Investor Luke Gromen, a prominent macro analyst, argues that the US might need to seriously consider Bitcoin as a neutral reserve asset. He believes the US faces a national security crisis following events in Ukraine, suggesting a shift away from the current fiat currency system is necessary.

The Dollar’s Weakness and the Rise of Bitcoin

Gromen claims the US dollar system’s weaknesses led to the decline of American manufacturing, hindering the country’s ability to produce defense materials. He suggests that the defense and intelligence communities now see Bitcoin as a way to revitalize domestic industries. This involves devaluing the dollar and using Bitcoin to support the Treasury market.

Political and Economic Shifts

Gromen points to various statements from politicians and the Treasury Department as evidence of a potential shift towards Bitcoin. He cites examples such as discussions about using stablecoins to manage T-bills and even mentions of Bitcoin as “the new oil” by former President Trump. He predicts a massive increase in Bitcoin’s market capitalization, similar to the oil price surge in 1973.

Bitcoin as a Solution

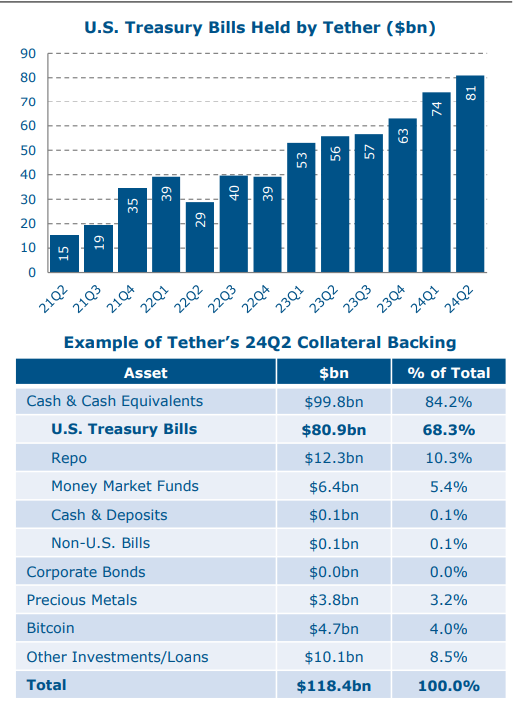

Gromen believes that making Bitcoin a neutral reserve asset would allow the US to rebuild its industries for national defense without causing widespread economic hardship for its citizens. He highlights a Treasury Borrowing Advisory Committee report showing a correlation between the market cap of cryptocurrencies and stablecoin purchases of T-bills. He argues that Bitcoin’s growth is not a threat, but rather a necessity to maintain financial stability and support the re-establishment of domestic industries.

The Bottom Line

Gromen’s argument centers on the idea that Bitcoin’s rise isn’t just a financial phenomenon, but a potential solution to critical national security and economic challenges. He believes that a strategic shift towards Bitcoin could revitalize American industry and bolster the nation’s economic standing.

(Note: At the time of writing, Bitcoin was trading at $105,063.)/p>