Ethereum Exchange Netflow Spikes

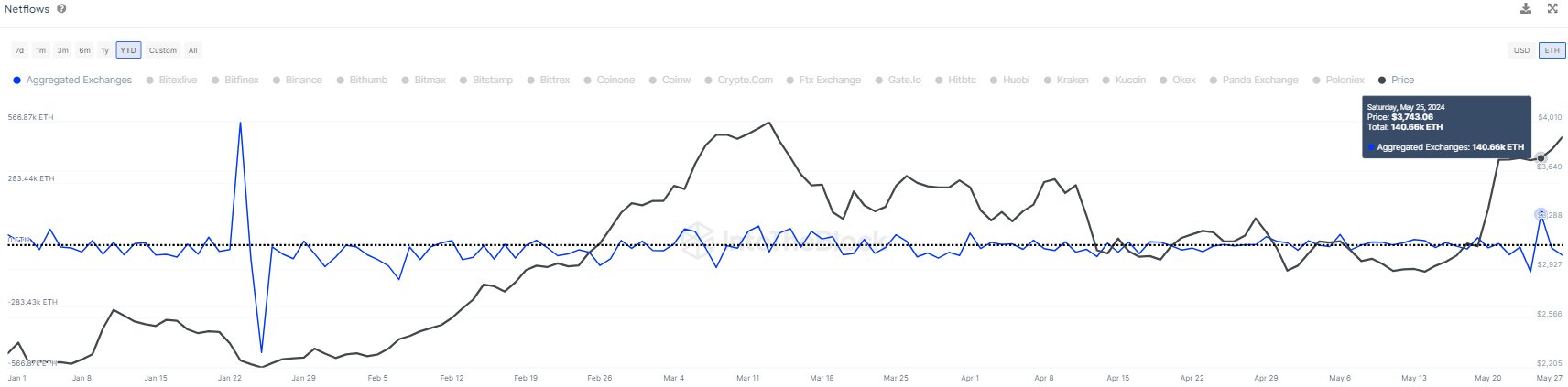

On-chain data reveals a recent spike in Ethereum exchange netflow, indicating a potential increase in deposits. This metric measures the net amount of ETH entering or leaving exchange wallets.

Positive Netflow: Bearish Signal?

Positive netflow typically suggests investors are depositing ETH for selling purposes, which could lead to a price decline.

Recent Spike: Largest in Months

The recent spike saw exchanges receive over $547 million worth of ETH in net deposits, the largest since January.

Whales in the Spotlight

Analytics firm IntoTheBlock suggests that whales may be behind the inflows. However, the asset’s price has risen since the deposits, indicating that whales may not have sold yet.

Market Absorption or Whale Sell-Off?

It’s unclear if the whales plan to sell or if the market demand has absorbed the selling pressure. If the whales do sell, Ethereum could experience a bearish impact.

Ethereum Price Update

Ethereum recently recovered from a pullback and is currently trading above $3,900.