Bitcoin’s price has been on a downward trend recently, and there are a few reasons why.

Recession Fears

The possibility of a US recession is causing a lot of anxiety in the financial markets, and Bitcoin is no exception. The Federal Reserve is getting ready to make a decision about interest rates, and many people are expecting a cut. While this might seem like good news, some analysts believe a big cut could actually be a sign of a bigger economic problem, which would be bad for Bitcoin.

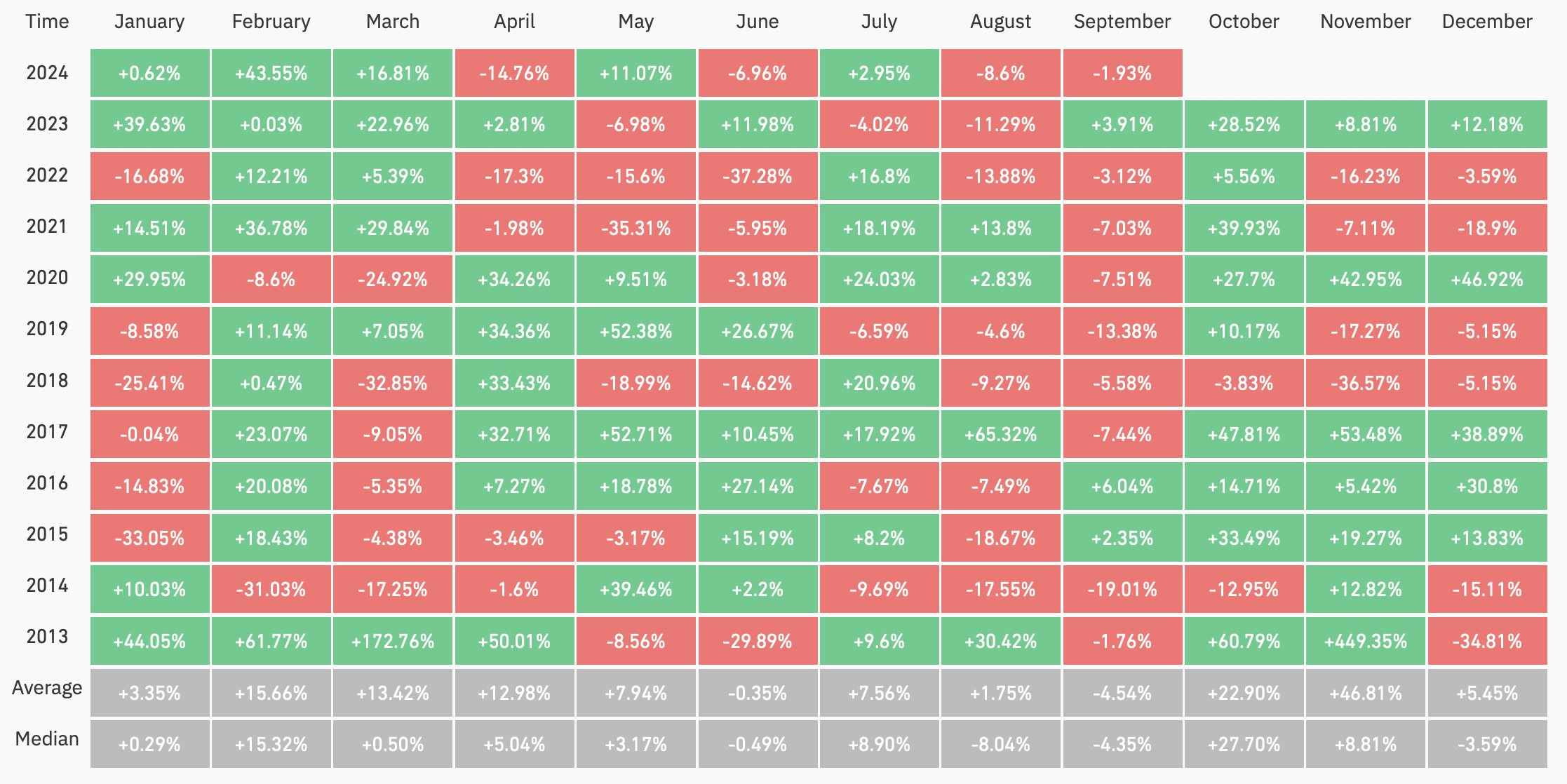

Seasonal Trends

Historically, September hasn’t been a great month for Bitcoin. While there have been some years with good gains, there have also been years with significant losses.

