Ethereum is stuck in a rut, with prices hovering between $2,100 and $2,800. While some hope for a breakout, there are some worrying signs.

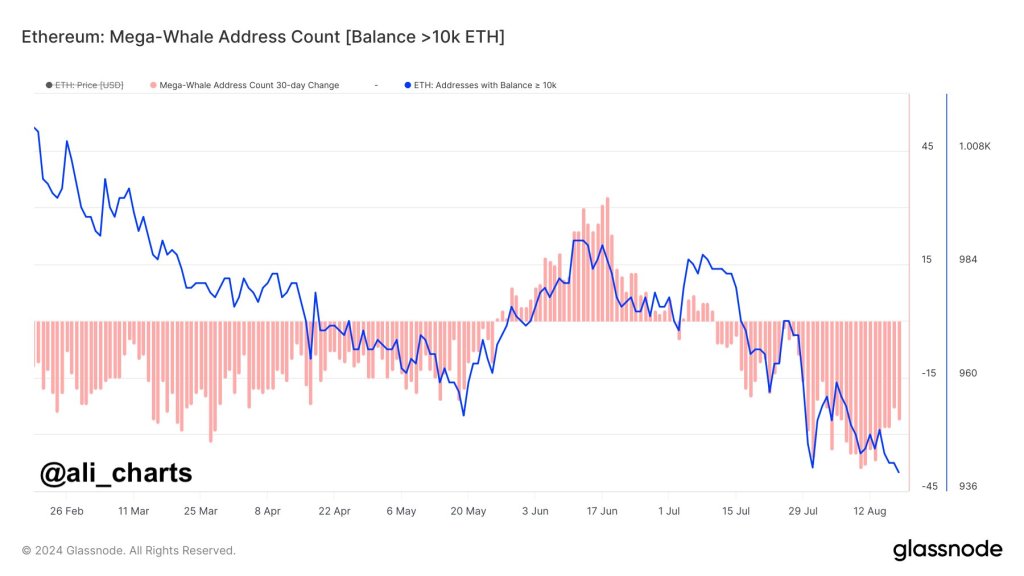

Whales Dumping Their Holdings

Big players, known as whales, who own at least 10,000 ETH, have been selling off their coins for the past month. This suggests they might not be optimistic about Ethereum’s future. If more people follow suit, it could lead to a flood of ETH in the market, driving prices down.

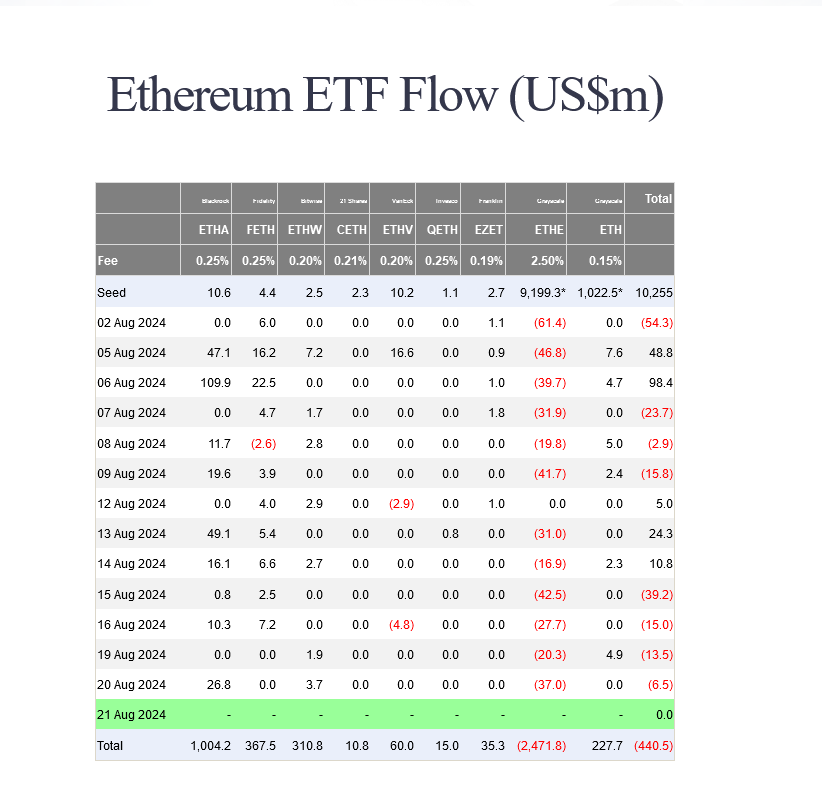

Ethereum ETFs Losing Steam

The launch of spot Ethereum ETFs in May initially boosted prices, but things haven’t been so rosy since. Investors have been pulling their money out of these ETFs, especially Grayscale’s ETHE, which has seen over $247 million in redemptions. This indicates a lack of confidence in Ethereum’s short-term prospects.

A Bearish Outlook

The combination of whale selling and ETF outflows paints a gloomy picture for Ethereum. Investors are choosing to move their money elsewhere, suggesting a bearish outlook for the short to medium term.