Investors are pouring money into money market funds, a safe haven for cash, even as the Federal Reserve is expected to cut interest rates soon.

Record Highs in Money Market Funds

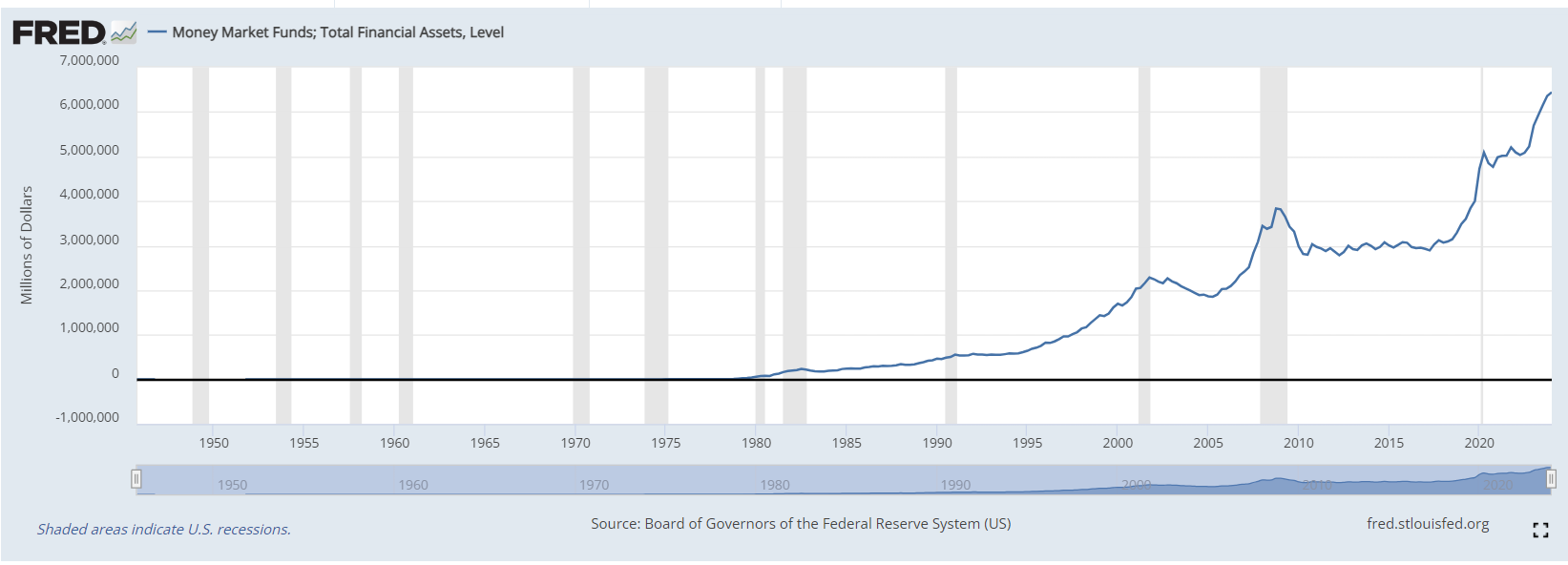

The amount of money invested in these funds has reached a record high of over $6.44 trillion, according to the Federal Reserve. This surge started last year when the Fed aggressively raised interest rates to fight inflation, making short-term investments like US Treasuries more attractive.

Will Rate Cuts Change Things?

While the Fed is expected to cut interest rates soon, Bank of America analysts don’t think this will lead to a sudden shift of money from money market funds into stocks.

They argue that historically, investors tend to put more money into these funds before the first rate cut, anticipating a “soft landing” for the economy. If the economy takes a harder hit, they believe investors will likely favor bonds over stocks.

What Does This Mean for Investors?

The current trend suggests that investors are still cautious about the economy and are choosing to keep their money in safe, liquid investments. While a rate cut might be on the horizon, it might not be the catalyst for a big stock market rally just yet.