Bitcoin spot ETFs are having a moment! For the third week in a row, they saw massive inflows of cash. This positive trend is also reflected in the Ethereum ETF market.

Bitcoin ETFs: Billions Flowing In

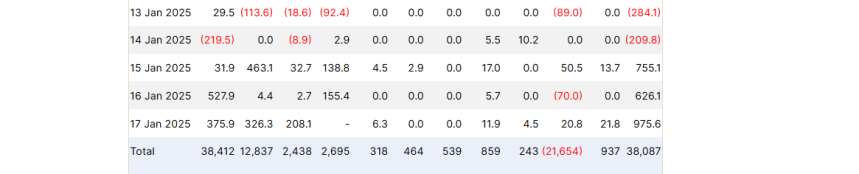

The week ending [Date – this needs to be added] saw a whopping $1.862 billion poured into Bitcoin spot ETFs. This brings the total for 2025 to a staggering $2.42 billion. It wasn’t all smooth sailing though. The week started with a $493.9 million outflow due to a brief Bitcoin price crash below $90,000. But things quickly turned around, with a massive $2.35 billion inflow in the following days as Bitcoin prices recovered.

Top Performers:

- BlackRock’s IBIT: Leading the pack with $745.7 million in inflows. It’s the biggest player in the market, holding $38.41 billion in cumulative inflows and $59.28 billion in net assets – almost half the total market share!

- Fidelity’s FBTC:

A strong second place with $680.2 million.

A strong second place with $680.2 million. - Bitwise’s BITB and Ark’s ARKB: Also saw significant inflows, totaling $216 million and $204.7 million respectively.

Other ETFs like Invesco’s BTCO, Grayscale’s BTC, WisdomTree’s BTCW, VanEck’s HODL, and Franklin Templeton’s EZBC saw smaller inflows. Grayscale’s GBTC was the only ETF to see an outflow ($87.7 million), and Valkyrie’s BRRR saw zero net flow.

Ethereum ETFs Join the Party

Ethereum ETFs also had a good week, recording $212 million in net inflows. This marks a turnaround after a slow start to 2025. BlackRock’s ETHA was the star performer, bringing in $151.3 million. Ethereum ETFs now hold a total of $12.66 billion in net assets.

Current Market Prices

As of [Date – this needs to be added], Bitcoin is trading at $104,837, and Ethereum is at $3,297.