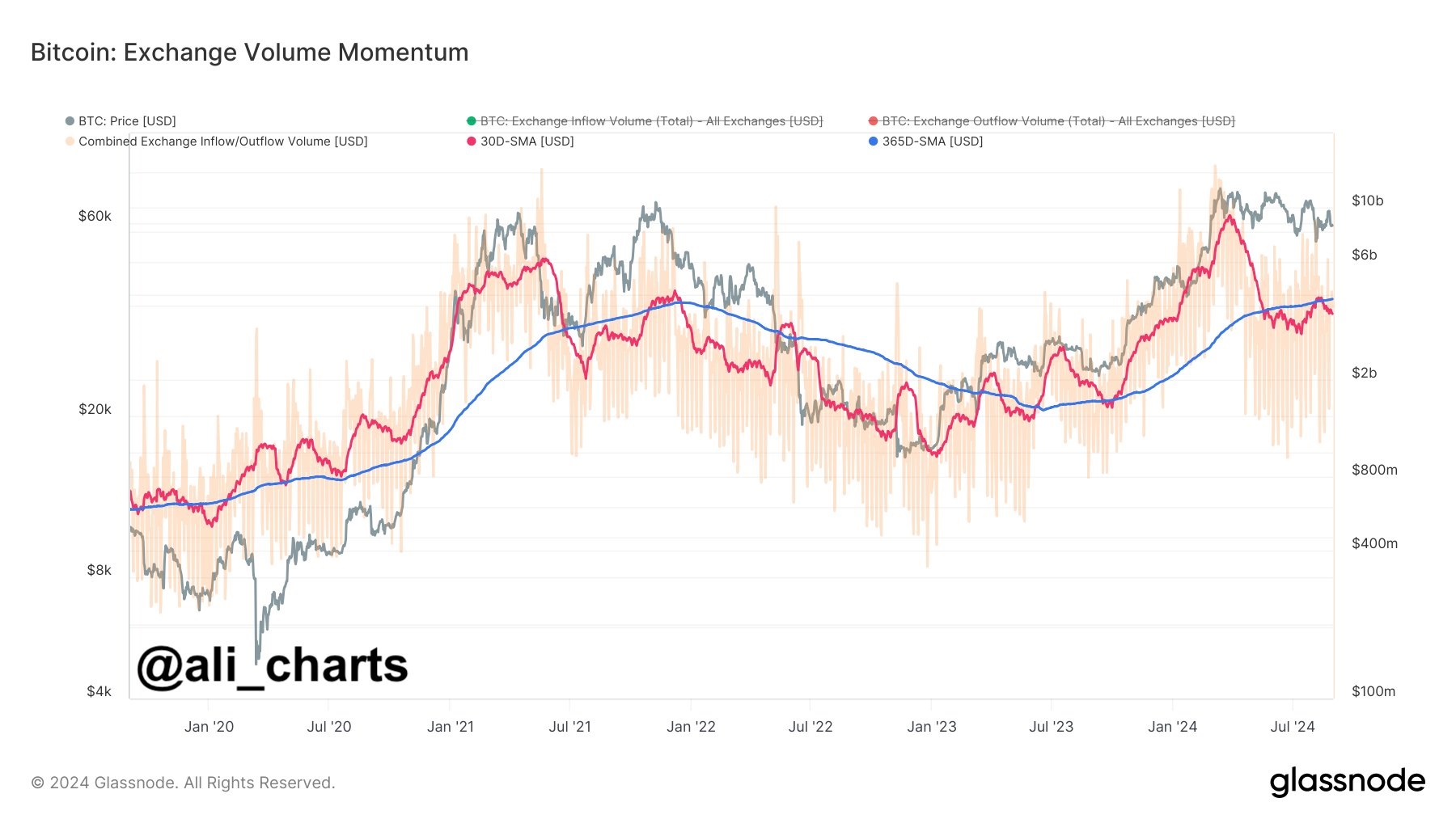

Lack of Interest

Bitcoin’s activity on exchanges has been declining, which suggests that investors are becoming less interested in the cryptocurrency. This could be a sign that people are not as excited about Bitcoin as they used to be, which could impact its price.

Technical Analysis

Technically, Bitcoin is looking weak. It needs to close above a certain price level to avoid further losses. If it doesn’t, it could continue to go down.

Overall, there are a few factors that are contributing to Bitcoin’s recent price drop. It’s important to keep an eye on these factors to see how they might impact Bitcoin’s future.