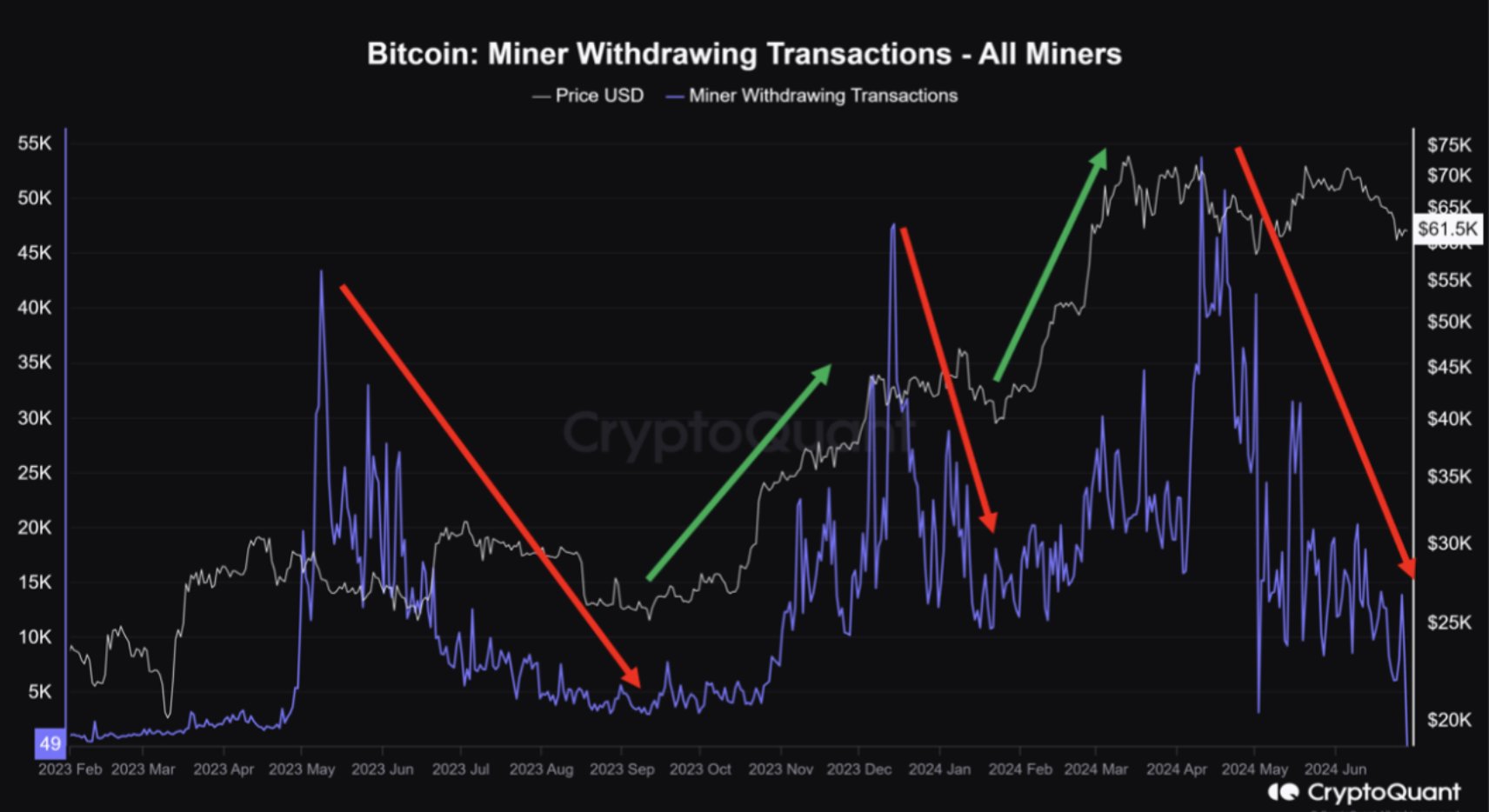

Reduced Miner Selling

CryptoQuant analyst Crypto Dan has observed a decline in miners selling Bitcoin. Miners have been major sellers in recent months, contributing to the market downturn. However, the recent reduction in selling pressure suggests a potential shift.

Market Absorption

The market appears to be absorbing the miners’ sell-off. The volume and frequency of Bitcoin transfers from miners’ wallets have decreased significantly. This indicates that the market is digesting the selling activity.

Bullish Implications

Crypto Dan believes that the weakening miner selling pressure could lead to a bullish rally. Historically, when miner selling activity has decreased, Bitcoin prices have resumed an upward trend.

