Bitcoin ETFs are becoming more popular with big investors. In the second quarter of 2024, the number of institutional firms holding Bitcoin ETFs jumped by a whopping 27%! This means more and more big players like Goldman Sachs and Morgan Stanley are seeing Bitcoin as a good investment.

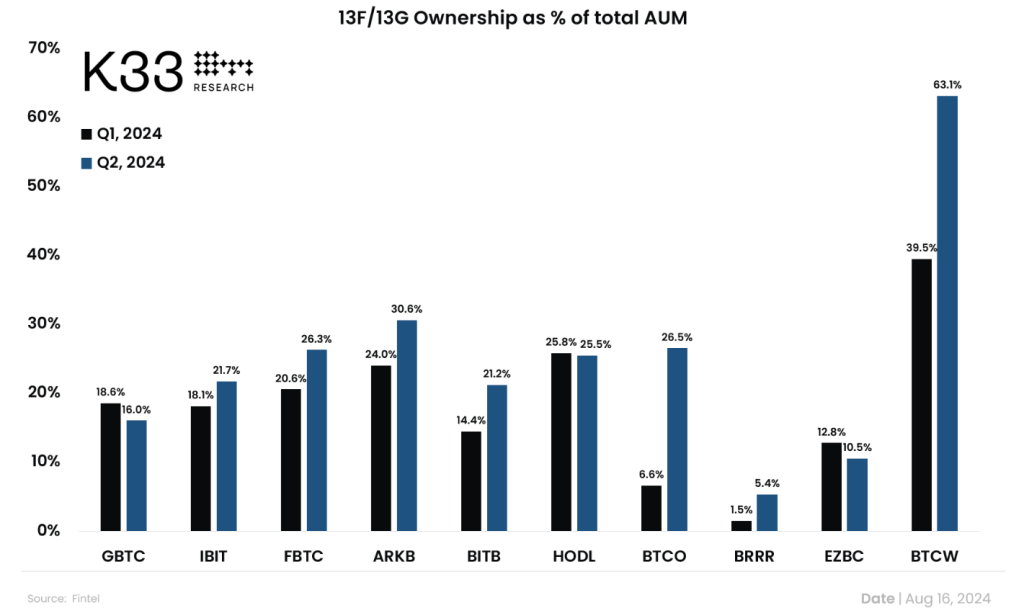

But retail investors still hold the majority of Bitcoin ETFs. While institutions are increasing their ownership, they still make up only about 21% of the total assets in Bitcoin ETFs.

Bitcoin’s price is lagging behind, even with growing institutional interest.

Despite the increase in big money flowing into Bitcoin ETFs, the price of Bitcoin has been stuck around $60,000. Analysts think this might be because of lower-than-average inflows into Bitcoin ETFs.

The future of Bitcoin might depend on institutional acceptance. The fact that over $4.7 billion flowed into Bitcoin ETFs in the second quarter shows that big financial firms are starting to see Bitcoin as a real asset class, not just a risky gamble.

If Bitcoin can break through the $60,000 resistance level, it could trigger a big price jump. Analysts are watching closely to see if Bitcoin can overcome the resistance levels at $61,700 and $59,000. If it does, it could lead to a lot of short-sellers being forced to buy back Bitcoin, which would push the price even higher.

The future of Bitcoin is uncertain, but the increasing institutional interest is a positive sign. The balance between retail and institutional investors will be key to Bitcoin’s future. If institutions continue to embrace Bitcoin, it could pave the way for wider acceptance of cryptocurrencies in traditional finance. /p>