Bitcoin is currently experiencing a phase where struggling miners are selling off their holdings, according to on-chain analyst Willy Woo.

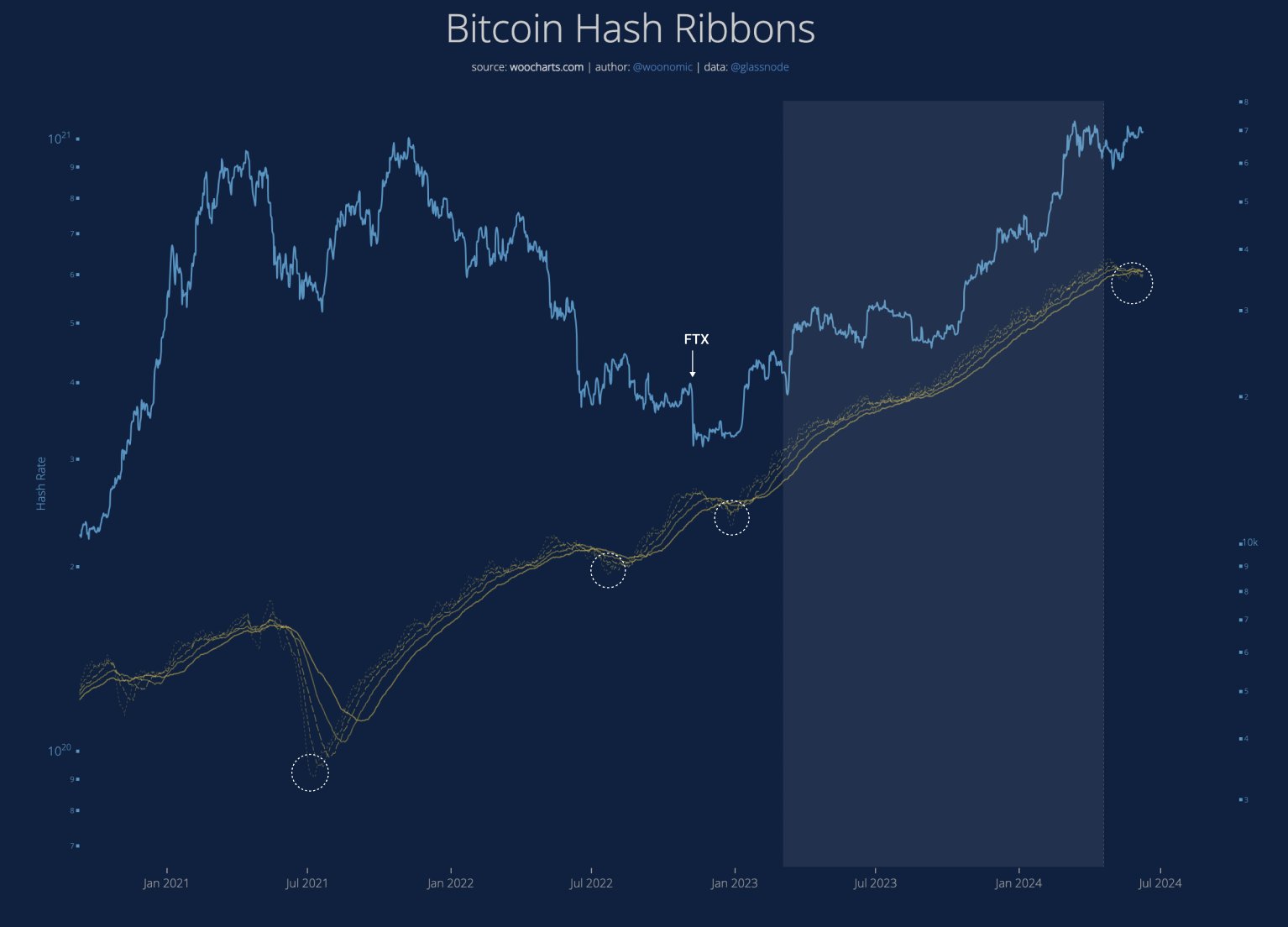

Miner Capitulation

The Bitcoin halving event in April has triggered a “culling” of weak miners. This event, which occurs every four years, reduces the rewards miners receive for verifying transactions, limiting the new supply of Bitcoin.

