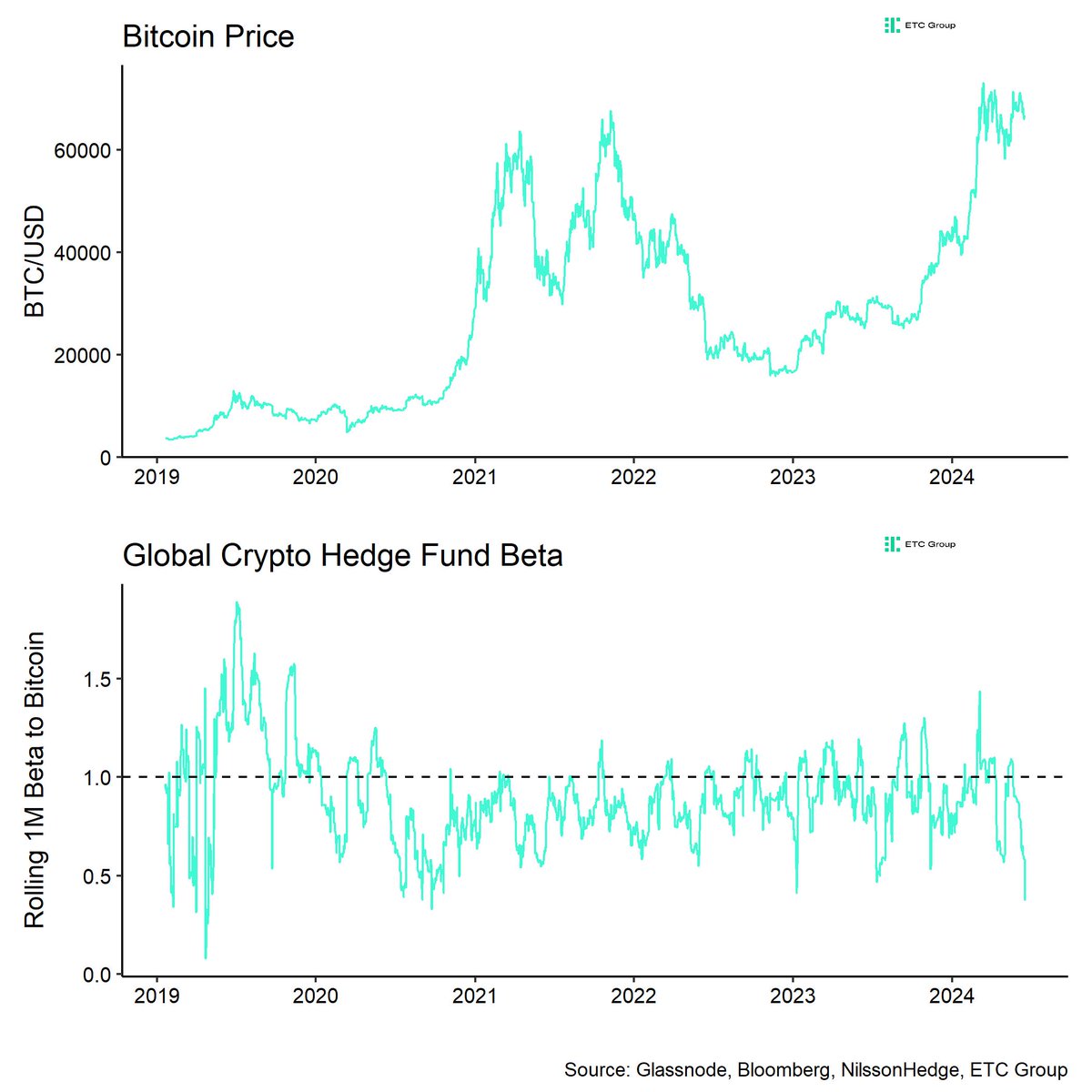

Falling Bitcoin Exposure

Hedge funds are getting cold feet on Bitcoin. Their exposure to the cryptocurrency has dropped to its lowest level since October 2020.

André Dragosch, a research expert, says this shift shows a cautious or even negative view of Bitcoin among professional investors.

Broader Market Trends

This caution aligns with other trends, like reduced investments in crypto exchange-traded products. It suggests that institutional investors are losing confidence in the crypto market.

Bitcoin’s Resilience

Despite the drop in hedge fund interest, Bitcoin has held its ground. It recently reached $66,000 before settling at $65,142.

Factors Driving the Downturn

Several factors are driving the recent market downturn, including:

- Miners selling Bitcoin to cover costs

- Slowdown in stablecoin issuance

- Speculative actions, like the alleged sale of Bitcoin by the German government

Support Levels

Despite the pressures, analysts see a glimmer of hope. Current prices are near support zones that have historically provided a bounce-back effect.