Retail investors are losing interest in Bitcoin, according to recent data.

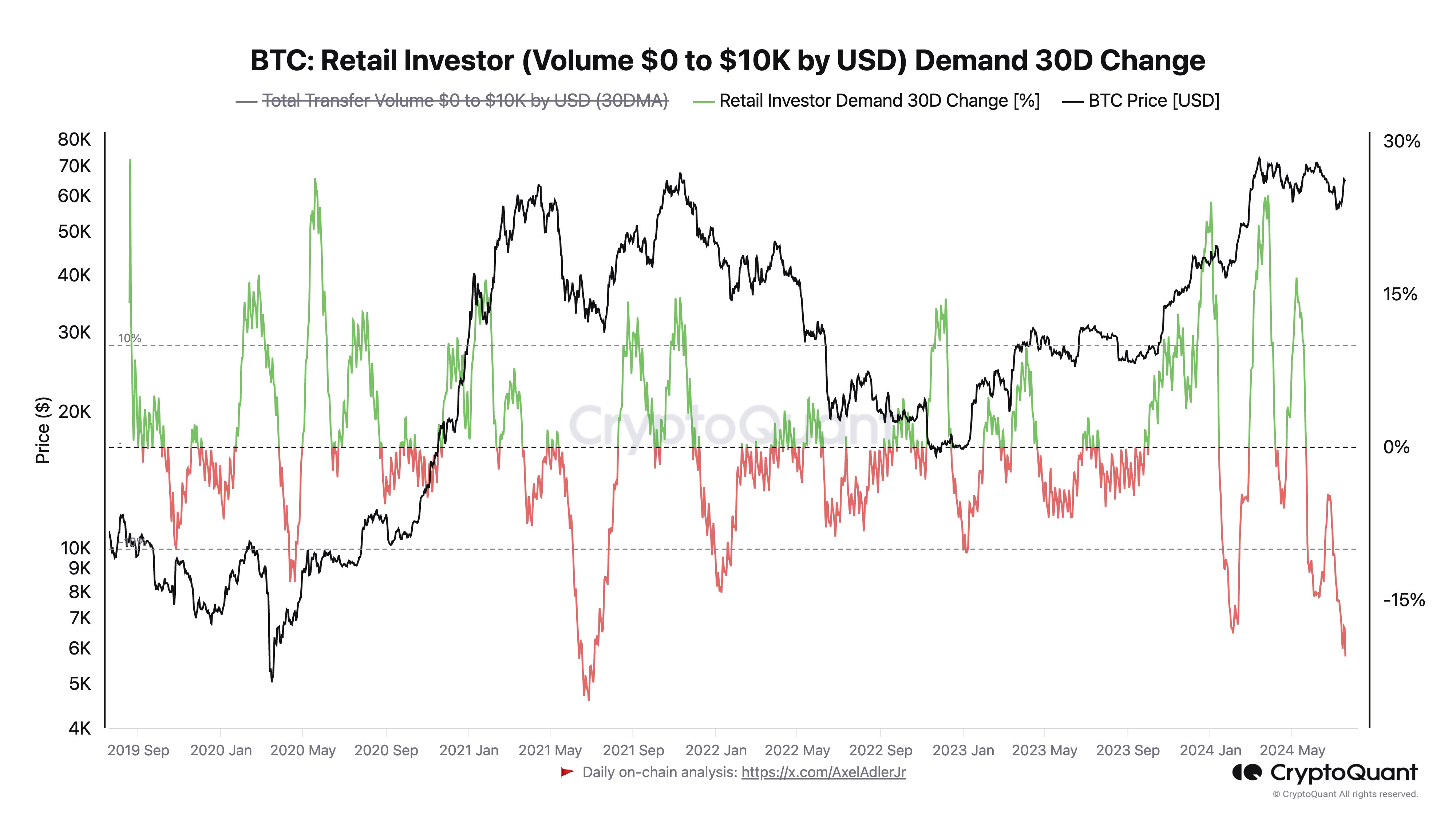

The amount of money small investors are moving around in Bitcoin has plummeted to its lowest point in three years. This is a bad sign for the price of Bitcoin, as it shows that even though the price has been going up recently, people aren’t buying in as much as they used to.

What’s happening?

- Small investors are making fewer transactions: The average transaction size for retail investors is less than $10,000. The amount of money they’re moving around has been shrinking, suggesting they’re not as interested in Bitcoin as they were before.

- Recent price drops have scared them off: The price of Bitcoin has been going up lately, but it’s still not enough to convince small investors to jump back in after the recent price drops.

- Smart money is still buying: While small investors are hesitant, larger investors are still buying Bitcoin, especially when the price dips. This suggests that they believe the price will go up in the future.

What does this mean for Bitcoin?

It’s hard to say for sure what will happen to the price of Bitcoin. It’s possible that the price will continue to rise if larger investors keep buying. However, if small investors stay on the sidelines, it could be harder for the price to break through resistance levels.

The bottom line:

The decline in retail investor interest is a worrying sign for Bitcoin. It remains to be seen whether the price can recover without more support from small investors.