Admission Criteria

The London Stock Exchange (LSE) will start accepting applications for Bitcoin and Ethereum Exchange Traded Notes (ETNs) in Q2 2024. These ETNs will:

- Track the performance of Bitcoin and Ethereum during London trading hours.

- Be physically backed by the underlying crypto assets.

- Not be leveraged (no borrowing).

- Require the underlying crypto assets to have a reliable market price.

- Be held in cold storage or under equivalent security measures.

Regulatory Oversight

The LSE will review all applications carefully and has the right to refuse any that do not meet its standards. This move aligns with the UK Financial Conduct Authority’s (FCA) ban on selling crypto derivatives and ETNs to retail investors.

Professional Investors Only

These ETNs are designed for professional investors only. Issuers are encouraged to contact the LSE early on to facilitate the admission process.

Market Impact

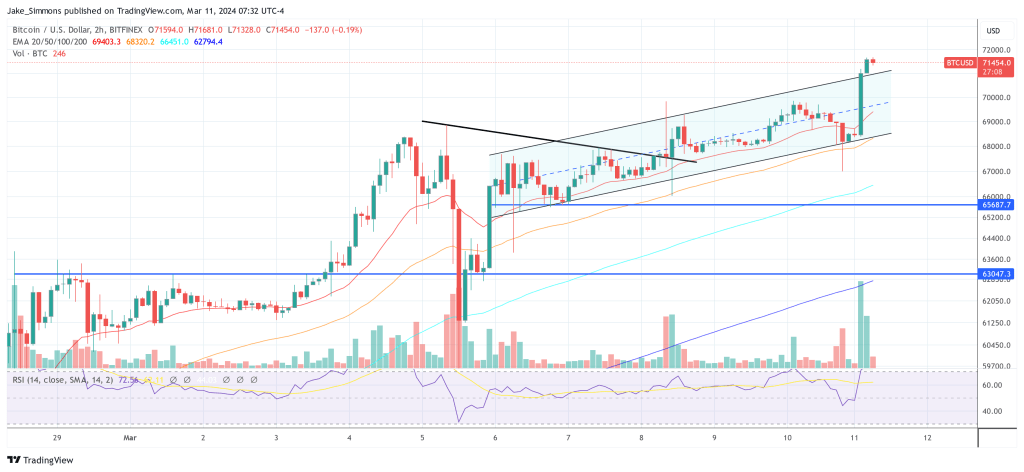

The LSE’s decision has been met with positive sentiment in the crypto market, with Bitcoin’s price rising above $71,000 shortly after the news was announced.