Bitcoin exchange-traded funds (ETFs) are seeing a huge surge in popularity, with investors pouring billions of dollars into them.

Big Money is Flowing In

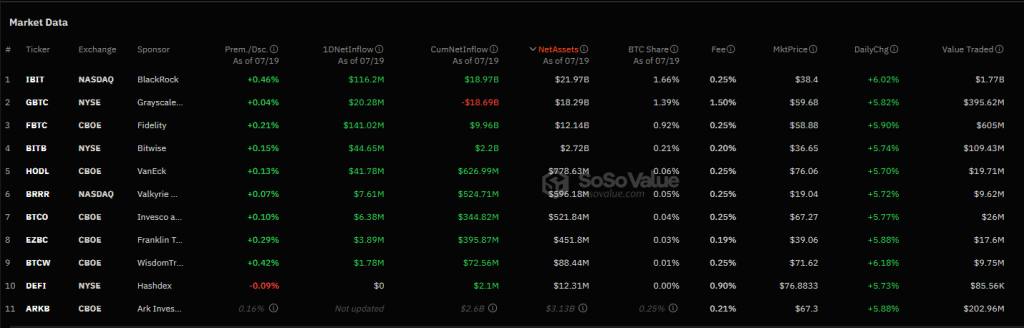

In just a few days, Bitcoin ETFs saw a record-breaking $18 billion in inflows. This massive amount of money came from both big institutions and individual investors who are excited about the future of Bitcoin.

On July 16th alone, investors poured a whopping $424 million into Bitcoin ETFs! Two big players, BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FBTC), were the main drivers of this surge, attracting over $250 million between them.

Other ETFs like Bitwise Bitcoin ETF (BITB) and VanEck’s HODL also saw significant inflows, showing that the interest in Bitcoin ETFs is widespread. Even Grayscale’s GBTC, which had been struggling, saw a reversal of its negative trend with $20 million in inflows.

Institutional Investors Are Leading the Charge

The massive inflows into Bitcoin ETFs are being driven by institutional investors who are looking for safe and controlled ways to invest in Bitcoin. They see the potential for huge returns and are using these ETFs to get a piece of the action.

Bitcoin’s Price is Soaring

Bitcoin’s price has been on a tear, rising by 5% in the last 24 hours and a whopping 14% over the past week. This surge is likely fueled by the strong investor sentiment and the growing popularity of Bitcoin ETFs.

The Future Looks Bright

Experts are predicting that Bitcoin’s price could reach new highs in the coming weeks and months. Technical indicators suggest a strong bullish outlook, and the Fear & Greed Index is currently at 74, indicating a high level of optimism.

What Does This Mean for Investors?

The current surge in Bitcoin ETF inflows is a positive sign for the cryptocurrency market. With strong institutional support and a bullish outlook, Bitcoin could be poised for further growth. Investors should stay tuned for further developments and be prepared for potential price swings.