Bitcoin is currently holding steady, but it’s facing a lot of selling pressure after the big drop on August 27th. Things look a bit shaky right now, but if Bitcoin bulls can push prices above $66,000, things could change.

Binance Traders Are Bearish

Despite the recent stabilization, traders on Binance, the biggest exchange out there, are mostly bearish. More traders are placing bets against Bitcoin, which could lead to further losses.

This shift in sentiment comes at a time when most traders are neutral on Bitcoin. The Crypto Fear and Greed Index shows that people are taking a wait-and-see approach. This has been the case since Bitcoin prices took a dive in early August.

However, if prices can recover above $63,000 and reverse the losses from August 27th, it could spark some demand and lead to further gains.

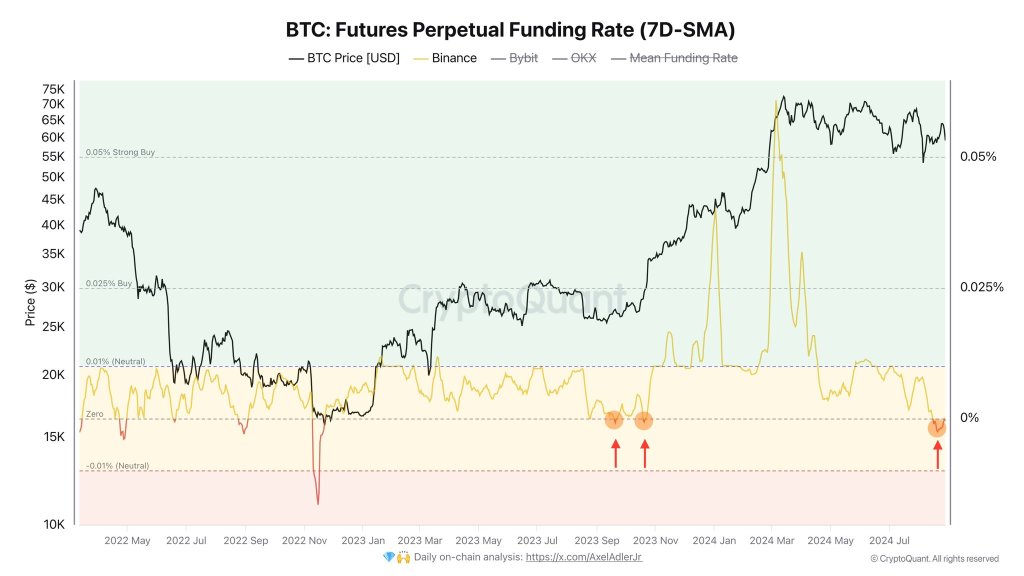

A Strange Twist: Positive Funding Rate

Here’s the weird part: even though Bitcoin is struggling, the average funding rate across Binance, Bybit, and OKX is positive. This means that short-leverage traders (those betting against Bitcoin) are getting paid for holding their positions.

Normally, a positive funding rate happens when prices are rising, indicating bullish sentiment. When prices drop, the funding rate usually goes negative, meaning short sellers have to pay those who are betting on a price increase.

This positive funding rate, despite the bearish market, could encourage even more selling pressure and fuel the downtrend. It’s a confusing situation that could add to Bitcoin’s volatility in the coming days.