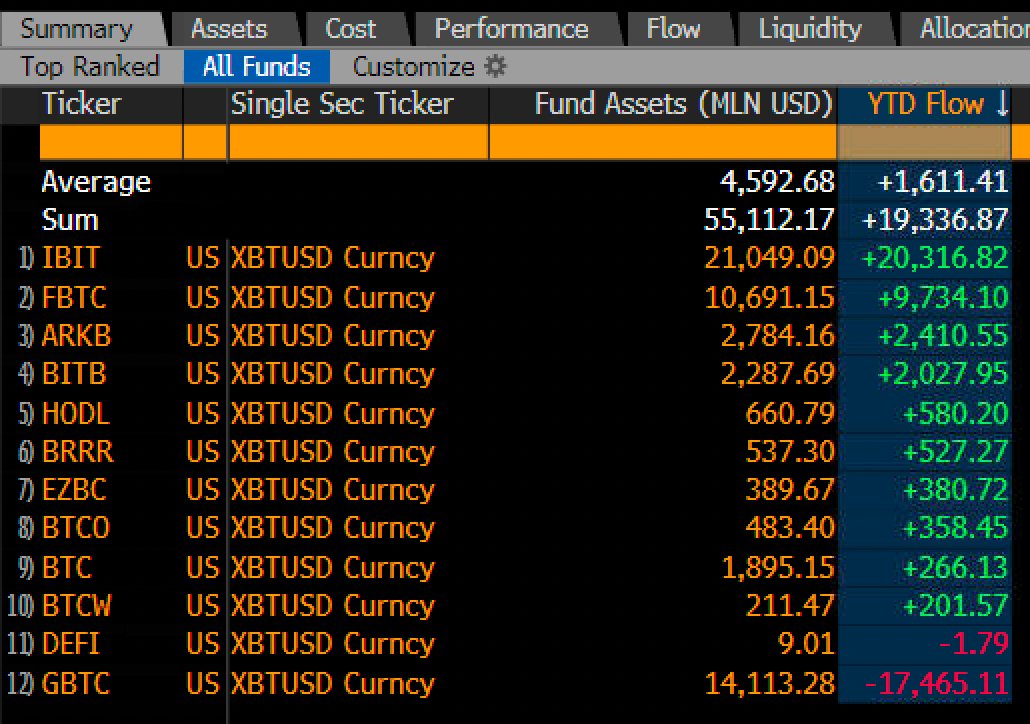

Bitcoin exchange-traded funds (ETFs) are seeing a huge surge in popularity, with over $19 billion flowing into them this year. That’s according to Bloomberg ETF analyst Eric Balchunas, who calls this a “surprisingly strong” trend.

