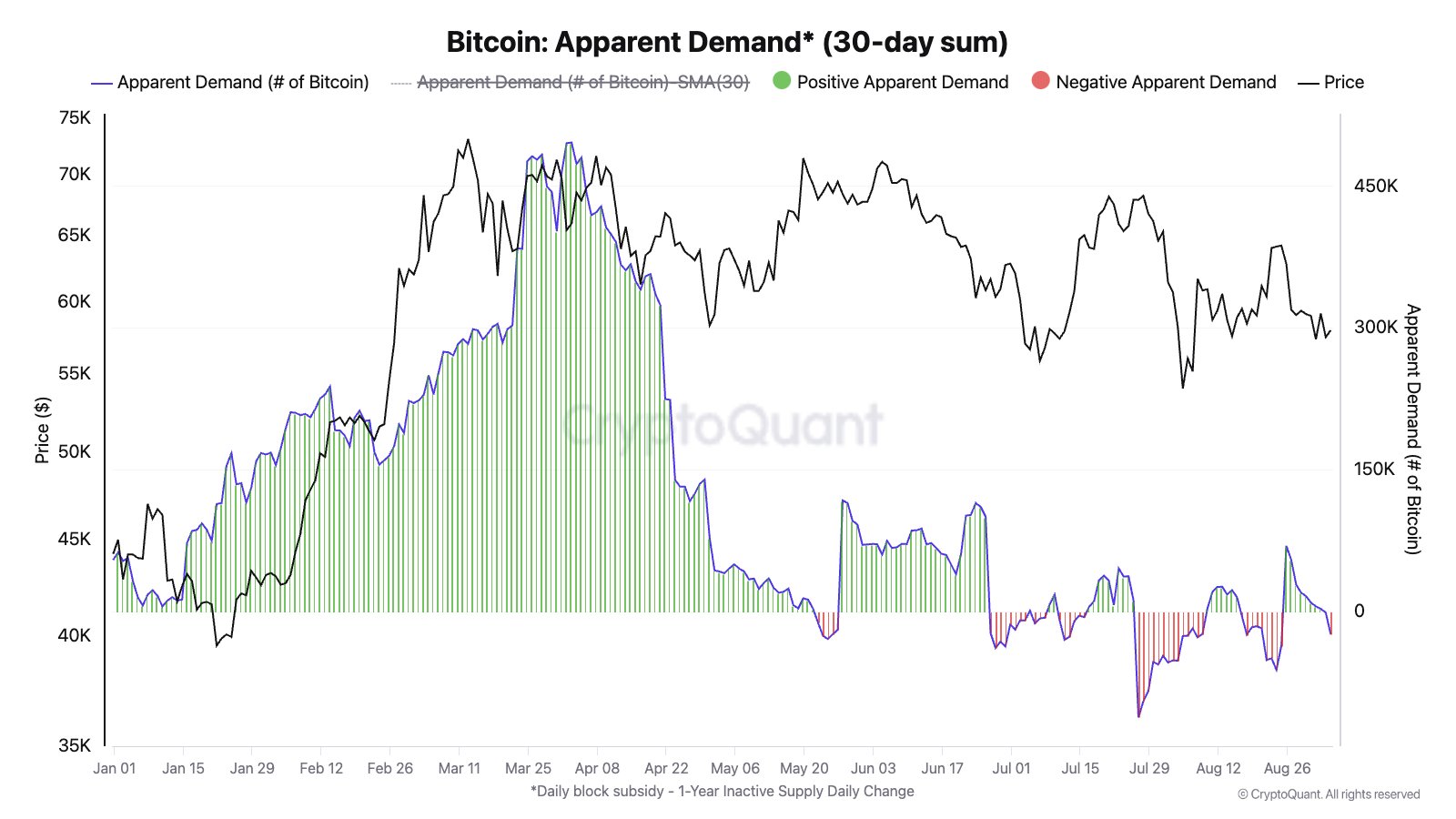

Bitcoin (BTC) is struggling to gain ground, and a leading crypto analyst is pointing to a lack of demand as the culprit. Julio Moreno, head of research at CryptoQuant, says that demand for BTC is declining and “all valuation metrics are looking bearish.”

