Cryptocurrency enthusiasts are always on the lookout for promising chances, especially during market downturns. Recently, the MVRV (market-value-to-realized-value) ratio has caught the attention of many, pointing out several cryptocurrencies that seem notably undervalued.

The Gems in the Shadows

The MVRV ratio, comparing a crypto’s market capitalization to its realized capitalization, gives us a glimpse of whether a crypto’s price is above or below its “fair value.” It’s like a weather vane for market profitability and potential turning points.

In simpler terms, when the market cap surpasses the realized cap, it might indicate high unrealized profits, hinting at a possible sell-off. On the flip side, a lower market cap relative to the realized cap could suggest undervaluation or weak demand.

Right now, various cryptocurrencies are flashing low MVRV values, suggesting potential undervaluation.

Spotting the Hidden Treasures

Here’s a lineup of cryptocurrencies that currently seem undervalued:

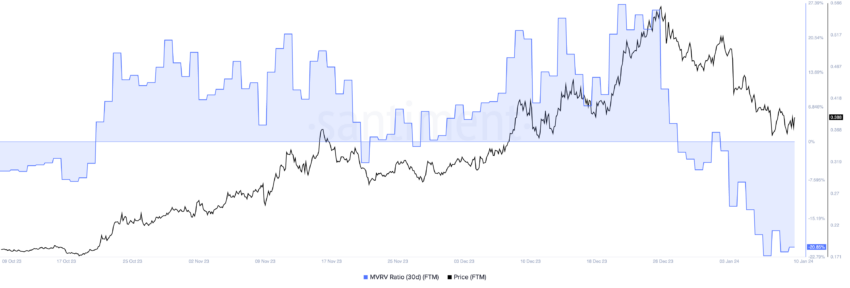

- Fantom (FTM) is rocking a 30-day MVRV of -22.78%.

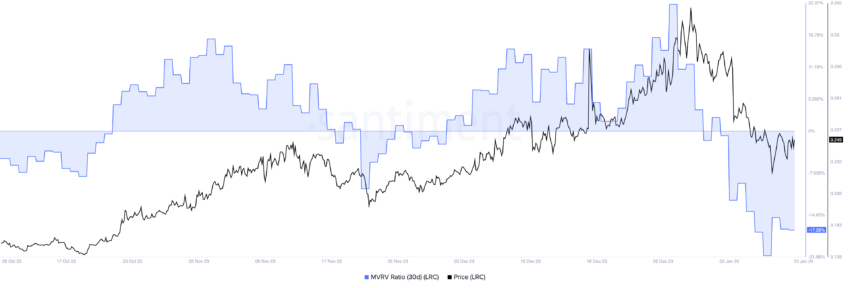

- Loopring (LRC) is flaunting a 30-day MVRV of -18.12%.

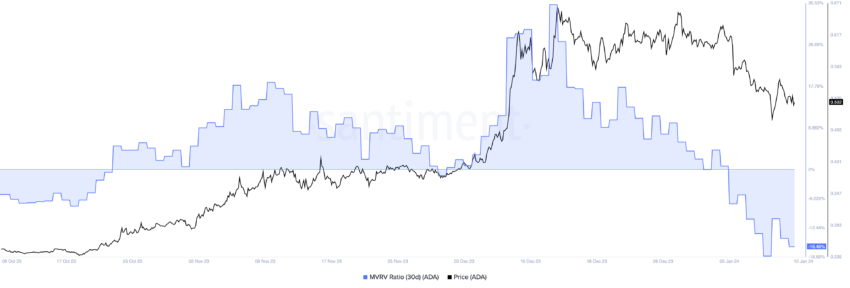

- Cardano (ADA) proudly holds its 30-day MVRV at -14.48%.

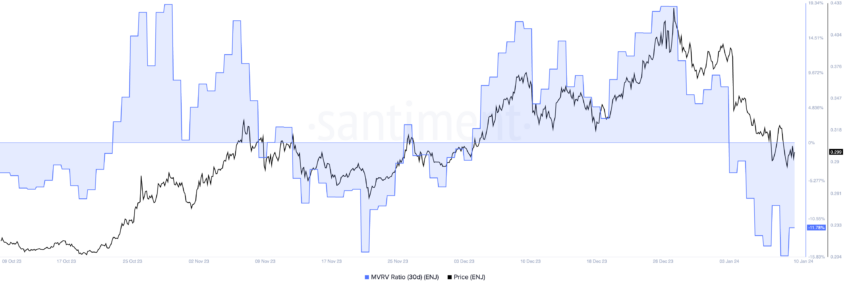

- Enjin Coin (ENJ) is signaling a 30-day MVRV of -13.31%.

- Decentraland (MANA) is trading with a 30-day MVRV at -13.21%.

These negative values hint that a significant chunk of these assets is currently in or near a loss, a classic sign of market capitulation. For bargain hunters, this could be a signal worth exploring.

Time to Dive In?

It’s a familiar tale – savvy investors often see market dips as golden opportunities. The idea is that purchasing an asset when its market value lags behind its realized value could lead to substantial gains when the market corrects itself. Yet, the crypto market’s volatile nature means what looks undervalued today might dip even further tomorrow.

While the MVRV ratio is a valuable tool, it’s not the only player in the game. The broader market trend, global economic conditions, and specific news about each cryptocurrency also sway their future value. Technological updates, regulatory shifts, and changes in investor sentiment can be game-changers too.

Moreover, each cryptocurrency has its unique story. Fantom stands out for its advanced blockchain tech, focusing on scalability and efficiency. On the other hand, Decentraland is a metaverse platform with a different appeal. Crypto narratives also play a significant role, as highlighted by Ran Neuner, founder of Crypto Banter.

So, is it time to buy the dip? The decision should be a blend of market indicators, personal investment strategy, and risk tolerance. It’s all about finding that sweet spot between potential and prudence in the ever-evolving crypto landscape.