The future of Bitcoin is a hot topic. Some experts think it will become a global powerhouse, while others think it will crash and burn. Let’s dive into both sides of the story.

Bitcoin: A $52 Million Treasure?

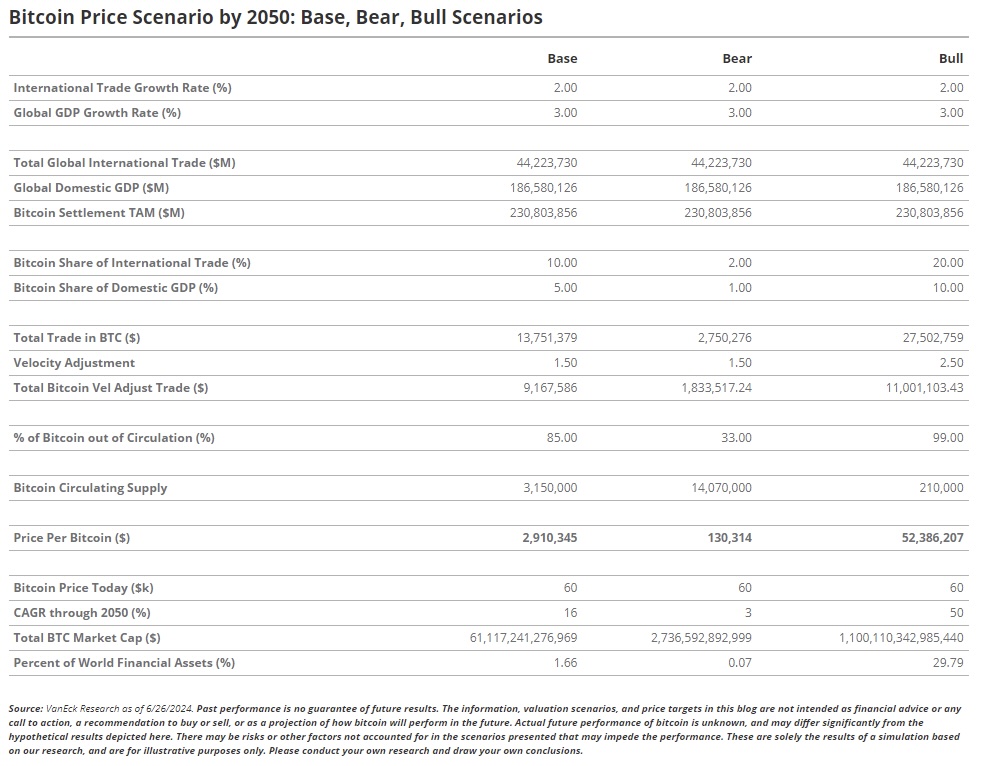

Some experts believe Bitcoin could be worth a staggering $52 million by 2050. They point to several factors that could drive this massive growth:

- A Changing World Order: The global financial system is shifting away from traditional currencies like the US dollar. This opens the door for Bitcoin to become a major player.

- De-dollarization: Countries are increasingly looking for alternatives to the US dollar, and Bitcoin could fill that gap.

- Bitcoin as a Reserve Currency: Bitcoin’s decentralized nature and lack of government control make it an attractive option for countries seeking a more stable reserve currency.

The Skeptics: Bitcoin’s Zero-Dollar Trap

Not everyone is convinced. Some prominent investors, like Jim Rogers and Charlie Munger, believe Bitcoin will ultimately be worthless. They argue that:

- Bitcoin is Unproven: They see Bitcoin as a speculative bubble with no real value. They prefer tangible assets like gold and silver.

- Regulatory Risks:

Governments could crack down on Bitcoin, limiting its growth and potential.

Governments could crack down on Bitcoin, limiting its growth and potential. - Competition from CBDCs: Central bank digital currencies (CBDCs) could become more popular, potentially making Bitcoin obsolete.

The Reality: Somewhere in Between

The truth likely lies somewhere between these extreme predictions. Bitcoin has proven resilient, but its price is highly volatile and driven by speculation.

- A $52 Million Bitcoin? While it’s not impossible, it would require unprecedented levels of global adoption and trust in Bitcoin.

- Bitcoin Going to Zero? While possible, Bitcoin’s growing institutional adoption and its role as “digital gold” make this scenario less likely.

The Bottom Line: Stay Informed and Be Realistic

The cryptocurrency world is full of hype and uncertainty. Don’t get caught up in sensational predictions. Do your research, consider your risk tolerance, and diversify your investments. Remember, cryptocurrencies can offer big returns, but they also come with big risks.