Market Downturn Impact

Amidst a broader market decline, Solana (SOL), known for its fast and affordable transactions, has hit a 45-day low. This has raised concerns among investors about the asset’s short-term prospects.

Underperformance Compared to Peers

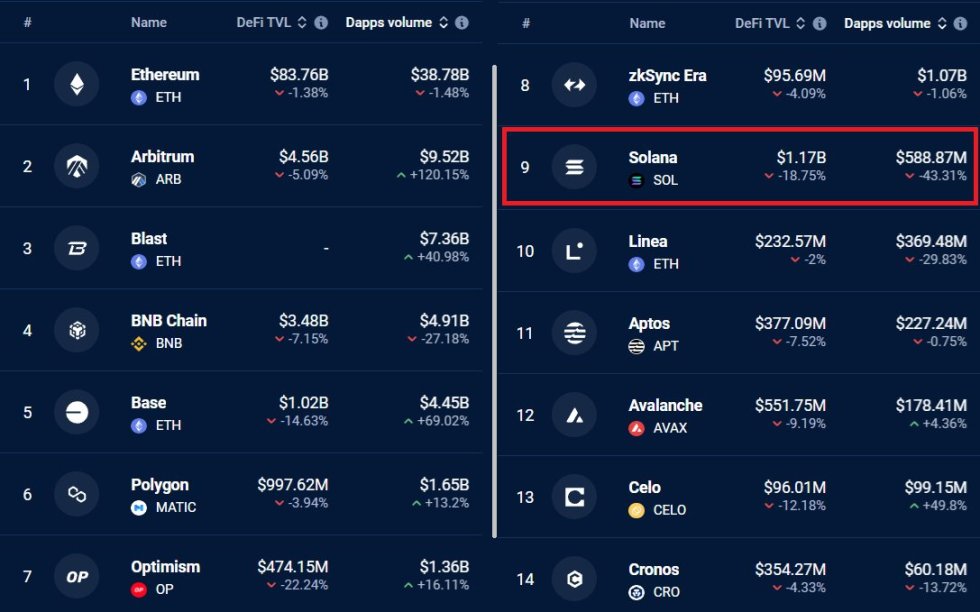

According to trading data, Solana has fallen by 24% since June 7th, underperforming major cryptocurrencies like Ethereum, Arbitrum, and Polygon. This decline reflects a loss of investor confidence in the industry as a whole.

Contributing Factors

The decline is attributed to both general market weakness and specific challenges faced by Solana, including:

- Reduced on-chain activity

- Lack of demand for leveraged positions

- Competition from other smart contract-focused blockchains

Price Outlook

Without increased demand or institutional support, SOL’s valuation could continue to decline, potentially breaking below the $130 support level.

Expert Opinion

Despite the current downturn, some experts remain bullish on SOL. Raoul Pal, CEO of Real Vision, believes that SOL is currently a good entry point for investors and predicts a substantial rise in the autumn. He compares the potential growth to bananas ripening, indicating a positive outlook for the digital asset in the coming months.