Inflows Drive Rally

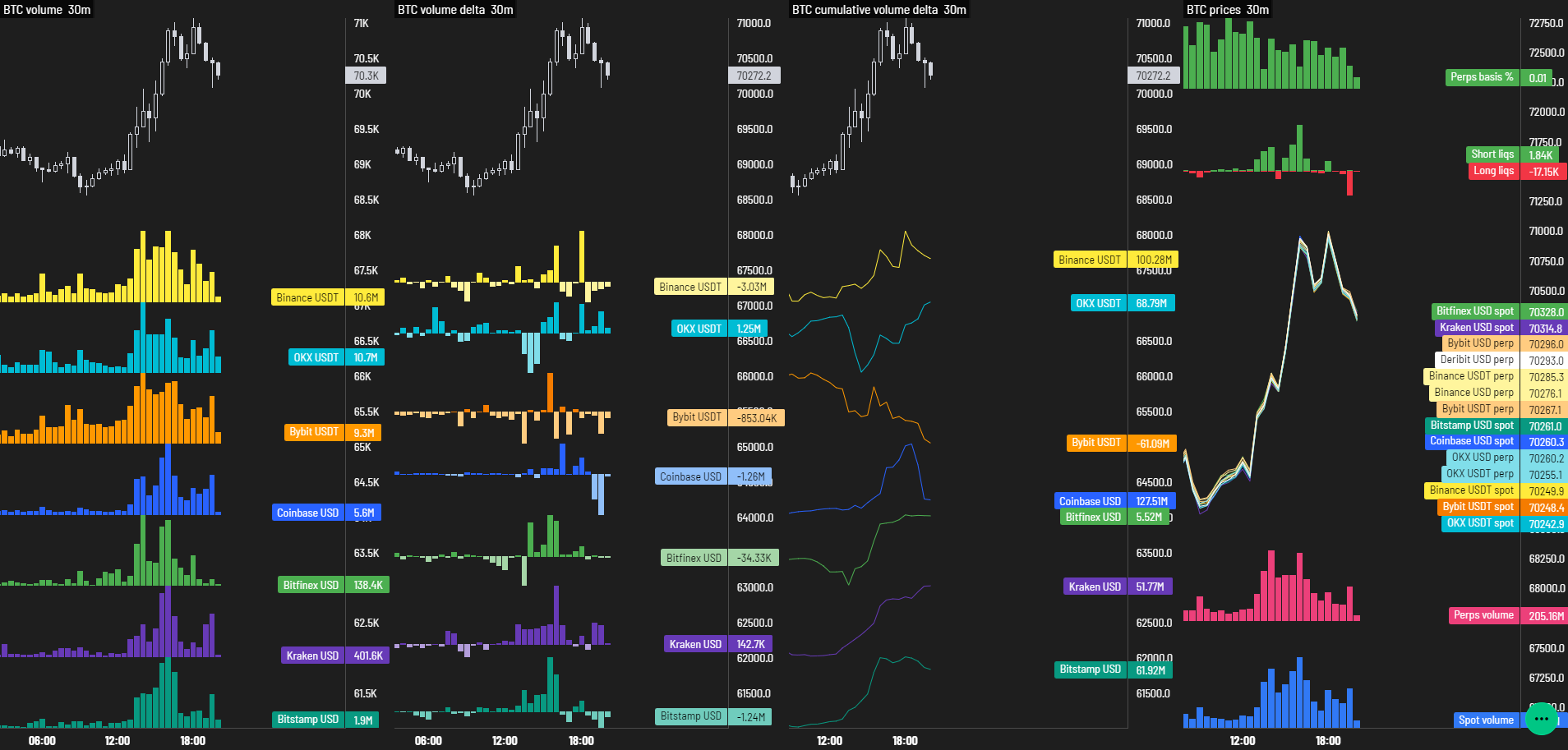

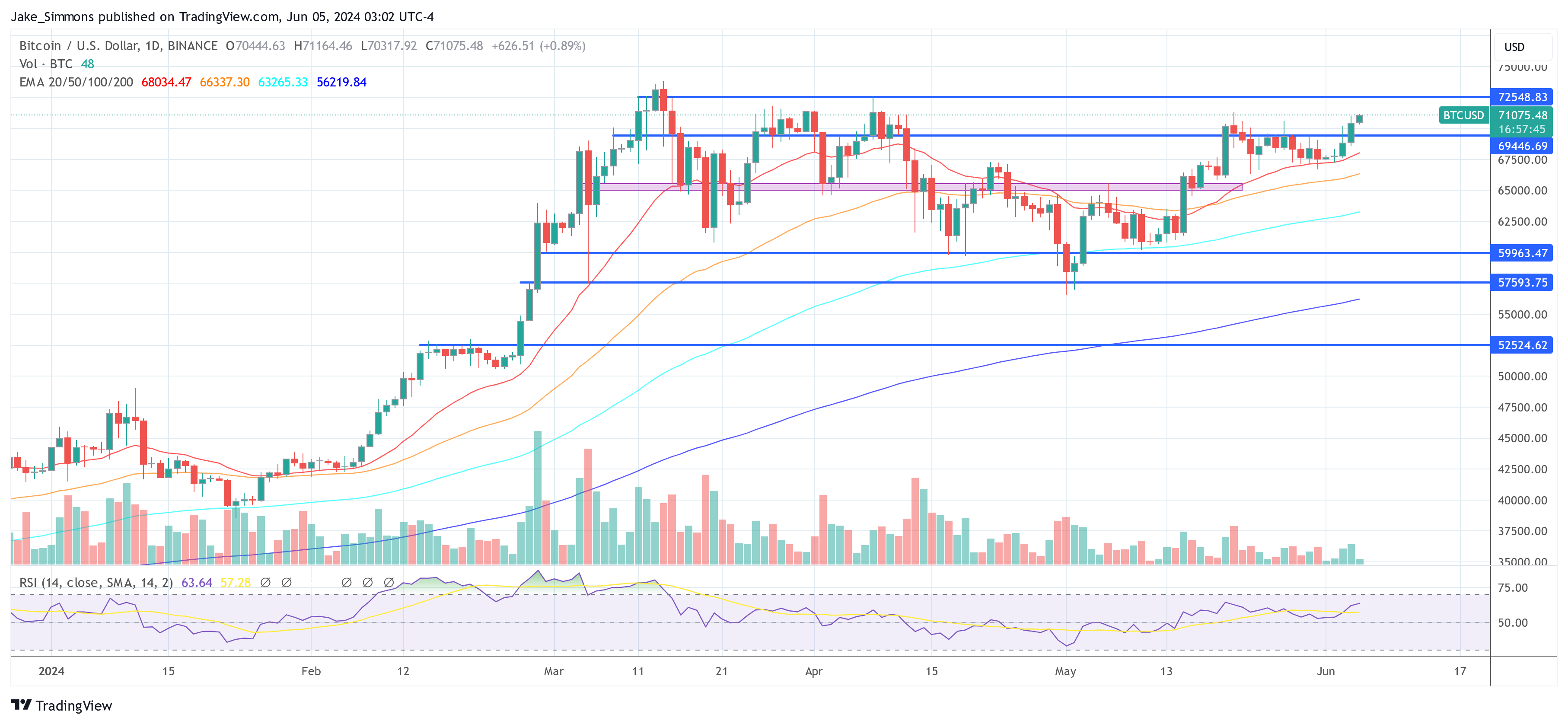

Bitcoin has surged 2.9% in the past 24 hours, hitting a high of $71,166. This rally is largely attributed to strong inflows into US spot Bitcoin ETFs.

These ETFs have seen a record 16 consecutive days of net inflows, with yesterday alone seeing $886.6 million flowing in. Fidelity led the way with $378.7 million, followed by BlackRock with $274.4 million.

Institutional Interest

BlackRock’s iShares Bitcoin ETF has surpassed $20 billion in assets, making it the fastest ETF to reach this milestone. This reflects significant institutional momentum and investor enthusiasm.

Analyst Perspectives

Eric Balchunas, a Bloomberg ETF analyst, emphasized the scale of the inflows, stating that Fidelity and BlackRock have contributed significantly to the recent surge.

However, Byzantine General, a crypto analyst, noted that the price surge could have been more pronounced due to passive supply on spot exchanges.