Key Price Levels and Bearish Indicators

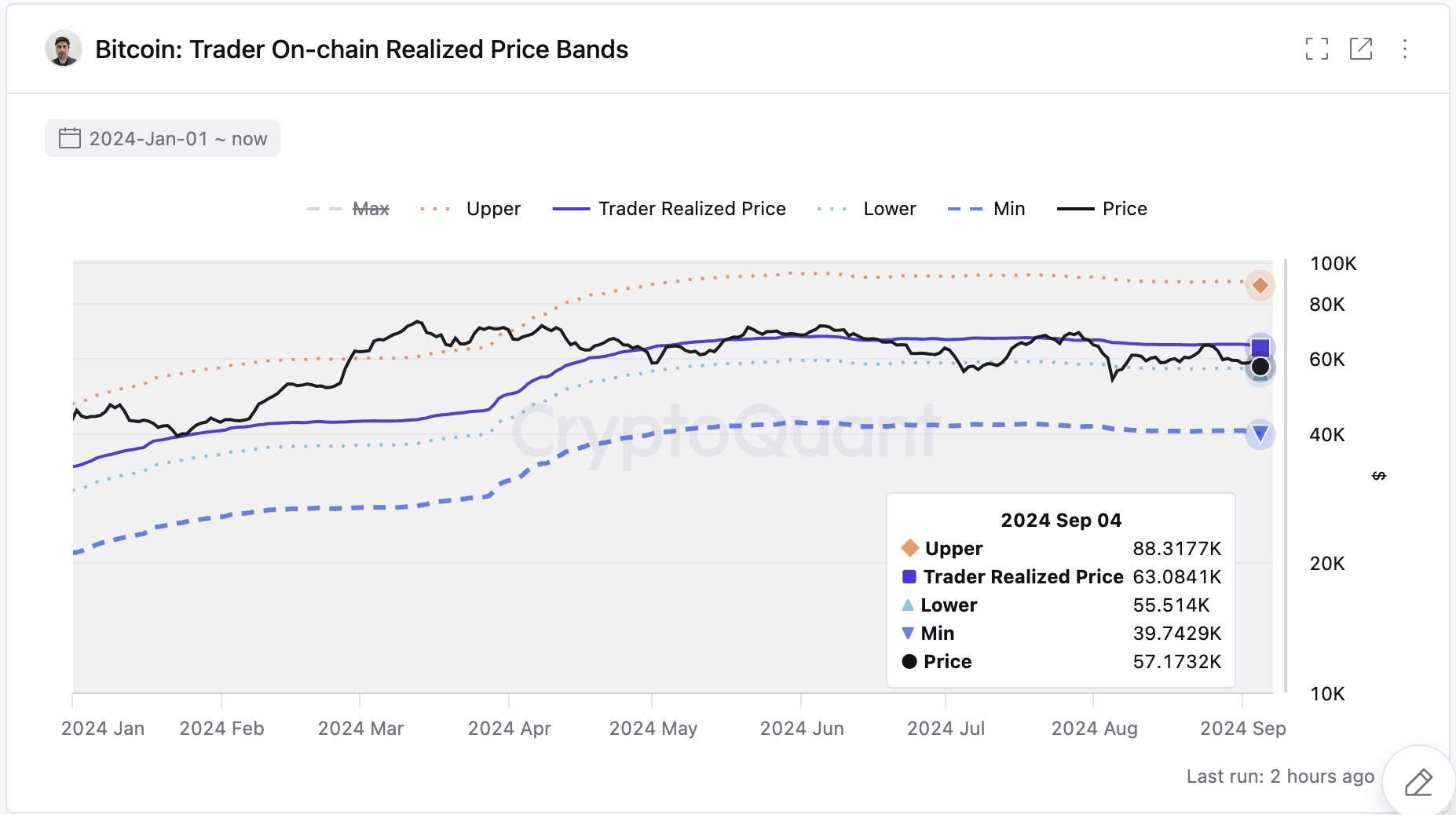

Moreno highlights $55,000 as a key price level to watch. This is the lower band of the “realized price,” which is the average price of Bitcoins in circulation based on their last transaction. Currently, BTC is trading below this level, down over 4% in the past 24 hours and 9% in the past week.

