Ethereum (ETH) has been stuck in a rut lately, trading between $2,300 and $2,800 since the beginning of August. It’s been trying to break past $2,600 for the past few days, but hasn’t been able to. This is disappointing, especially compared to Bitcoin’s strong performance this year.

Ethereum ETFs: A Flop?

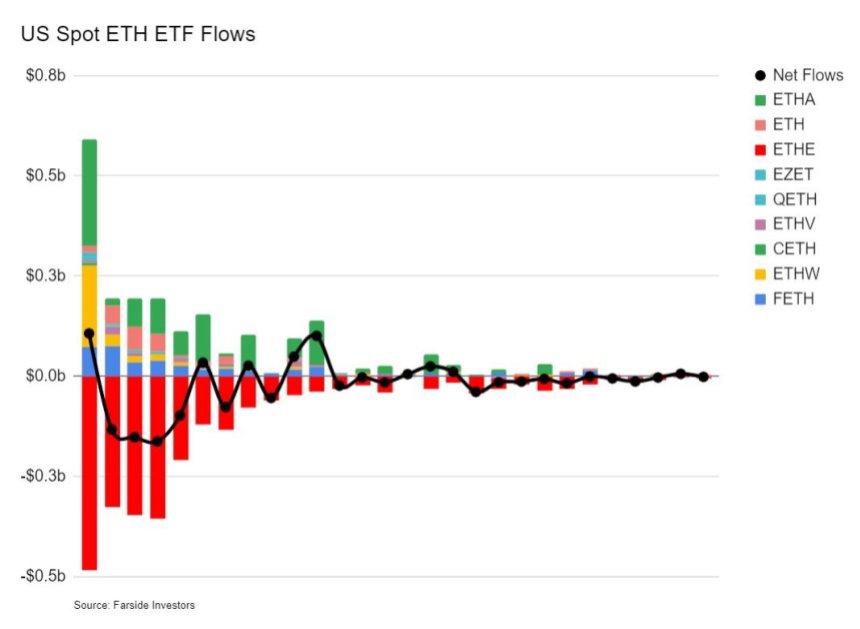

Ethereum ETFs were supposed to be a big deal, but they haven’t lived up to the hype. Data shows that investor interest in these ETFs has been pretty weak. This could be a sign that people are worried about Ethereum’s future.

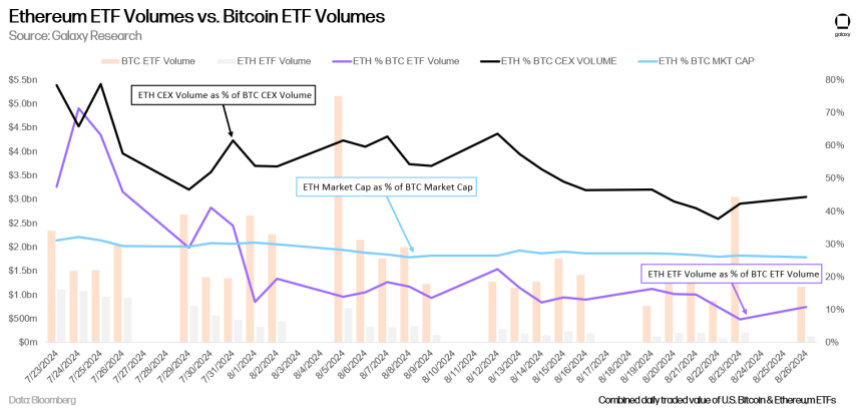

It’s also interesting that Ethereum ETFs are trading at much lower volumes than Bitcoin ETFs. This is surprising considering how popular Ethereum is. It seems like investors are more interested in Bitcoin, or even other cryptocurrencies like Solana, than Ethereum right now.

Ethereum’s Price: A Battle for Control

Ethereum is currently trading at $2,522, and it’s been stuck below $2,600 since last Tuesday. This is a key level because it was a strong support level for most of August. The fact that it’s now acting as resistance suggests that Ethereum could fall further in the near future.

If Ethereum can break past $2,600, it could move towards $2,820, which would be a good sign for the bulls. But if it fails to break through, it could continue to fall, with the next support level around $2,310.

So, the next few days are crucial for Ethereum. We’ll see if it can regain its momentum or if it will continue to lag behind its peers.