As these weak miners sell their Bitcoin to stay afloat, the price of Bitcoin tends to drop. However, Woo believes that this selling pressure will eventually subside, paving the way for a price rebound.

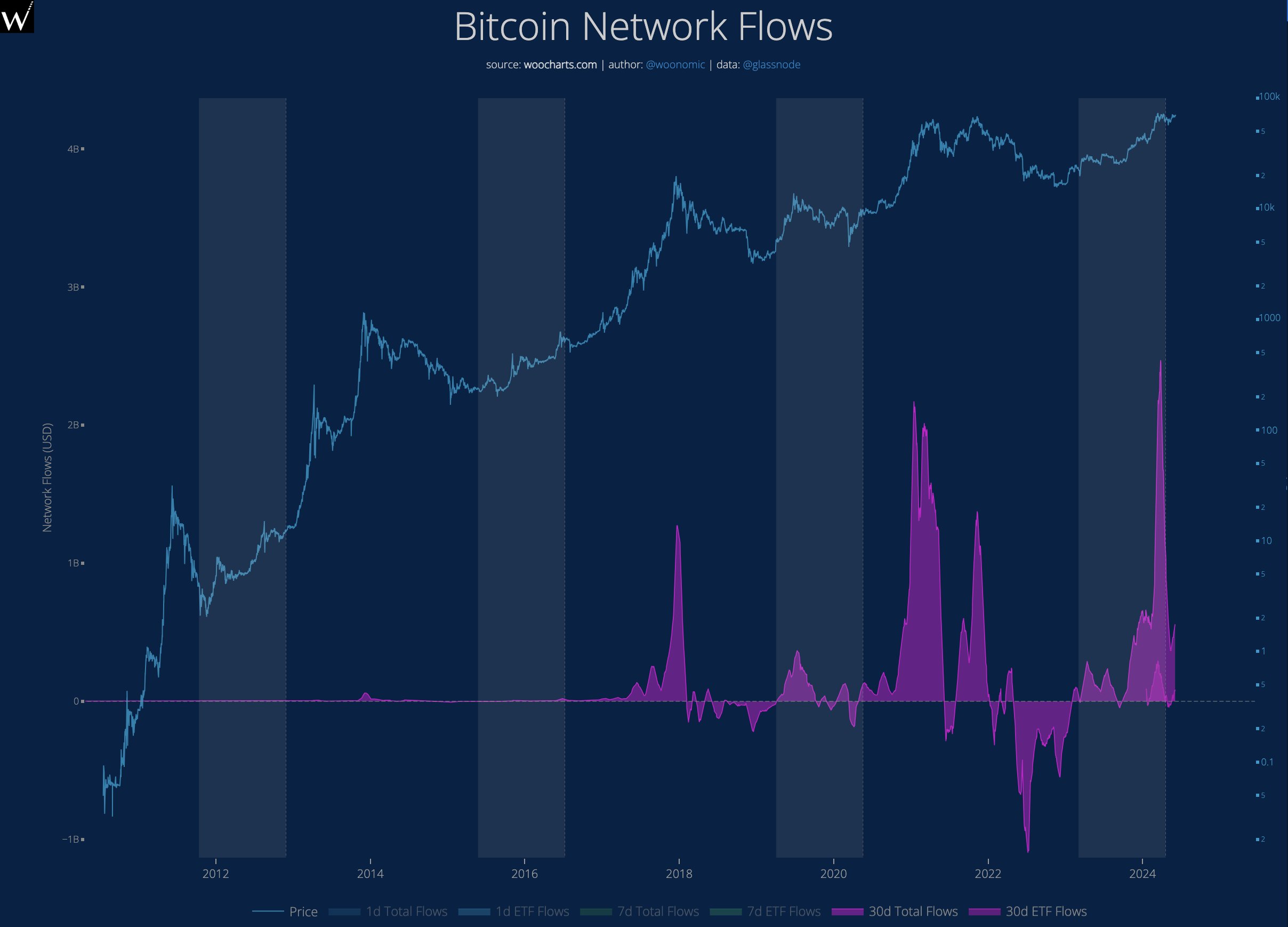

Network Flows

Woo shared a chart showing the flow of capital into and out of the Bitcoin network. He explained that these flows typically increase gradually before experiencing a sudden surge.

Market Conditions

At the time of writing, Bitcoin is trading at $66,681, down about 5% in the past day and 5.5% in the past week. It remains below its all-time high of $73,738 set in March.