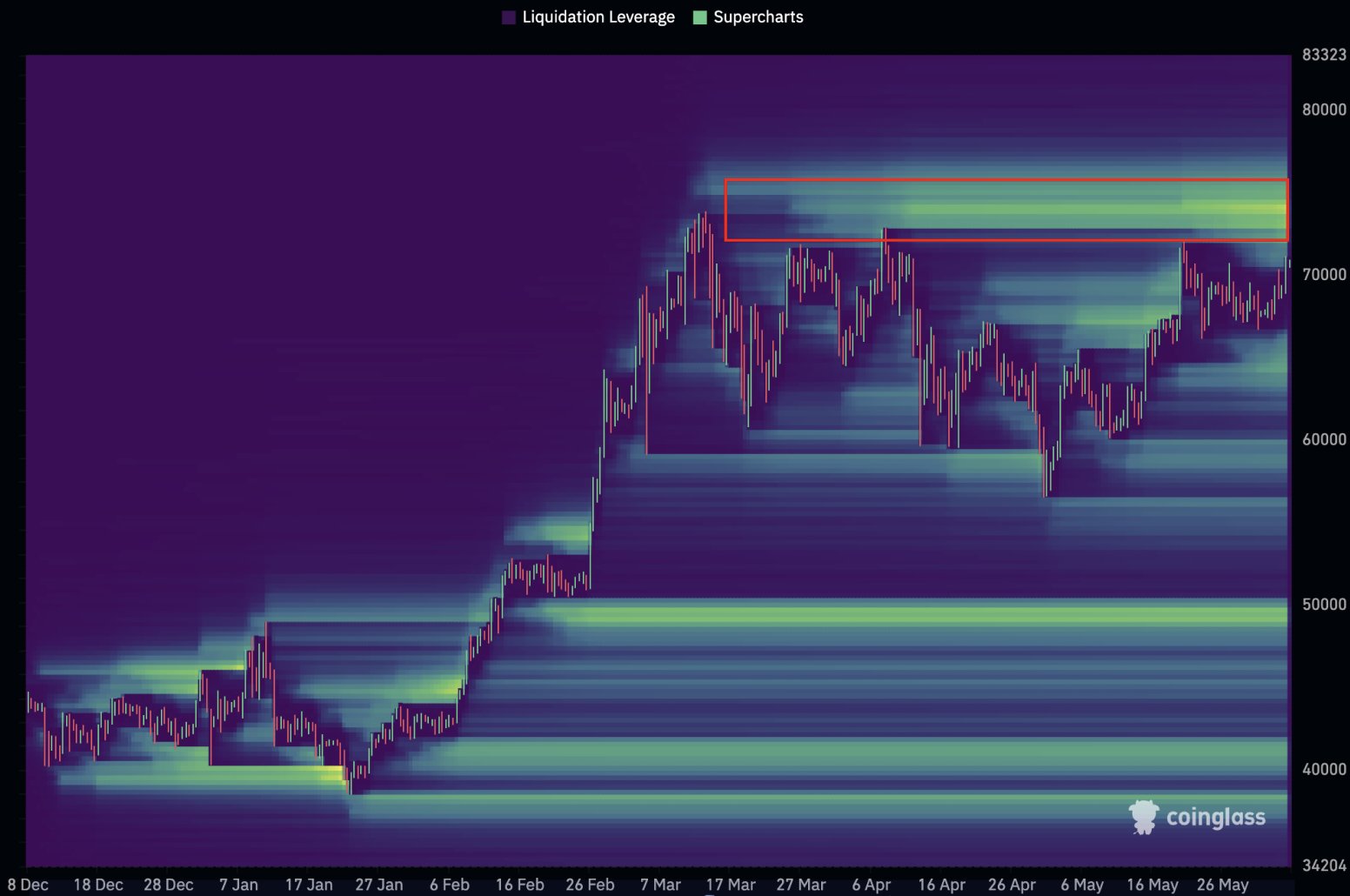

Short Squeeze Potential

Willy Woo, an on-chain analyst, warned that a continued rise in price could trigger a significant short squeeze, as there are $1.5 billion of short positions ready to be liquidated.

At the time of writing, Bitcoin trades at $71,075.