Crypto analytics firm Santiment reports a massive Bitcoin sell-off.

Miners Cash Out

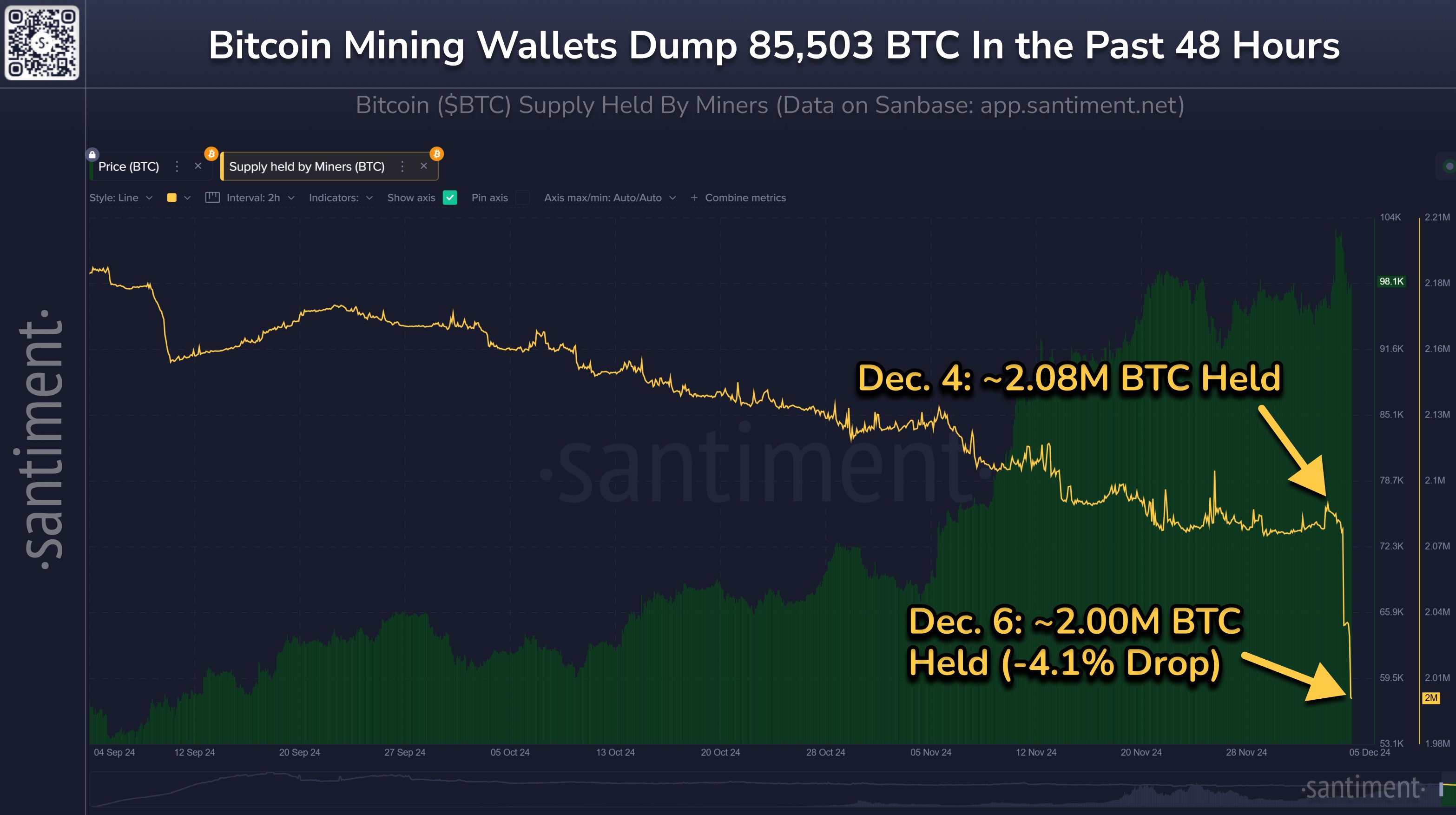

Over the past two days, Bitcoin miners sold off a whopping $8.55 billion worth of BTC. This is the biggest sell-off in the last 10 months, according to Santiment. While this is a significant amount, it’s important to note that this has been happening since April. This recent drop, however, is the most extreme since late February. Interestingly, the price of Bitcoin hasn’t directly followed this trend for most of the year.

Whales and Sharks Still Buying

Despite the miners’ massive sell-off, Santiment points out that other large Bitcoin investors (“whales” and “sharks”) are still accumulating BTC. This makes the overall situation appear somewhat neutral for now.

Bitcoin’s Price Tied to the Stock Market

Currently, Bitcoin’s price is closely mirroring the S&P 500. Santiment suggests that if Bitcoin breaks free from this correlation with the stock market, it could be a positive sign for Bitcoin’s future price. Historically, Bitcoin has performed better when its price isn’t so heavily influenced by traditional stock markets.

The Bottom Line

While a significant amount of Bitcoin was sold recently, the overall picture is complex. Large investors are still buying, and a decoupling from the stock market could be bullish for Bitcoin. As always, it’s crucial to do your own research before making any investment decisions.