A major Ethereum investor, often called a “whale,” recently sold off 10,000 ETH after holding it for over two years. This could be a sign of things to come.

A Whale’s Big Sell-Off

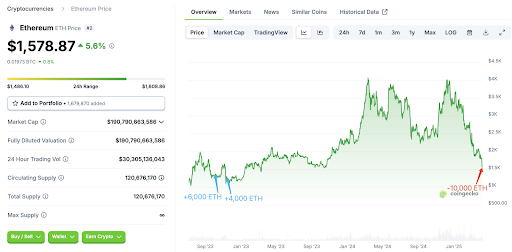

This whale initially bought the 10,000 ETH for about $12.95 million in late 2022. They held onto it even when Ethereum’s price surged past $4,000 earlier this year. But recently, with the price dipping below $1,500, they decided to sell, making a profit of around $2.75 million. That’s not bad, but they left a lot of potential profit on the table – their unrealized profit was much higher at its peak.

More Than Just One Whale

This wasn’t an isolated incident. Other big Ethereum investors have also been selling off large amounts of ETH recently, totaling over 500,000 coins in just 48 hours. This massive sell-off suggests a bearish outlook on the market.

The Blame Game: Tariffs and a Market Crash

The current crypto market downturn is partly blamed on trade tensions. Specifically, tariffs imposed by Donald Trump have fueled a trade war with China, causing widespread investor concern. This uncertainty is driving many investors, including these whales, to sell and reduce their risk.

Trump’s Company Also Selling?

Even Donald Trump’s company, World Liberty Financial (WLFI), which owns a significant amount of ETH, appears to be selling. They’ve reportedly sold off a chunk of their holdings at a loss, leaving them with a substantial unrealized loss on their remaining ETH.

What’s Next for Ethereum?

Crypto analysts are predicting further drops in the Ethereum price, possibly reaching as low as $1,200. Given the recent activity from large investors, this prediction seems plausible. The current price is hovering around $1,400, down significantly in the last 24 hours. This makes many wonder if now is the time to cash out their own ETH holdings.