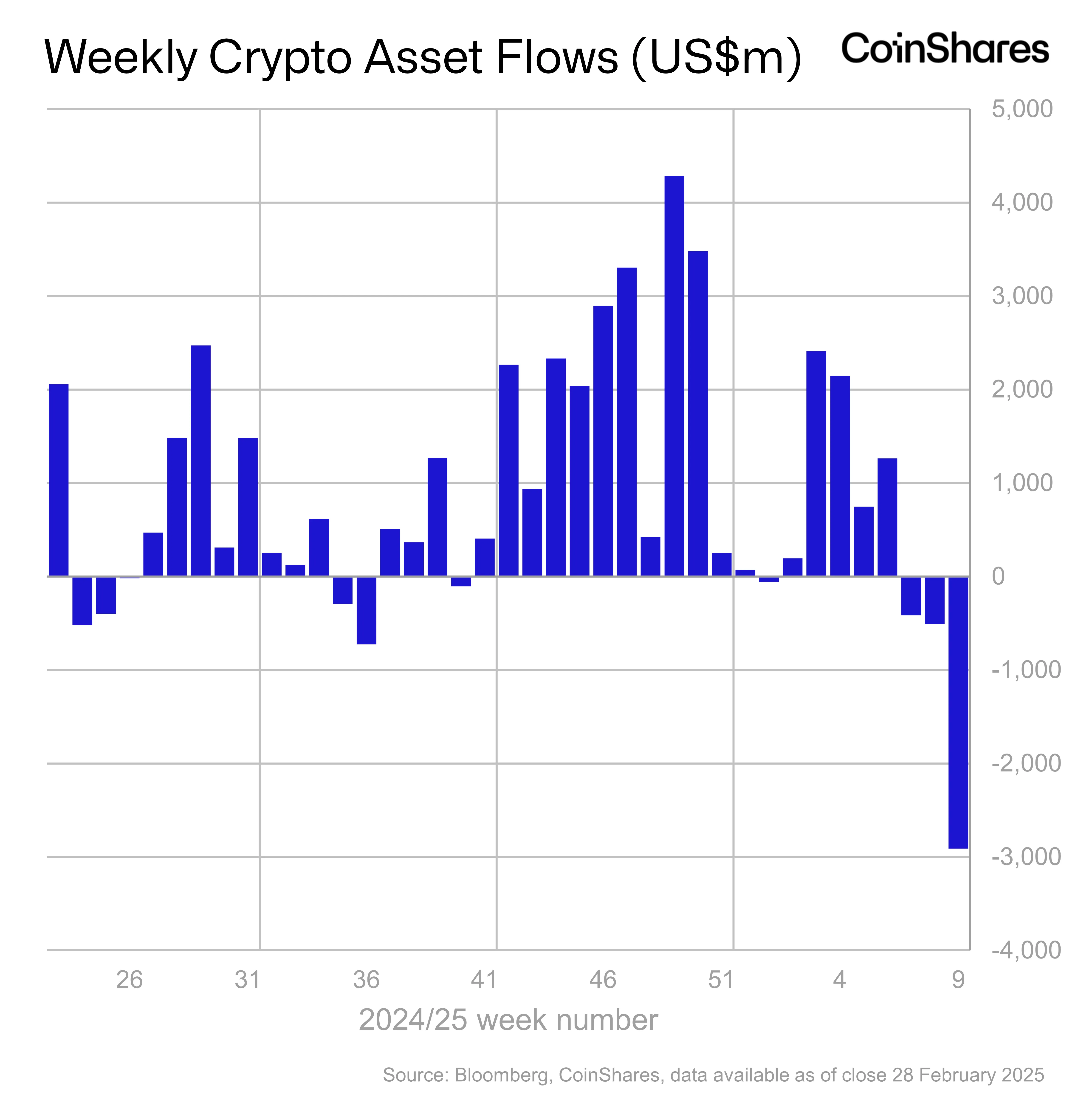

Institutional investors pulled a record amount of money out of cryptocurrency investment products last week, according to CoinShares. The outflow totalled a staggering $2.9 billion, marking the third consecutive week of withdrawals and the largest single-week drop ever recorded. Over the past three weeks, a total of $3.8 billion has flowed out.

What Caused the Crypto Crash?

CoinShares points to several factors contributing to this massive sell-off:

- The Bybit hack: A recent security breach at the cryptocurrency exchange Bybit likely shook investor confidence.

- The Federal Reserve: A more hawkish stance from the Federal Reserve, suggesting continued interest rate hikes, generally hurts riskier assets like crypto.

- Profit-taking: After a 19-week period of inflows totaling $29 billion, some investors may have decided to cash in their profits.

Where Did the Money Go?

The US saw the biggest outflow, losing $2.87 billion. Switzerland and Canada also experienced significant outflows, while Germany was the exception, seeing an inflow of $55.3 million.

Bitcoin took the biggest hit, with outflows of $2.6 billion. Ethereum also suffered, recording a record weekly outflow of $300 million. Other altcoins like Solana and Ton also saw significant outflows.

However, not all cryptocurrencies suffered. Sui, XRP, and Litecoin saw inflows of $15.5 million, $5 million, and $1 million respectively.

The Bottom Line

The massive outflow highlights the volatility of the cryptocurrency market and the impact of macroeconomic factors and security concerns on investor sentiment. It’s a reminder that crypto investments are inherently risky.