Bitcoin has been stuck in a range for a while, bouncing between $54,000 and $71,500. This has made some traders nervous, with the Fear and Greed Index showing a “fear” score. But some experts believe this is a good time to buy.

History Repeating Itself?

James Seyffart, a Bloomberg ETF expert, thinks the current situation is similar to what happened in 2019. Back then, Bitcoin traded between $7,000 and $10,000 for a long time. He acknowledges that past performance doesn’t guarantee future results, but sees some interesting parallels.

2019 vs. 2024: The Similarities

James “Checkmate” Check, a leading on-chain analyst, agrees with Seyffart. He points out that both in 2019 and 2024, Bitcoin experienced a period of consolidation after a big price increase.

In 2019, Bitcoin surged from $4,000 to $14,000 in just three months. This was fueled by a Ponzi scheme in China that bought up a significant amount of Bitcoin. The scheme later collapsed, leading to a sell-off and market volatility.

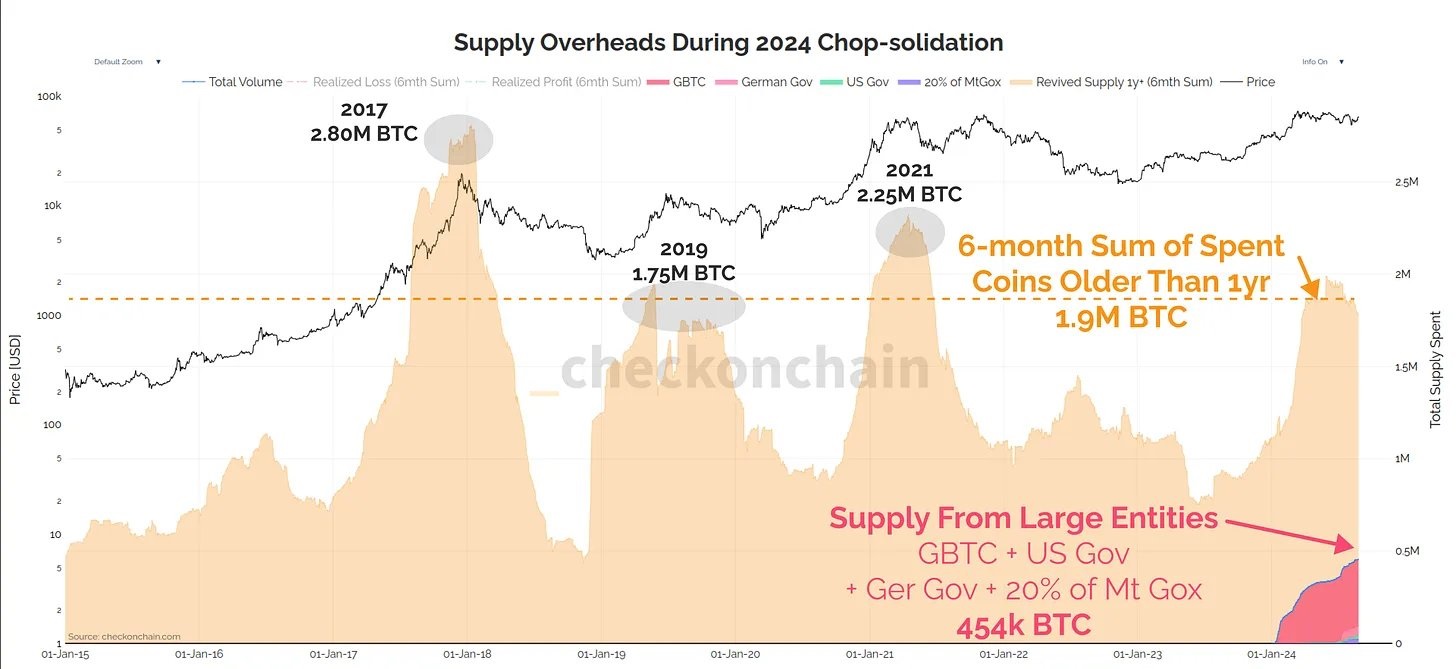

In 2024, Bitcoin rose from $40,000 to $73,777, driven by the adoption of Bitcoin ETFs in the US. However, selling by governments in the US and Germany caused the market to become choppy.

