Short-Term Surge Fueled by ETF Craze

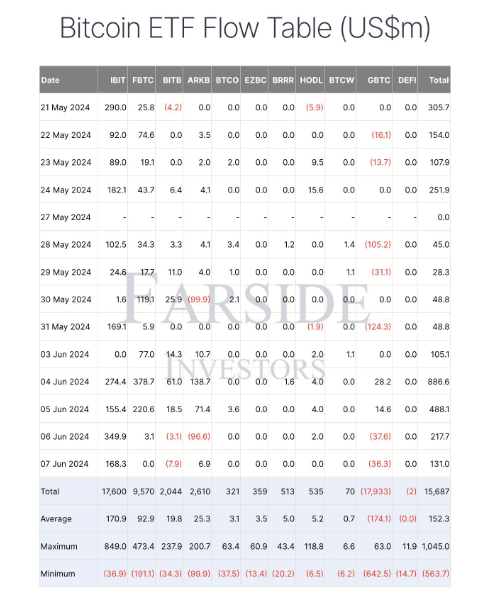

Bitcoin ETFs, which track Bitcoin’s price, have attracted new investors looking for quick profits. This has led to a surge in short-term holders (holding Bitcoin for less than 155 days), whose holdings have jumped by 55% since January.

Long-Term Holders: Unwavering Faith

Despite the short-term hype, long-term holders remain committed to Bitcoin. They’ve been buying back after selling some at its all-time high in March. Most of their Bitcoin was purchased below the current price, indicating a “hodling” mentality. Bitcoin whales are also accumulating aggressively, suggesting a potential market upswing.

Navigating the Crosscurrents

The current market presents a mix of short-term traders and long-term hodlers. While the influx of new investors brings liquidity, it also introduces volatility. Long-term holders provide stability and confidence.

Bitcoin Price Forecast

A technical analysis predicts a potential 29.51% rise in Bitcoin’s price to $87,897 by July 13, 2024. However, the market sentiment is mixed, with a “Greed” reading on the Fear & Greed Index. This suggests caution, as investor optimism can sometimes precede price corrections.