Crypto analyst Ted has shared evidence that suggests the current Bitcoin bull run is far from over. Here are four key reasons why:

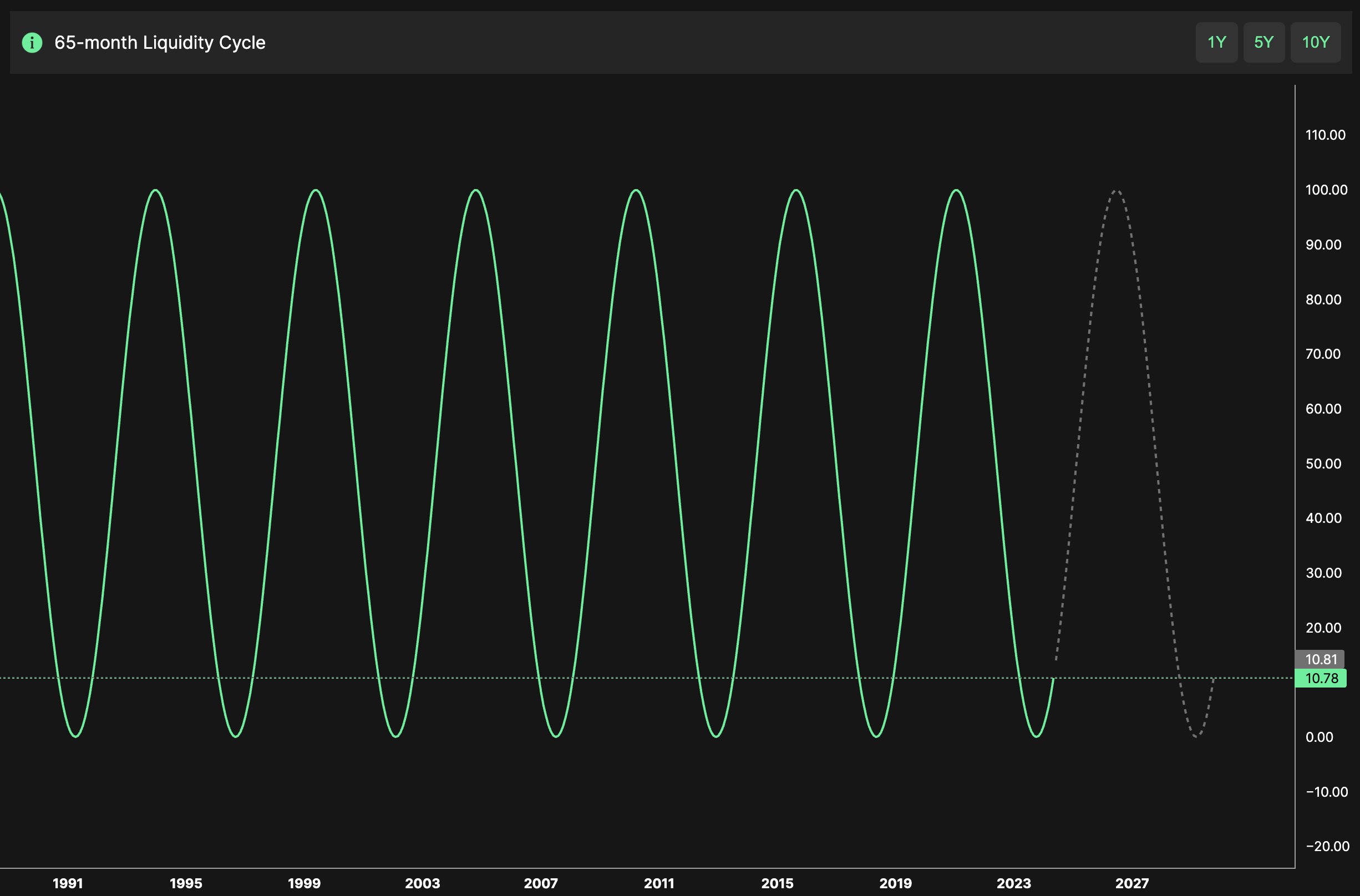

1. Liquidity Cycle

Bitcoin follows a 65-month liquidity cycle, which is currently in an expansion phase that began in October 2023. This expansion is expected to peak in 2026, coinciding with central banks easing monetary policies. Historically, increased liquidity has fueled bull markets in various assets, including Bitcoin.

