Bitcoin is on a roll, climbing towards $66,000. But despite this bullish momentum, some big investors, known as “whales,” are starting to bet against Bitcoin.

Whales Are Shorting Bitcoin

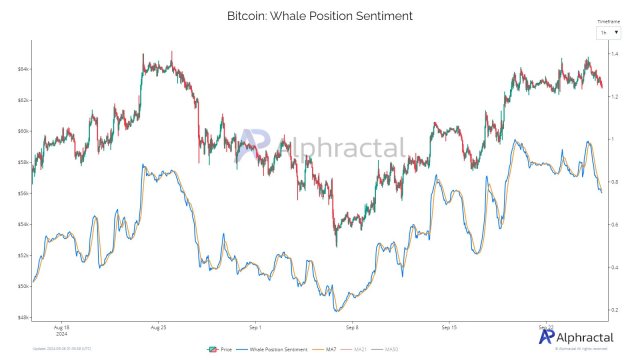

A recent analysis by Alphractal, a platform that tracks investment data, shows that whales are increasing their short positions. This means they’re betting that Bitcoin’s price will go down.

This is concerning because whales have a huge impact on the market. They can move the price of Bitcoin significantly. So, when they start shorting, it can put downward pressure on the price.

What Does This Mean For Bitcoin?

Alphractal says Bitcoin needs to stay above $62,200 to avoid a bearish turn. If it falls below this level, it could signal a downward trend.

However, it’s not all doom and gloom. Despite the whales’ shorting activity, Bitcoin is still holding its own above $65,000. It’s also showing strong gains over the past week and month.

The Bigger Picture

Looking at the bigger picture, Alphractal found that the largest liquidity pool for Bitcoin is below $40,000. This means there’s a lot of potential for Bitcoin to rise even further.

What’s The Takeaway?

While whales shorting Bitcoin is a cause for concern, it’s important to remember that Bitcoin is still showing strong signs of growth. It’s still too early to say whether this shorting activity will have a significant impact on the price.

It’s important to stay informed and keep an eye on the market.