Big money is leaving Bitcoin and Ethereum exchange-traded funds (ETFs). Let’s look at what’s happening.

Bitcoin ETFs See Massive Withdrawals

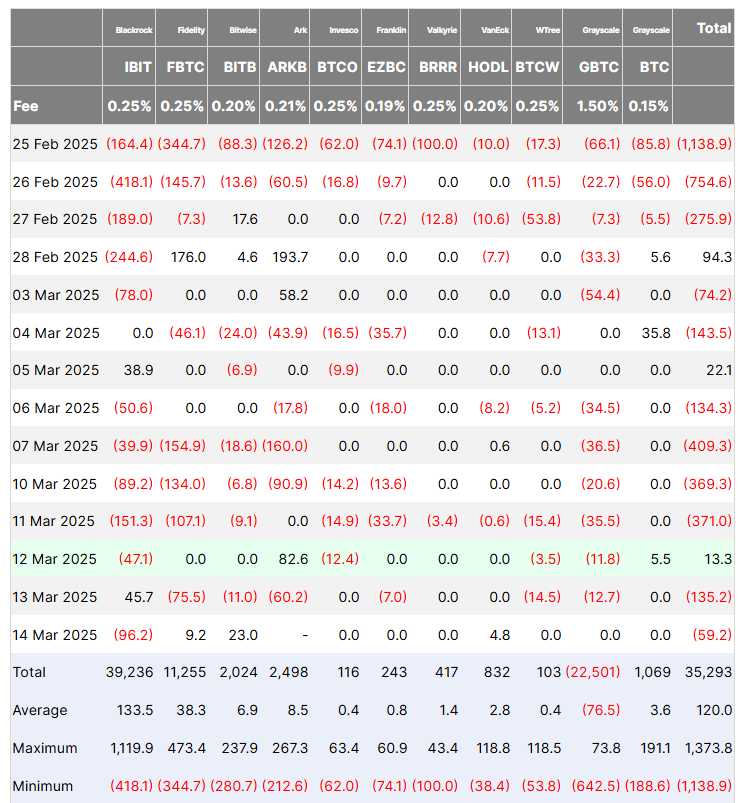

For the fifth week in a row, investors pulled a huge amount of money out of Bitcoin ETFs – over $900 million! This shows a lack of confidence from institutional investors. After a strong start to the year with over $5 billion in investments, things have taken a sharp turn. In total, about $5.4 billion has been withdrawn over the past five weeks.

Who Pulled Out?

BlackRock’s IBIT ETF took the biggest hit, with $338.1 million in outflows. Fidelity’s FBTC wasn’t far behind, losing $307.4 million. Other ETFs like Ark’s ARKB, Invesco’s BTCO, Franklin Templeton’s EZBC, WisdomTree’s BTCW, and Grayscale’s GBTC also saw significant outflows (between $33 million and $81 million). A few, like Bitwise’s BITB, Valkyrie’s BRRR, and VanEck’s HODL, saw only small withdrawals. Interestingly, Grayscale’s BTC was the only one with net inflows – a small $5.5 million.

This mass exodus is likely due to Bitcoin’s recent price drop of about 12% over the past month. The total assets in Bitcoin Spot ETFs are down 21.70% to $89.89 billion.

Ethereum ETFs Follow Suit

Ethereum ETFs aren’t doing much better. They also saw significant outflows – $190 million last week, marking the third week in a row of withdrawals. This adds up to $645.08 million in outflows over the past three weeks.

BlackRock’s ETHA ETF had the largest withdrawals at $63.3 million. Currently, Ethereum ETFs have seen a total of $2.52 billion in inflows, with total net assets at $6.72 billion (a small percentage of the overall ETH market).

Current Market Conditions

At the time of writing, Ethereum is trading at $1,924, slightly up for the day. Bitcoin is at $84,009, with little daily price change.