So, Bitcoin exchange-traded funds (ETFs) are all the rage, right? They let regular investors easily buy into Bitcoin without dealing with the complexities of crypto exchanges. But are they actually taking over Bitcoin trading? Let’s look at the data.

ETFs vs. Exchanges: A David and Goliath Story

CryptoQuant, a company that analyzes blockchain data, recently compared the trading volume of US Bitcoin spot ETFs to major exchanges. The results? A pretty clear winner.

ETFs offer a simple way to invest in Bitcoin, bypassing the sometimes-scary world of crypto wallets and exchanges. They’ve become popular since getting the green light from the SEC last year. But how do their trading volumes compare?

The Numbers Don’t Lie

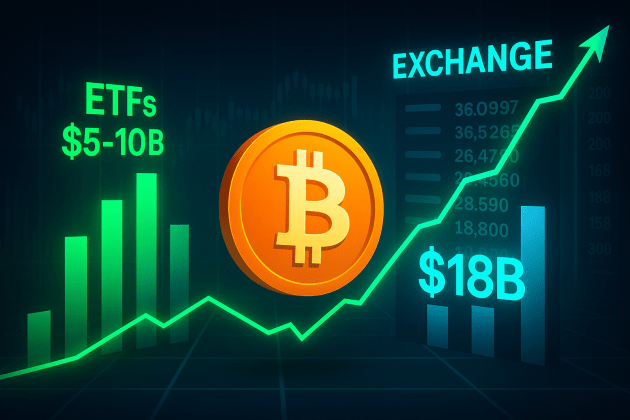

CryptoQuant’s data shows that daily ETF trading volume usually sits between $5 billion and $10 billion. That’s a lot, but it’s tiny compared to major exchanges.

Binance, the biggest crypto exchange, often sees daily volumes reaching $18 billion! In fact, Binance alone holds a massive 34.69% of the Bitcoin trading volume market share. Meanwhile, US Bitcoin spot ETFs only account for a measly 4.53%. Other exchanges like Crypto.com, Bybit, and MEXC all have bigger slices of the pie than the ETFs.

The same story plays out with Ethereum ETFs. Binance dominates with nearly 30% of the market share, while Ethereum ETFs only account for about 13%.

The Verdict? Exchanges Still Reign Supreme

The bottom line? Based on the data, exchanges are still the main place people trade Bitcoin (and Ethereum). While ETFs are growing, they’re still a small player in the overall market.

Bitcoin Price Dip

Oh, and one more thing: Bitcoin’s price has dropped about 3% in the last 24 hours, currently sitting around $108,500.