Accumulation on the Rise

Bitcoin investors have been on a buying spree, snapping up more than 5 times the amount of BTC that miners have produced recently.

Investor Activity vs. Miner Production

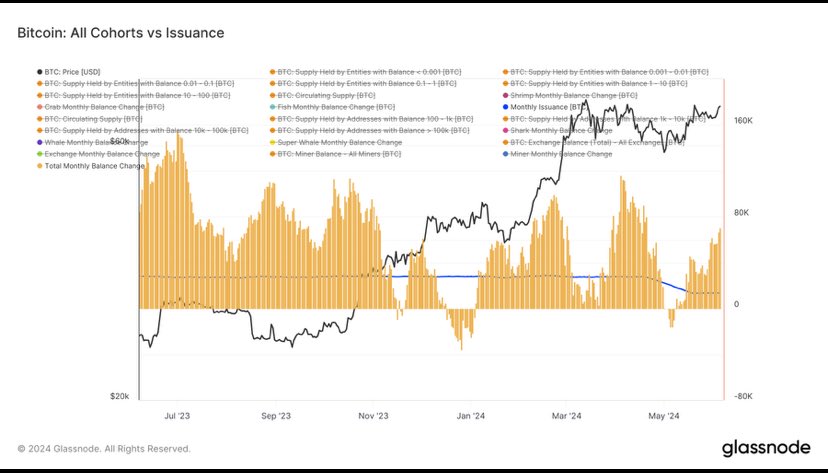

The chart below shows the net flow of BTC into investors’ wallets (blue line) compared to the monthly issuance by miners (red line).

[Image of chart showing net flow and monthly issuance]

As you can see, investors have been buying BTC faster than miners can create it. Over the past 30 days, investors bought 71,000 BTC, while miners produced only 13,000 BTC.

Where’s the Extra BTC Coming From?

Investors are getting their hands on BTC by withdrawing it from centralized exchanges. The Bitcoin Exchange Reserve has been declining steadily.

ETF Inflows vs. Investor Demand

Recent ETF inflows have brought $1.4 billion worth of BTC into the market. However, investors’ monthly net accumulation is a whopping $5.1 billion. This shows that the market demand is strong, even without ETF inflows.

Bitcoin Price

After a surge earlier in the week, Bitcoin’s price has stabilized around $71,000.