Ethereum’s price has been a rollercoaster lately. After failing to break past its December highs, it’s been a bit of a bumpy ride, leaving many wondering what’s next.

Whale Watching: A Billion-Dollar Buy-In

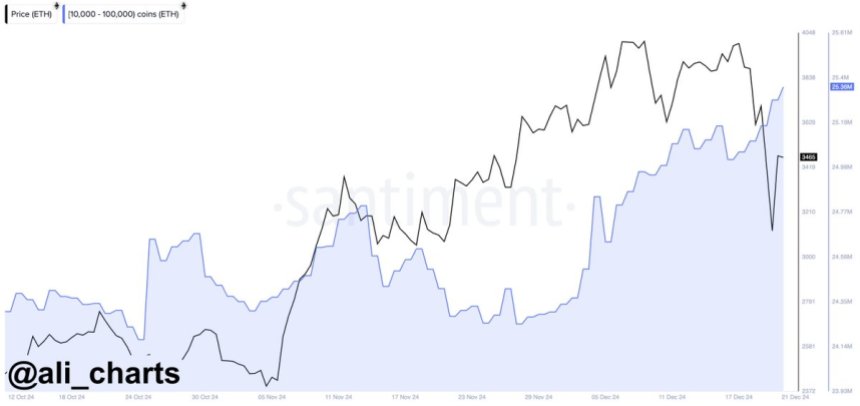

But here’s some interesting news: Big investors, known as “whales,” have been quietly scooping up massive amounts of ETH. According to analyst Ali Martinez, they’ve bought a whopping 340,000 ETH in just the last four days – that’s over a billion dollars!

This huge purchase suggests these whales believe Ethereum has a bright future, even if the short-term outlook is uncertain. Historically, this kind of buying spree often precedes a price surge. Why? Because increased demand and less available ETH usually push the price up.

Ethereum’s Resilience and the Road Ahead

Ethereum’s price has been up and down all year. Every attempt to rally has hit resistance, making it tough to maintain upward momentum. But even with the selling pressure, large holders keep buying, showing confidence in the long term.

Martinez’s data points to a significant trend: major players are betting big on Ethereum. This could mean a big price jump is coming. Many in the crypto community expect Ethereum to be a major player in the next altcoin boom.

Holding Strong: Key Support Levels

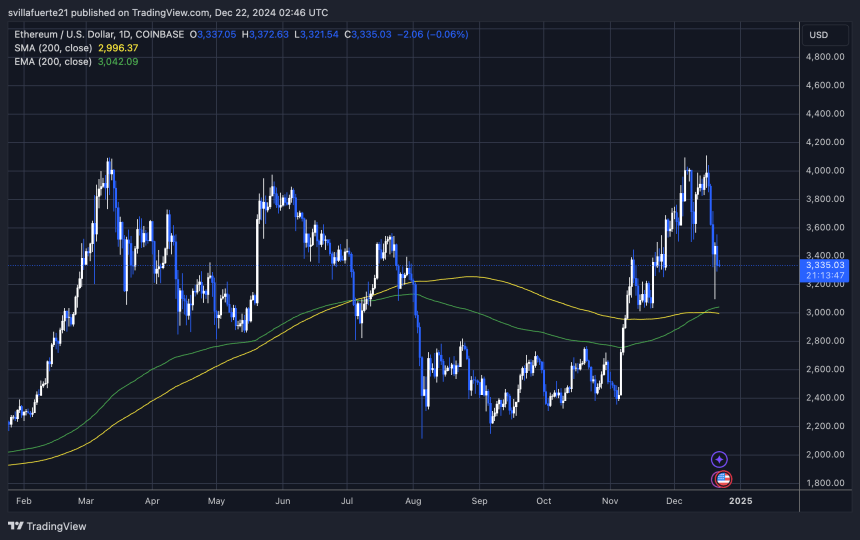

Right now, Ethereum is trading around $3,320. Importantly, it’s staying above the crucial 200-day moving average ($3,000), a key indicator of long-term strength. This is a good sign for bulls (those betting on higher prices).

To really gain momentum, Ethereum needs to break through the $3,550 resistance. If it does and stays above that level, we could see a significant price increase. However, a period of sideways movement (consolidation) is also possible before any major price action. Consolidation after a volatile period is normal; it lets the market settle before the next big move. Holding above $3,000 would solidify that level as strong support.