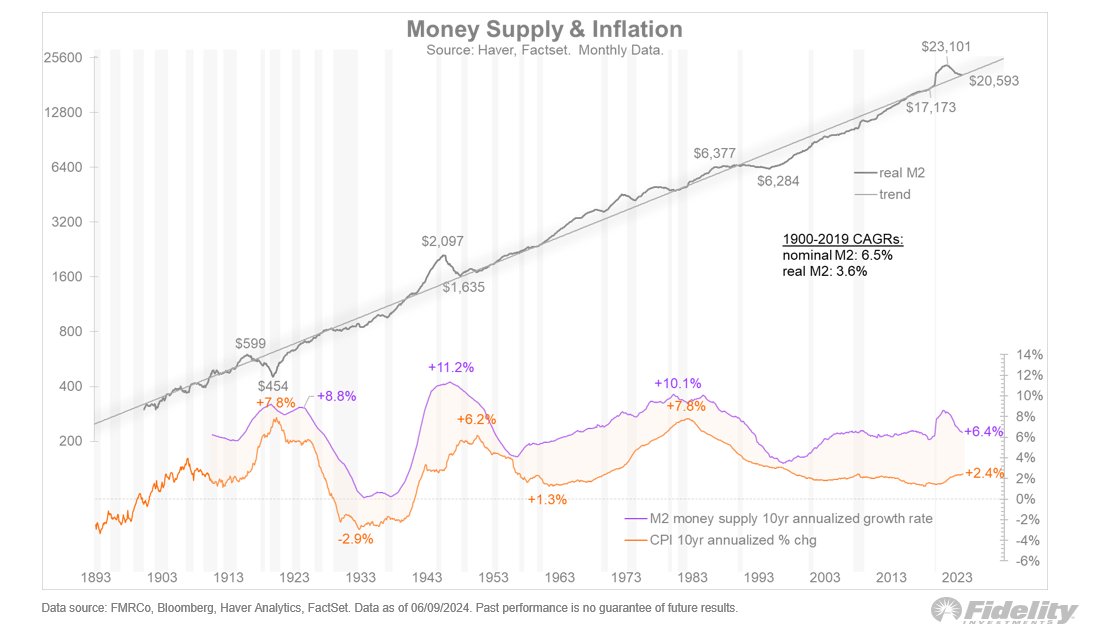

Jurrien Timmer, Fidelity’s global macro director, believes that sustained increases in money supply typically lead to inflation. This supports the idea that gold and Bitcoin can protect against the devaluation of fiat currencies.

Current Market Conditions

Timmer notes that the recent surge in money supply during the pandemic has subsided due to the Federal Reserve’s restrictive policies. This suggests that gold and Bitcoin are currently speculative assets rather than established hedges against inflation.

M2 Money Supply

M2 is a measure of money supply that includes cash, checking accounts, and other easily convertible deposits.

Bitcoin Price

At the time of writing, Bitcoin is trading at $68,435, down approximately 4% over the past week.