Bitcoin has been on a rollercoaster ride lately. After hitting a high of over $70,000 earlier this week, it’s now down about 7%. Some traders are still optimistic, pointing to the big jump in price between July 14th and 21st. But others are worried, saying the recent price drops are a sign that bears are taking control.

Bears Might Be in Charge

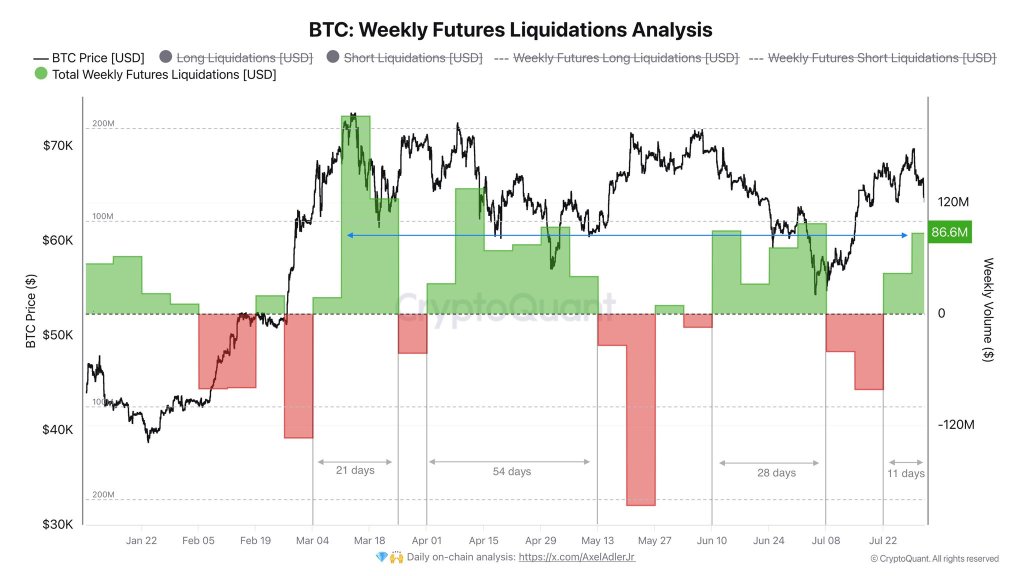

One analyst is predicting that Bitcoin could continue to fall in the coming days. They’re seeing signs that bears are dominating the market, including a rise in liquidation volume and a negative net taker volume. This means more traders are betting on the price going down. The analyst believes Bitcoin won’t recover until the net taker volume turns positive, giving bulls the upper hand.

Holding the Line

There’s some support for Bitcoin around the $63,000 level. But the real test will be whether it can hold above $60,000. If it falls below that, it could signal a more significant drop. On the other hand, breaking back above $70,000 would be a strong sign that the bullish trend is still alive.

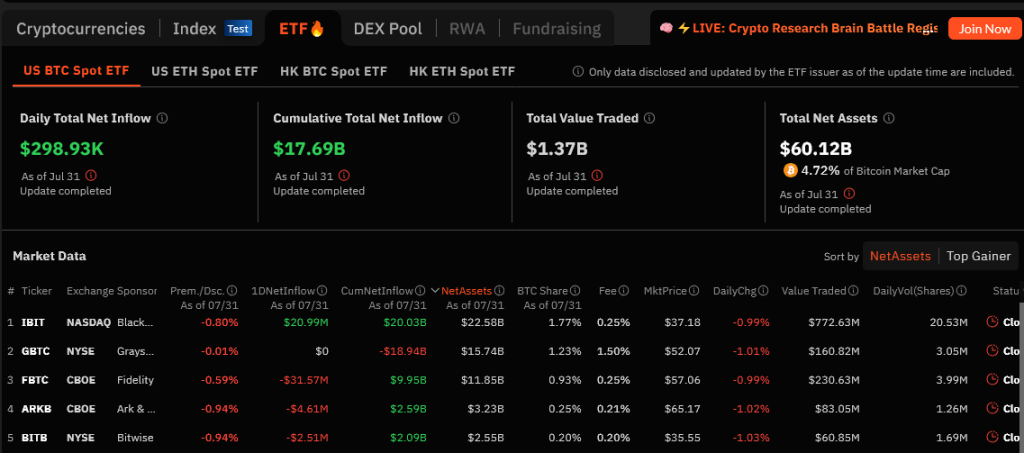

Institutions are Still Bullish

Despite the recent price drop, institutions are still buying Bitcoin. Since the approval of spot Bitcoin ETFs in the US, companies like Fidelity and BlackRock have accumulated nearly 300,000 BTC. This shows that institutions are confident in Bitcoin’s long-term potential, even if the short-term outlook is a bit uncertain.

So, what’s the verdict? It’s still too early to say for sure whether this is just a temporary dip or the start of a bigger downturn. But with institutions still buying and some key support levels to watch, it’s not time to panic just yet.