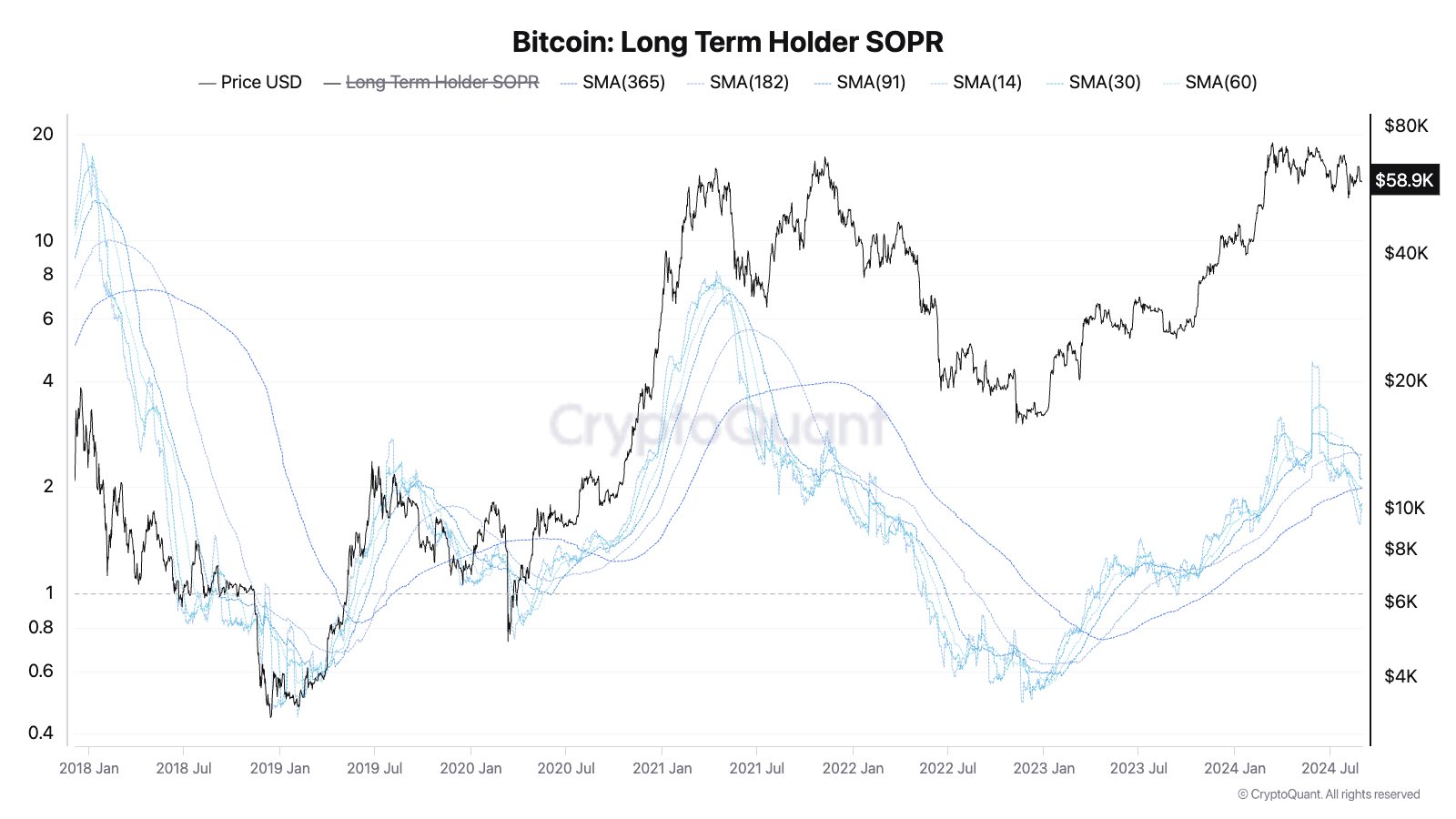

Moreno’s recent analysis also suggests that long-term Bitcoin holders are selling at lower profit margins, another bearish sign. This is reflected in the “spent output profit ratio” (SOPR), which tracks whether coins are being sold at a profit or loss.

Simulation Shows Limited Upside

Earlier this week, Moreno simulated Bitcoin’s price for September, and the results weren’t encouraging. The simulation predicted an average price of around $55,000 for the month, with prices fluctuating between $44,000 and $66,000.

What’s Next for Bitcoin?

The lack of demand and bearish indicators suggest that Bitcoin’s price may continue to struggle in the short term. However, it’s important to remember that the cryptocurrency market is volatile and unpredictable. Investors should conduct their own research and proceed with caution.