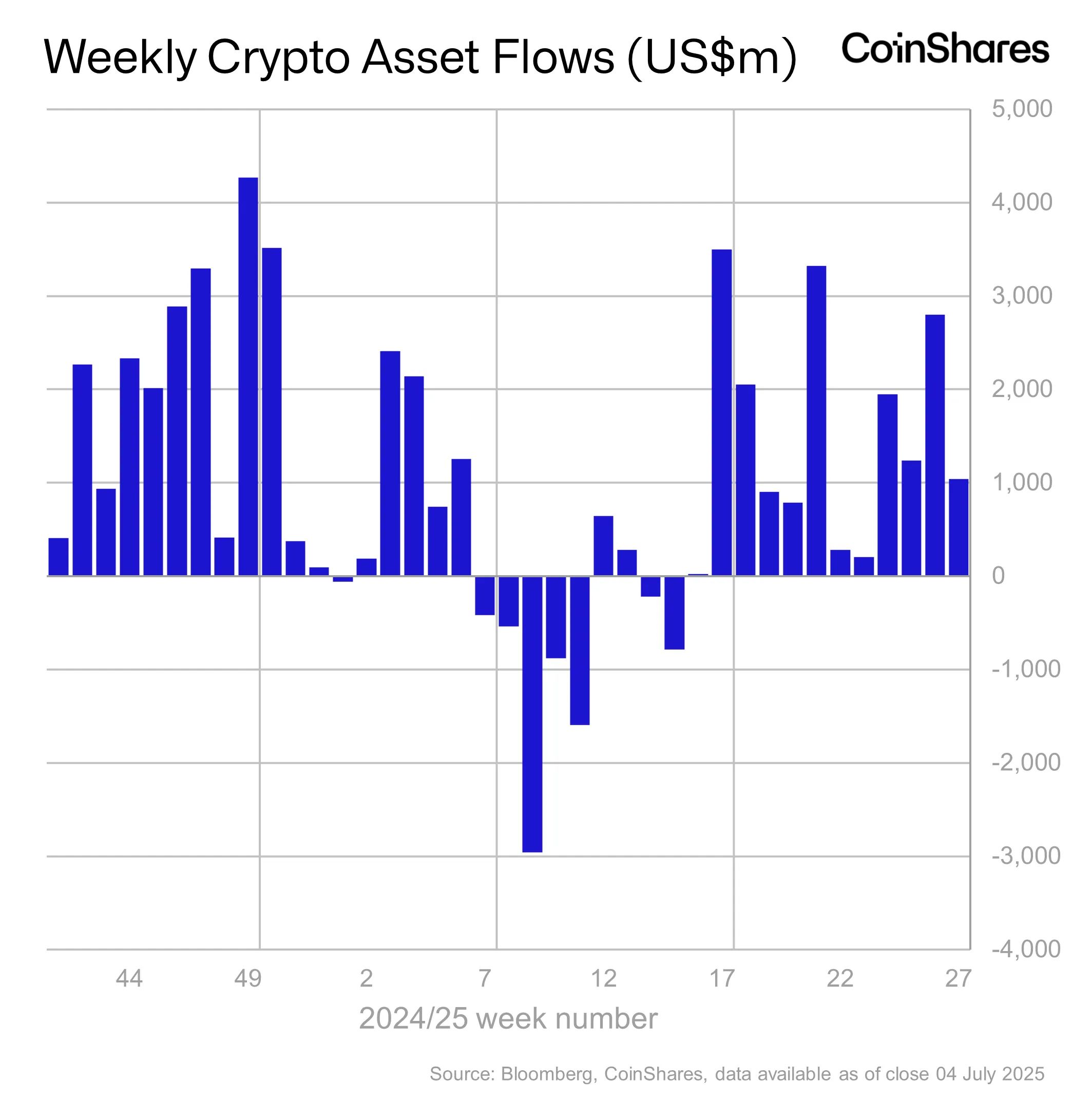

Institutional investors are piling into crypto, with over $18 billion flowing into digital asset investment products over the past 12 weeks, according to CoinShares. This massive influx has pushed total assets under management (AuM) to record highs.

A Billion-Dollar Week for Crypto

Last week alone saw $1.04 billion in inflows, marking the 12th straight week of positive investment. Trading volume also remained strong at $16.3 billion. The US led the way with $1 billion in inflows, while Switzerland and Germany also saw significant investment. Canada and Brazil, however, experienced outflows.

Bitcoin’s Slowdown, Ethereum’s Surge

While Bitcoin, the dominant cryptocurrency, saw substantial inflows of $790 million, this represents a slowdown compared to previous weeks. CoinShares suggests investors might be getting cautious as Bitcoin nears its all-time high.

In contrast, Ethereum (ETH) continues to shine. It’s been racking up inflows for 11 consecutive weeks, adding another $226 million last week. This performance is significantly outpacing other cryptocurrencies (altcoins). The report highlights that Ethereum’s weekly inflows are proportionally much higher than Bitcoin’s, suggesting a notable shift in investor sentiment.

Disclaimer: This information is for general knowledge and shouldn’t be considered investment advice. Always do your own research before investing in cryptocurrencies.

/p>