Bitcoin has been on a rollercoaster ride lately, and many investors are wondering if now is the time to buy the dip.

The Dip Might Not Be Over Yet

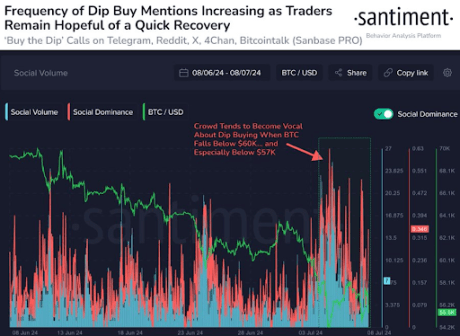

According to Santiment, a platform that analyzes on-chain data, the worst might not be over for Bitcoin. They suggest that the flagship cryptocurrency could experience further dips from its current price range. While some market participants anticipate a rebound, Santiment warns that the recent dip has been met with fear, uncertainty, and doubt (FUD). This means that those looking to buy the dip might need to be cautious, as Bitcoin could fall even further if panicked investors sell their holdings.

Wait for Positive Price Action

Crypto analyst CrediBULL Crypto agrees that those buying Bitcoin at its current price level should be prepared to hold for a while. He advises that anyone uncomfortable with potentially being “underwater” should wait for some positive price action to develop. This could involve a major liquidation flush or some strong price movement on the longer-term charts.

CrediBULL also reassures spot Bitcoin buyers that the current price range doesn’t invalidate the long-term bullish structure. He believes that Bitcoin will eventually reach $100,000, even after this correction.

Institutional Investors Are Buying

Despite the recent dip, institutional investors are still buying Bitcoin. Data from Farside investors shows that Spot Bitcoin ETFs saw significant net inflows on July 8th, with BlackRock, Fidelity, and Grayscale all recording impressive numbers. These inflows contributed to the recent price rebound, and Bitcoin is currently trading above $57,000.

The Bottom Line

While the Bitcoin market remains volatile, there are signs that the dip might be nearing its end. Institutional investors are still buying, and some analysts believe that the long-term bullish trend remains intact. However, it’s important to remember that the market is unpredictable, and those looking to buy the dip should be prepared for potential further declines.