Standard Chartered, a major global bank, has made a big move into the crypto world. They’ve become the first major bank to offer direct Bitcoin and Ethereum trading to its institutional clients. This is a huge step for crypto adoption by traditional finance.

A Giant Leap for Crypto

The bank announced the launch of its new spot trading service for Bitcoin and Ethereum. This means institutional clients can now buy and sell these cryptocurrencies directly through the bank, adding to their existing digital asset custody service. This is a significant event because Standard Chartered is a “globally systemically important bank” (G-SIB). G-SIBs are considered so crucial to the global economy that their failure could cause a major financial crisis. The fact that one is offering crypto trading shows how much mainstream acceptance crypto is gaining.

Standard Chartered’s Crypto Journey

Standard Chartered’s CEO, Bill Winters, sees digital assets as key to the future of finance, highlighting their potential for innovation and growth. This isn’t their first foray into crypto; they already have investments in companies offering crypto services. The new trading service integrates seamlessly with the bank’s existing infrastructure, letting clients trade Bitcoin and Ethereum using familiar systems. Clients can even choose where to store their crypto, including Standard Chartered’s own secure custody service. Tony Hall, the Global Head of Trading at Standard Chartered, emphasized the bank’s commitment to applying its expertise and robust risk management to the digital asset space.

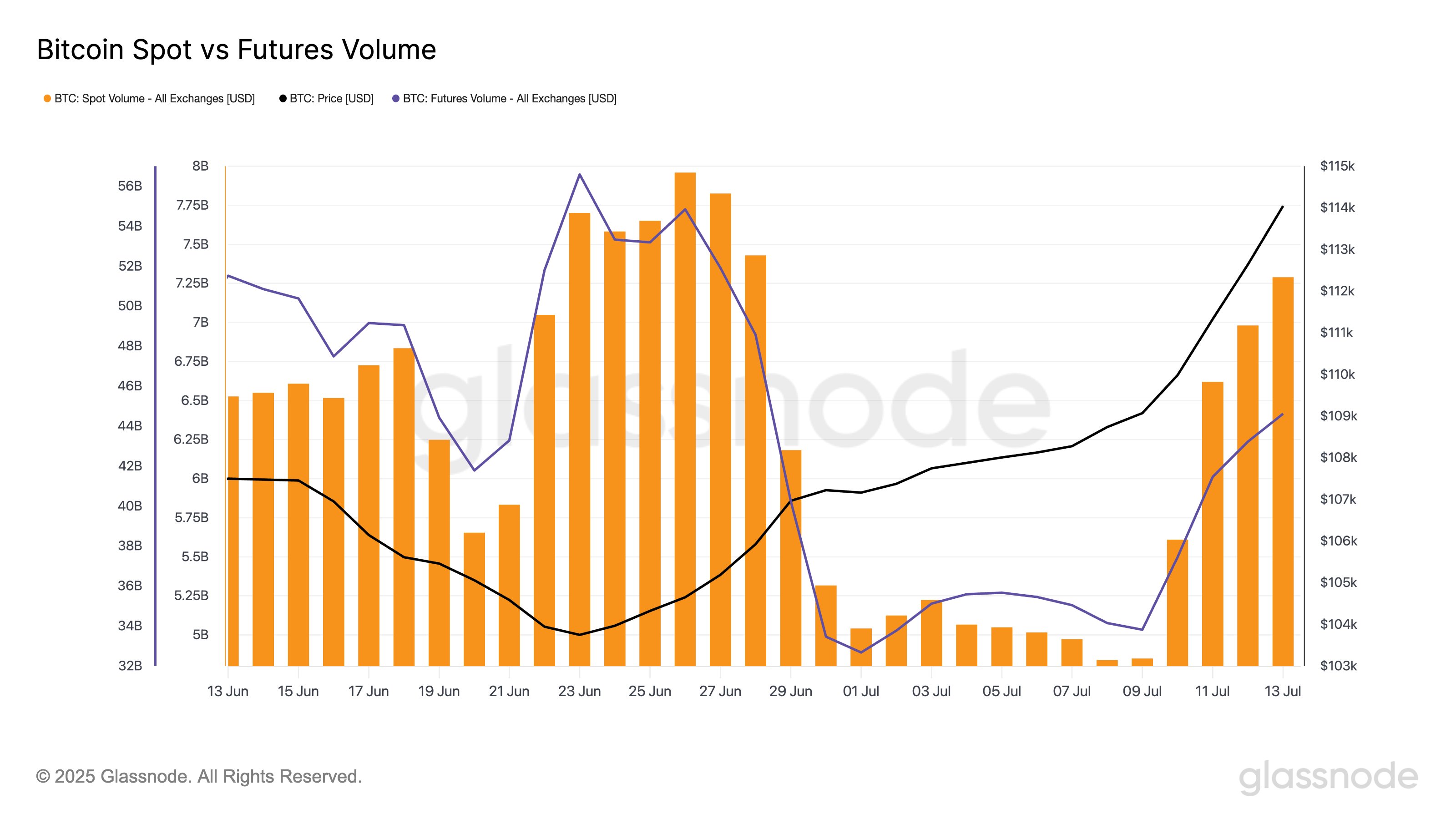

Bitcoin’s Recent Price Surge and Trading Activity

Interestingly, Bitcoin’s price has recently jumped, and trading volume has followed suit. Spot trading volume is up over 50% since early July, and futures volume is also up significantly. While this is a noticeable increase, overall trading activity is still relatively low compared to the average for the year.

Bitcoin’s Current Price

At the time of writing, Bitcoin is trading around $117,000, a significant increase from the previous week.