Economist Henrik Zeberg predicts that the current “everything bubble” in the economy will continue to inflate.

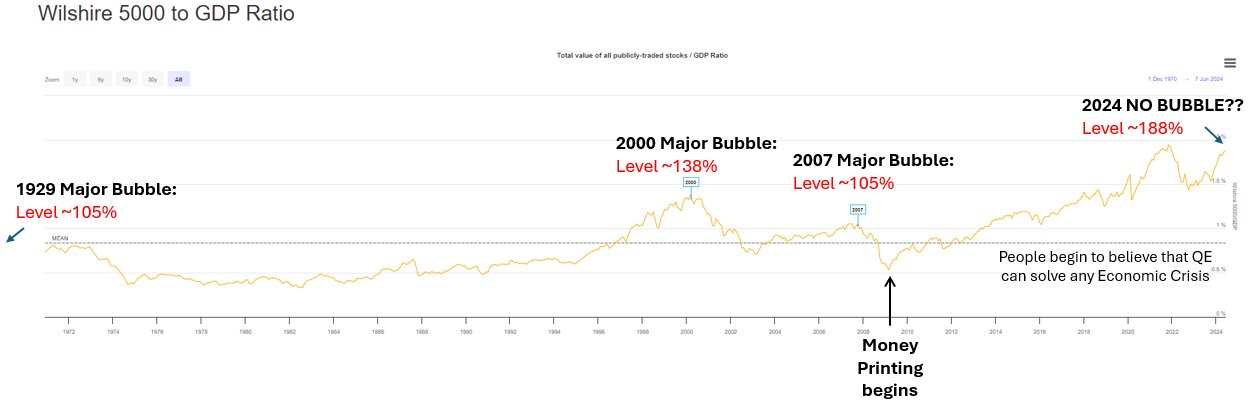

Market Capitalization to GDP Ratio

Zeberg highlights the historical significance of this ratio, which measures the value of all publicly traded stocks relative to the size of the economy. He notes that this ratio has reached unprecedented levels of 188%, surpassing previous bubble periods in 1929, 2000, and 2007.

Private Markets Boom

Zeberg also points to the remarkable growth in private markets over the past decade, with assets under management surging from $9.7 trillion in 2012 to an estimated $24.4 trillion in 2022.

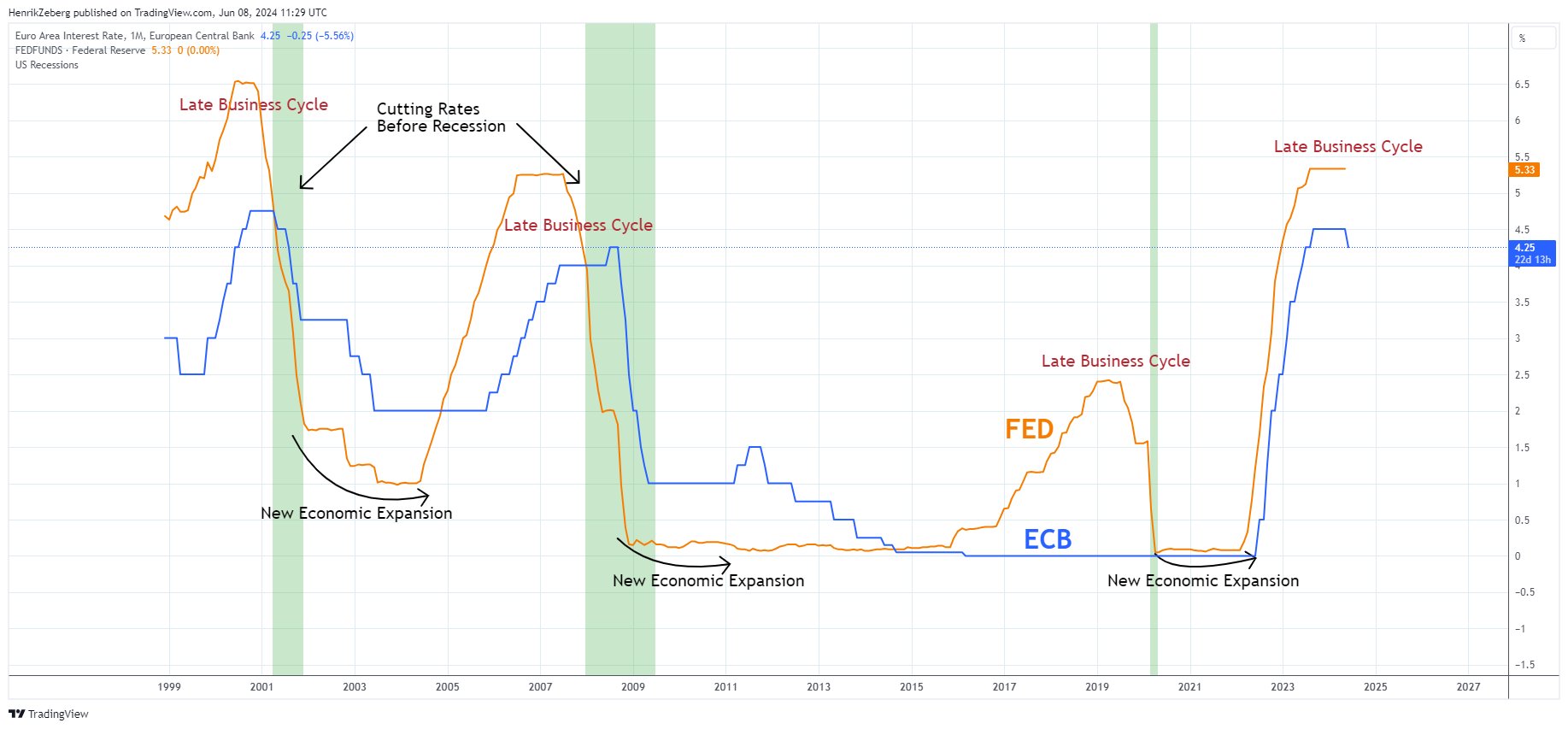

Central Bank Policy

Zeberg warns that central banks, such as the Federal Reserve and the European Central Bank, tend to cut interest rates shortly before a recession. He notes that the ECB recently cut its rates, which could indicate an impending economic downturn.

Federal Reserve’s Next Move

The Federal Reserve is expected to announce its decision on interest rates at its June 12th meeting. Zeberg predicts that the central bank will likely keep rates unchanged.