Bitcoin has been on a rollercoaster ride lately, despite the surge in buying from spot exchange-traded funds (ETFs) and institutional investors. Here’s what’s behind the recent bearish momentum:

Long-Term Holders Selling

One reason for the selling pressure is the long-term holders (LTHs) who have been holding onto their coins for a long time. When the price of Bitcoin hits new highs, these investors tend to sell a portion of their holdings. This has happened in the past during bull runs, and the recent spike in the Coin Days Destroyed (CDD) metric suggests that LTHs are selling again.

Paper Bitcoin

Another factor is “paper Bitcoin,” which refers to derivatives products that don’t involve owning actual Bitcoin tokens. These products have been growing rapidly, and they can influence the market price without affecting the supply of real Bitcoin.

When paper Bitcoin increases, it can lead to a decrease in bullish momentum, as investors who buy these derivatives are not actually holding onto the underlying asset. This has been happening during the current bull market, and it may be contributing to the recent slowdown in Bitcoin’s price appreciation.

Exchange Inventory

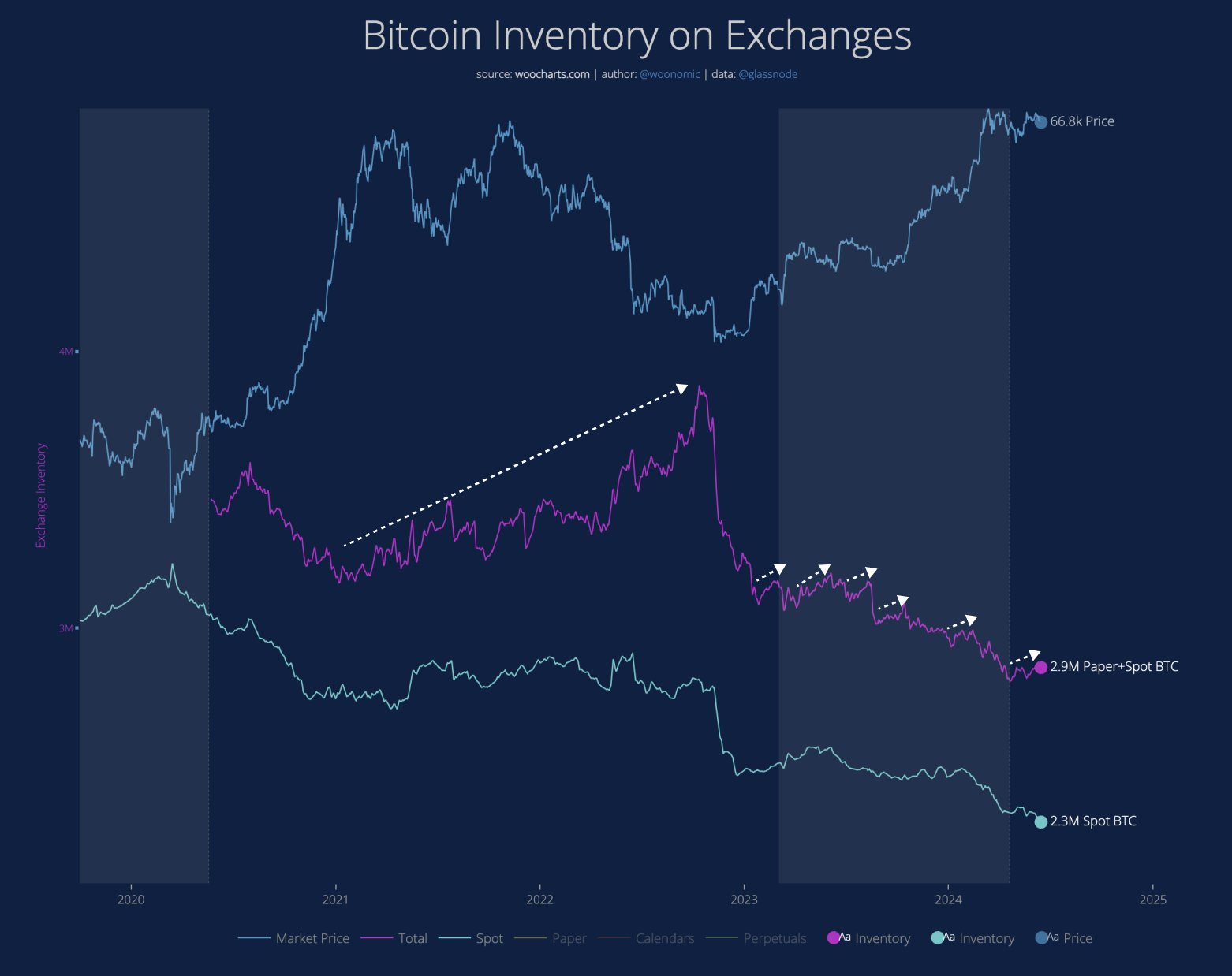

The inventory of Bitcoin on exchanges has also been a factor. In the past, Bitcoin would rise exponentially because there were few sellers. However, today, the magic of paper Bitcoin is what drives the market.

The chart below shows that the spot inventory of Bitcoin has been declining in recent years, but the spot plus paper BTC inventory has been increasing. This suggests that paper Bitcoin has been dictating the bear market.

Current Price

As of today, Bitcoin has retreated to $65,300 after recovering above $66,000 over the weekend. The recent increase in paper BTC inventory may be weighing on the price and preventing it from establishing bullish momentum.