A top crypto analyst is seeing some positive signs for altcoins, even though the overall market feels pretty gloomy.

A Four-Year Low Suggests a Turnaround

Jamie Coutts from Real Vision believes that the current sentiment in the altcoin market is extremely negative. He points to a key metric: the ratio between the equal-weighted market cap and the market cap-weighted average of the top 200 altcoins. This ratio is at a four-year low, which Coutts interprets as a sign that some high-quality altcoins could be poised for a comeback. He says that historically, this low point has been followed by a recovery in the prices of strong altcoins.

Bitcoin’s Peak and the Uncertain Future

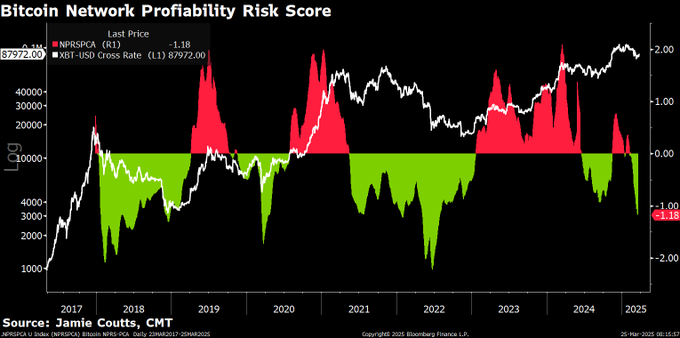

Coutts also looked at Bitcoin, using the Market Value to Realized Value (MVRV) metric. This metric suggests Bitcoin may have already peaked for this cycle, hinting at a potential bear market ahead.

However, he cautions that several factors could influence Bitcoin’s future price. He highlights the uncertainty caused by the US government’s efforts to reduce the federal budget deficit, and questions whether other global powers like China and Europe can pick up the slack if US liquidity shrinks. Essentially, the global economic situation will play a huge role in Bitcoin’s price movement.

Global Liquidity: The Key Factor

Coutts emphasizes that global liquidity conditions are crucial for Bitcoin’s trajectory. Improved global liquidity could lead to further Bitcoin gains, while constrained or declining liquidity could push Bitcoin’s price down.

Disclaimer: This information is for general knowledge and shouldn’t be considered investment advice. Always do your own research before investing in cryptocurrencies.

/p>