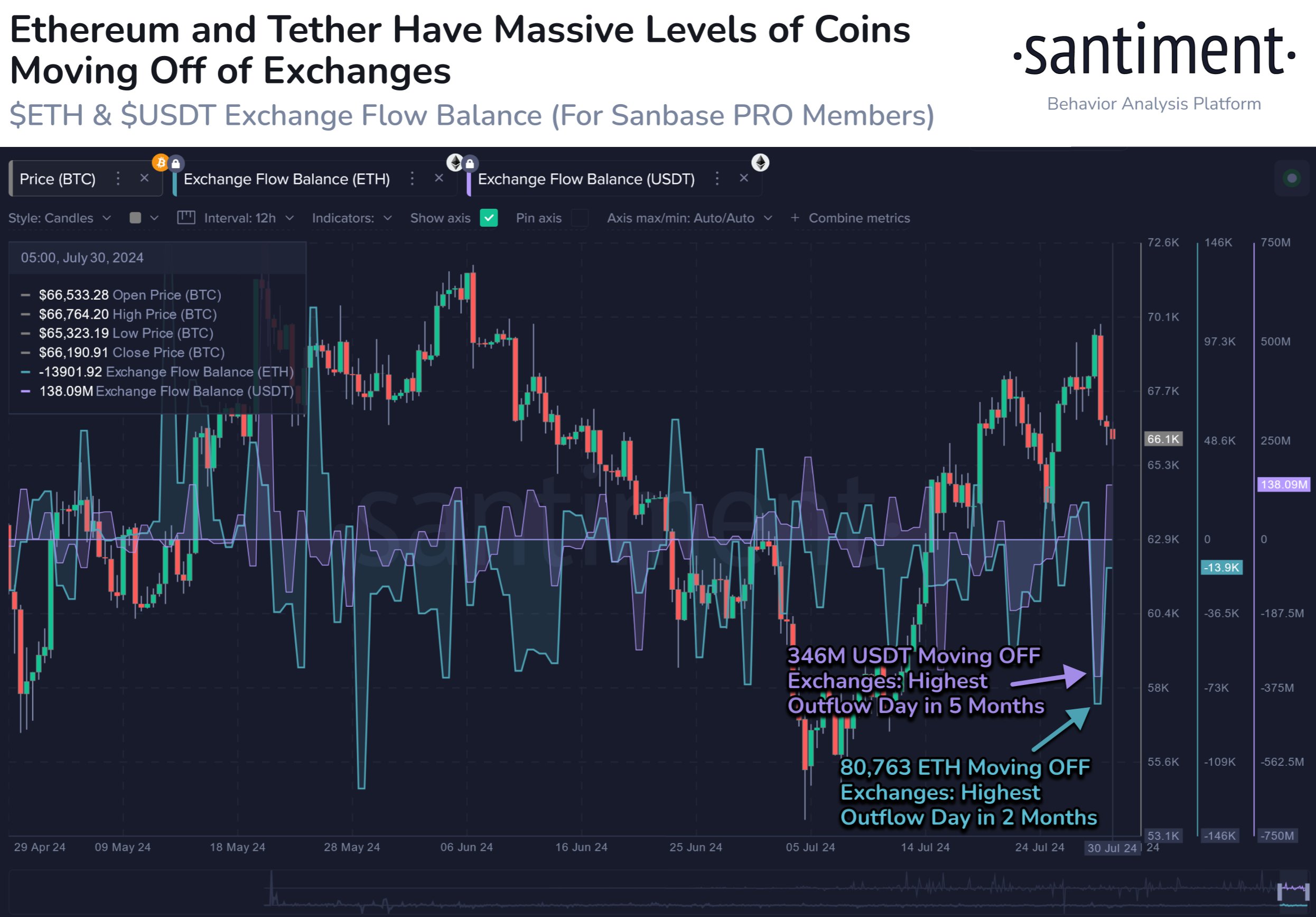

Ethereum has been seeing a lot of money leaving exchanges lately, which is usually a good sign for the price. But there’s a potential problem with Tether (USDT) that could put a damper on things.

What’s Going On With Ethereum and Tether?

Data from Santiment shows that both Ethereum and Tether have been experiencing withdrawals from exchanges. This means people are taking their coins off of exchanges and holding them themselves.

Why is this important?

- Ethereum: When people take their Ethereum off exchanges, it means there’s less Ethereum available to sell. This can lead to a higher price.

- Tether: Tether is a stablecoin, meaning its value is pegged to the US dollar. People often use Tether to buy other cryptocurrencies, like Ethereum. When people take Tether off exchanges, it means there’s less money available to buy Ethereum. This can make it harder for the price of Ethereum to go up.

The Tether Problem

Santiment points out that the recent Tether withdrawals are a potential bearish signal. This is because less Tether available on exchanges means less buying power for Ethereum.

In other words: Even though Ethereum is seeing less selling pressure, the lack of Tether on exchanges could make it harder for the price to rise.

What’s Next for Ethereum?

It’s hard to say what will happen to the price of Ethereum in the short term. We’re seeing both positive and negative signals at the same time. It will be interesting to see how things play out in the coming weeks.

At the time of writing, Ethereum is trading around $3,300, down more than 3% over the past week. /p>