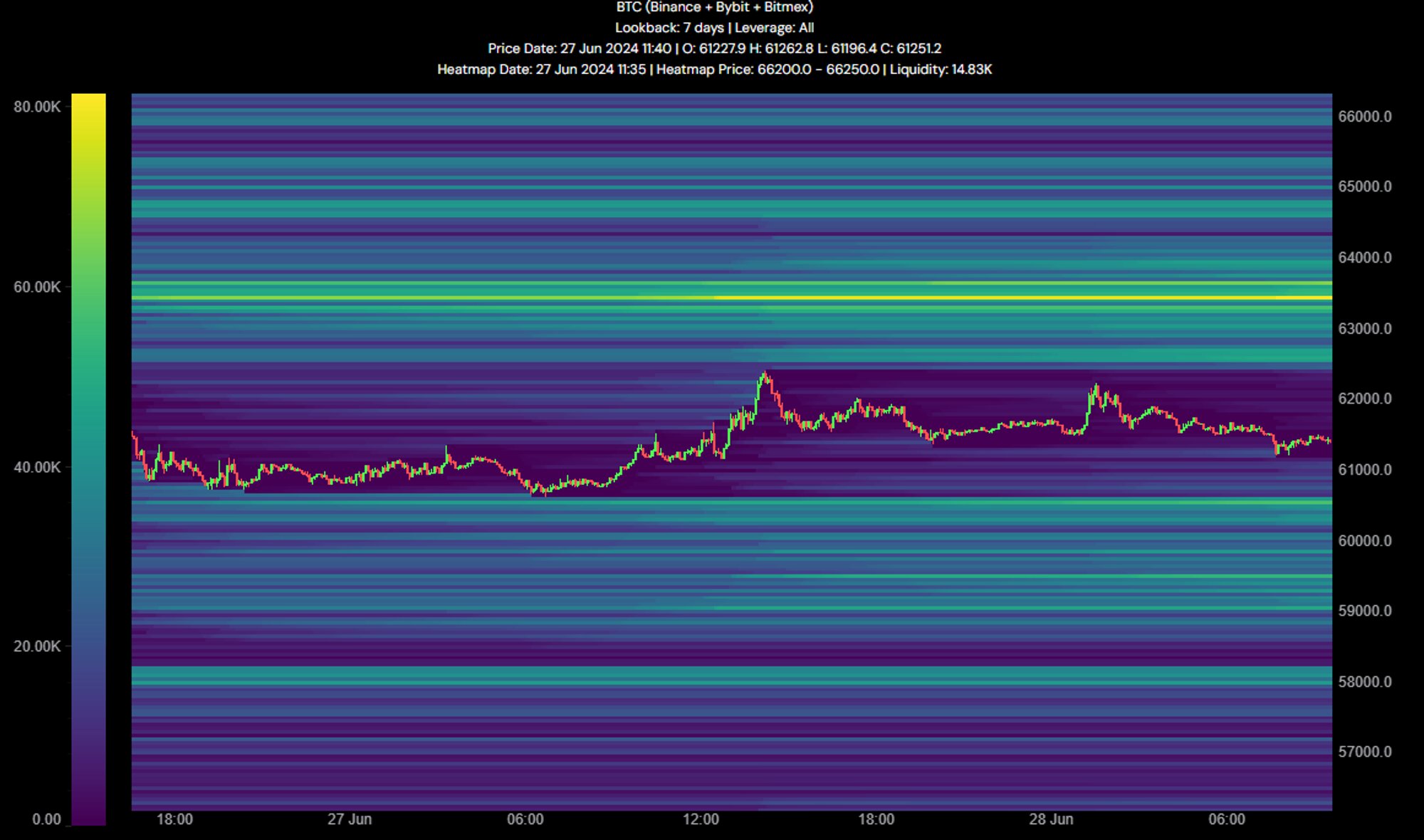

Key Price Levels

Technical analysts from alpha dōjō have identified key price levels for Bitcoin:

- Bullish: Reclaiming $63.5k

- Bearish: Losing $60k

Market Sentiment

The current market sentiment is indecisive, with Bitcoin “chopping around” without a clear direction. However, the order book data shows a dominance of sell orders, indicating a bearish sentiment among traders.

Conclusion

The recent slowdown in miner selling could be a sign of a turning point for Bitcoin. If the market continues to absorb the sell-off and Bitcoin reclaims the $63.5k level, a bullish rally could be in the making. However, the market remains cautious, awaiting more definitive signals before committing to substantial positions.