Institutional Investors Are Driving the Trend

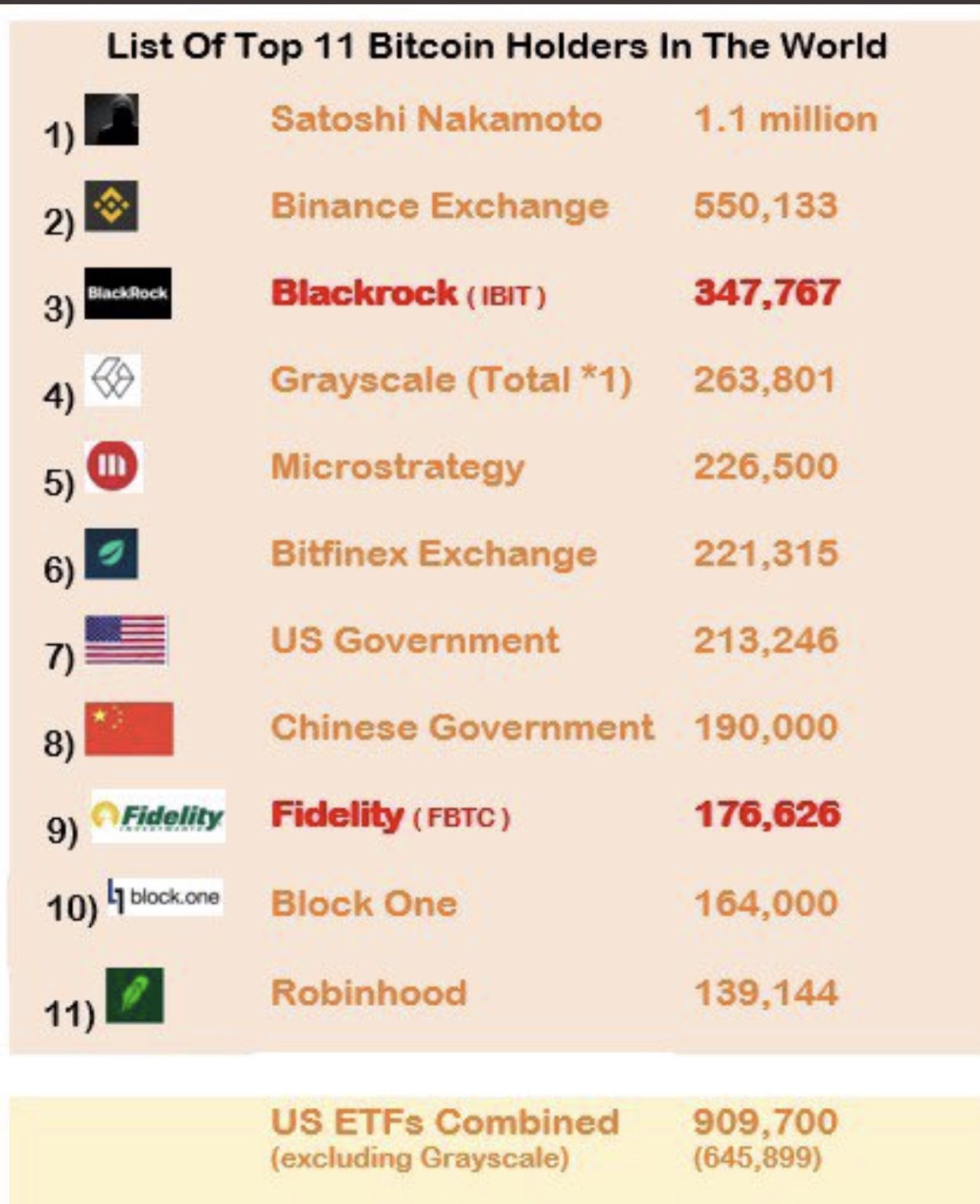

Balchunas believes this is a major sign of Bitcoin’s success, especially with Grayscale’s GBTC unlocking and the recent price fluctuations. He also points out that US ETFs are quickly becoming major Bitcoin holders, with BlackRock, the world’s largest asset manager, already being the third-largest holder. Balchunas predicts BlackRock will become the top holder by next year and stay there for a long time.

Stability in the Face of Volatility

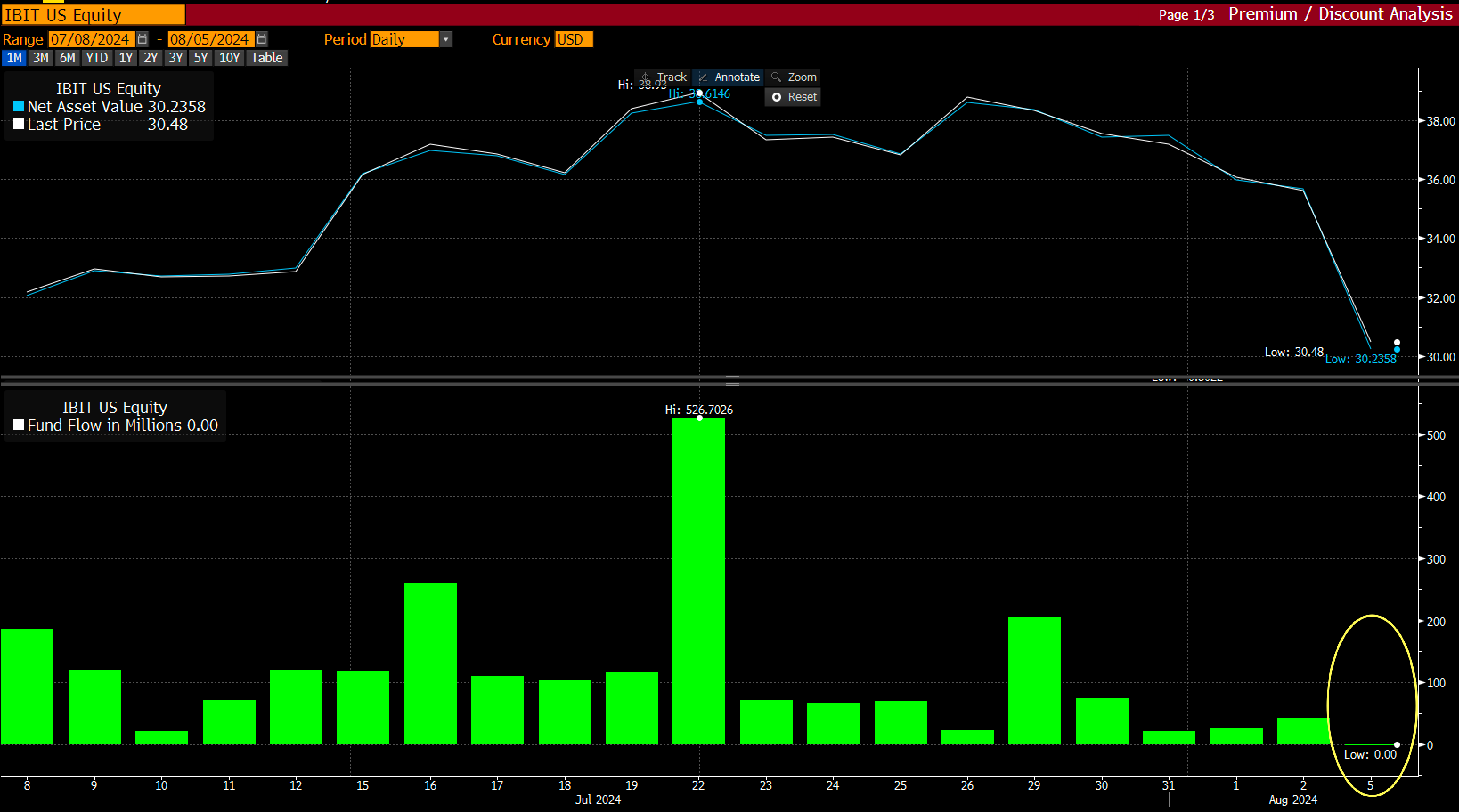

Balchunas argues that ETF investors, particularly those in BlackRock’s iShares Bitcoin Trust (IBIT), provide stability to Bitcoin’s volatile market. He notes that even with recent price drops, IBIT investors haven’t panicked and haven’t pulled out their money. This is a positive sign for Bitcoin’s long-term health.

Bitcoin’s Recent Performance

Bitcoin is currently trading at around $60,719, up over 1.5% in the past 24 hours and 8% in the past week. This strong performance is likely fueled by the growing interest in Bitcoin ETFs and the increasing institutional adoption of the cryptocurrency.