Key Findings

VanEck, a leading investment manager, predicts a remarkable surge in Ethereum’s value over the next decade.

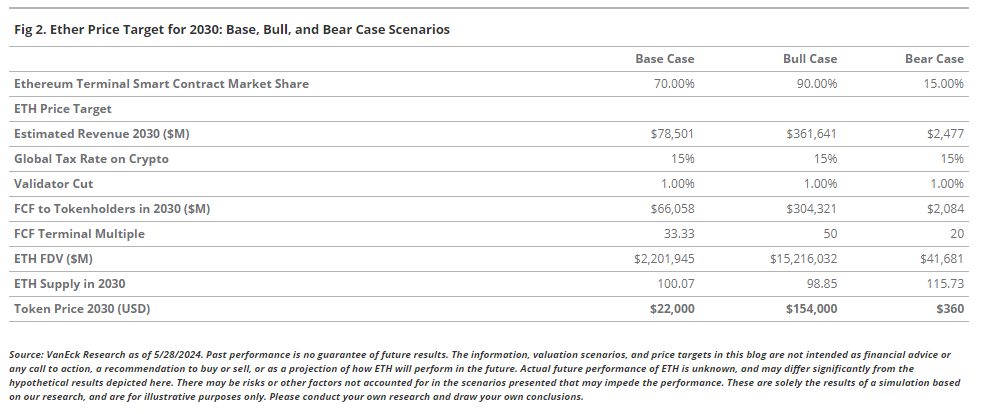

- Base Case Target (2030): $22,000 (472% gain)

- Bull Case Target (2030): $154,000 (3,905% gain)

Driving Factors

VanEck attributes Ethereum’s potential rally to an increase in its free cash flows, which represent the network’s earnings after deducting operating costs.

Ethereum’s Strength

- Generates more revenue per user than major brands like Apple Music and Netflix.

- Supports a thriving digital economy with millions of active users and billions of dollars in transactions.

Downside Risks

- Regulatory uncertainties, such as potential classification of ETH as a security.

- Lobbying efforts by large financial institutions could hinder Ethereum’s growth.

Current Value and Comparison

As of writing, Ethereum trades at $3,845. VanEck emphasizes that Ethereum’s current revenue generation surpasses that of some household brands.