On-Chain Data Supports the Comparison

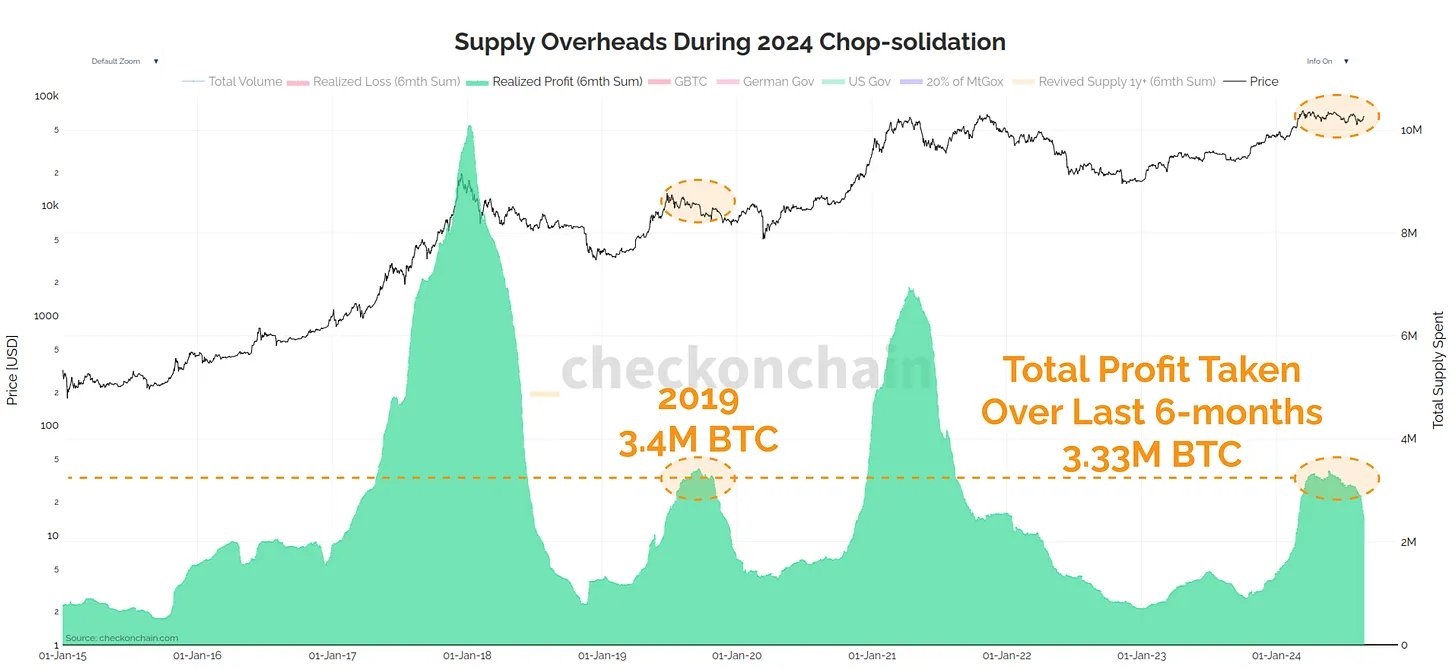

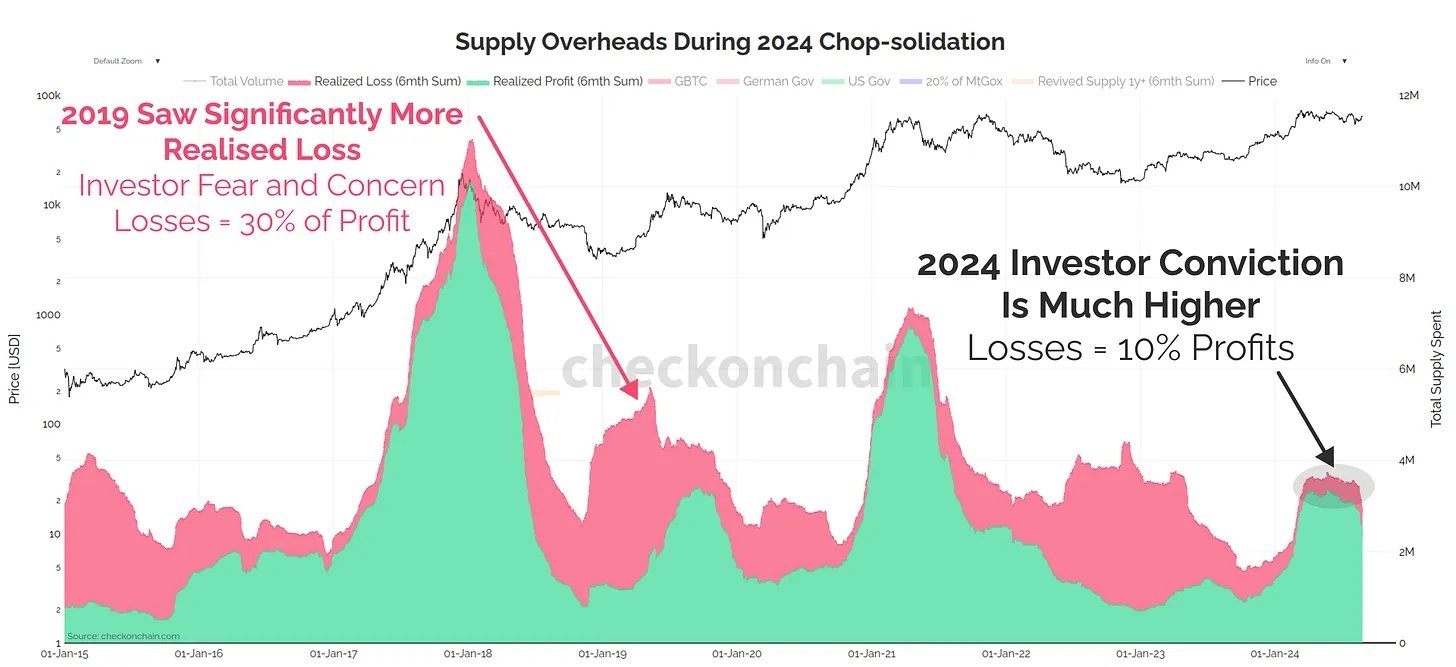

Check’s analysis of on-chain data shows further similarities between the two periods. He found that the amount of Bitcoin moved by long-term holders is similar in both 2019 and 2024. Additionally, the amount of Bitcoin sold for profit is also comparable.

However, there’s a key difference: in 2019, investors were more likely to sell at a loss, indicating fear. In 2024, investors seem more confident and less prone to panic selling.

The Bottom Line

While past performance isn’t a guarantee of future results, the similarities between 2019 and 2024 suggest that the current consolidation phase might be a good buying opportunity for Bitcoin.