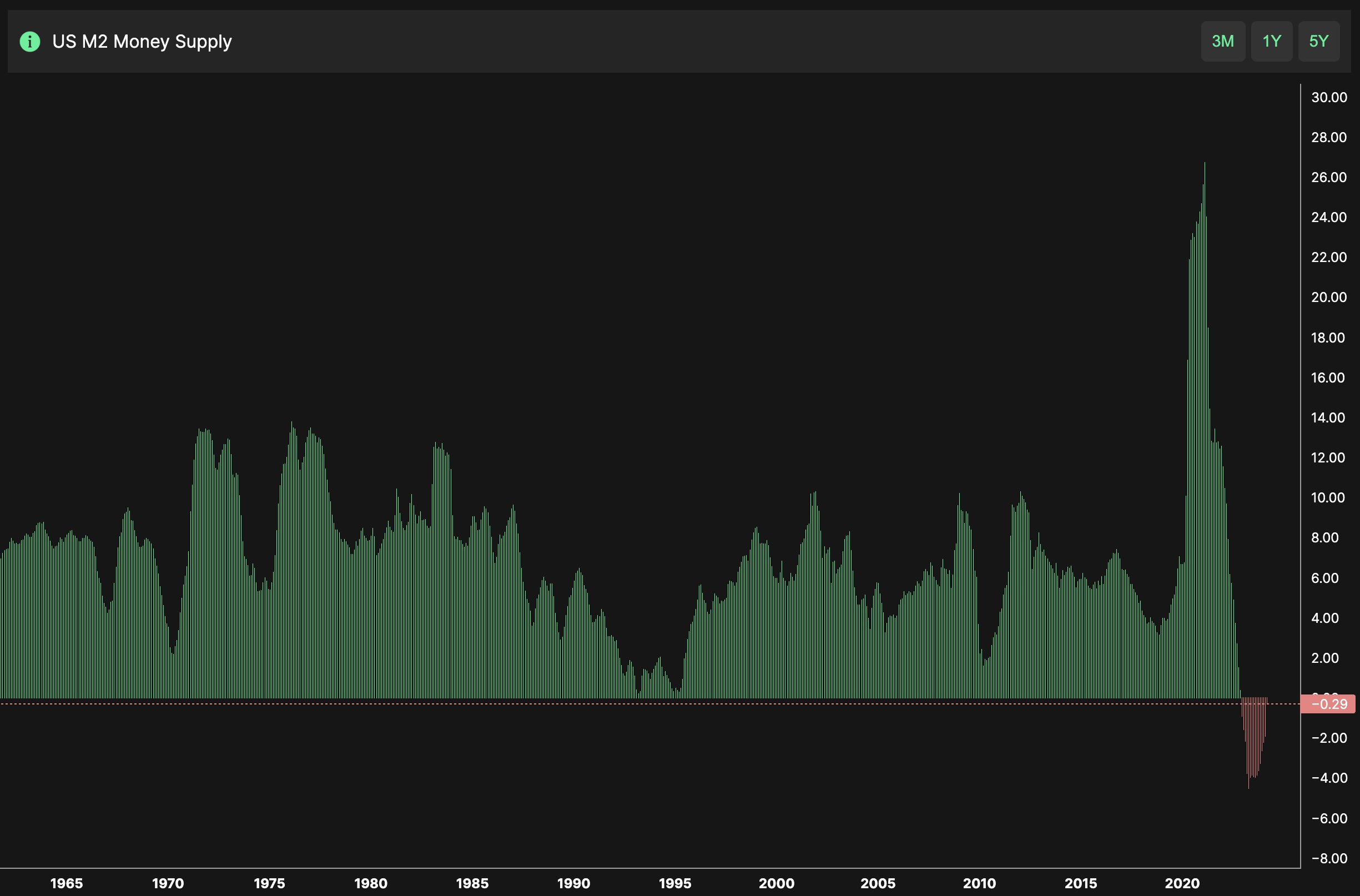

2. Money Supply

The M2 money supply, which measures cash and easily convertible funds, is at its lowest growth rate since the 1990s. This indicates that there is room for central banks to ease liquidity conditions. As they do, more capital could flow into risk assets like Bitcoin.

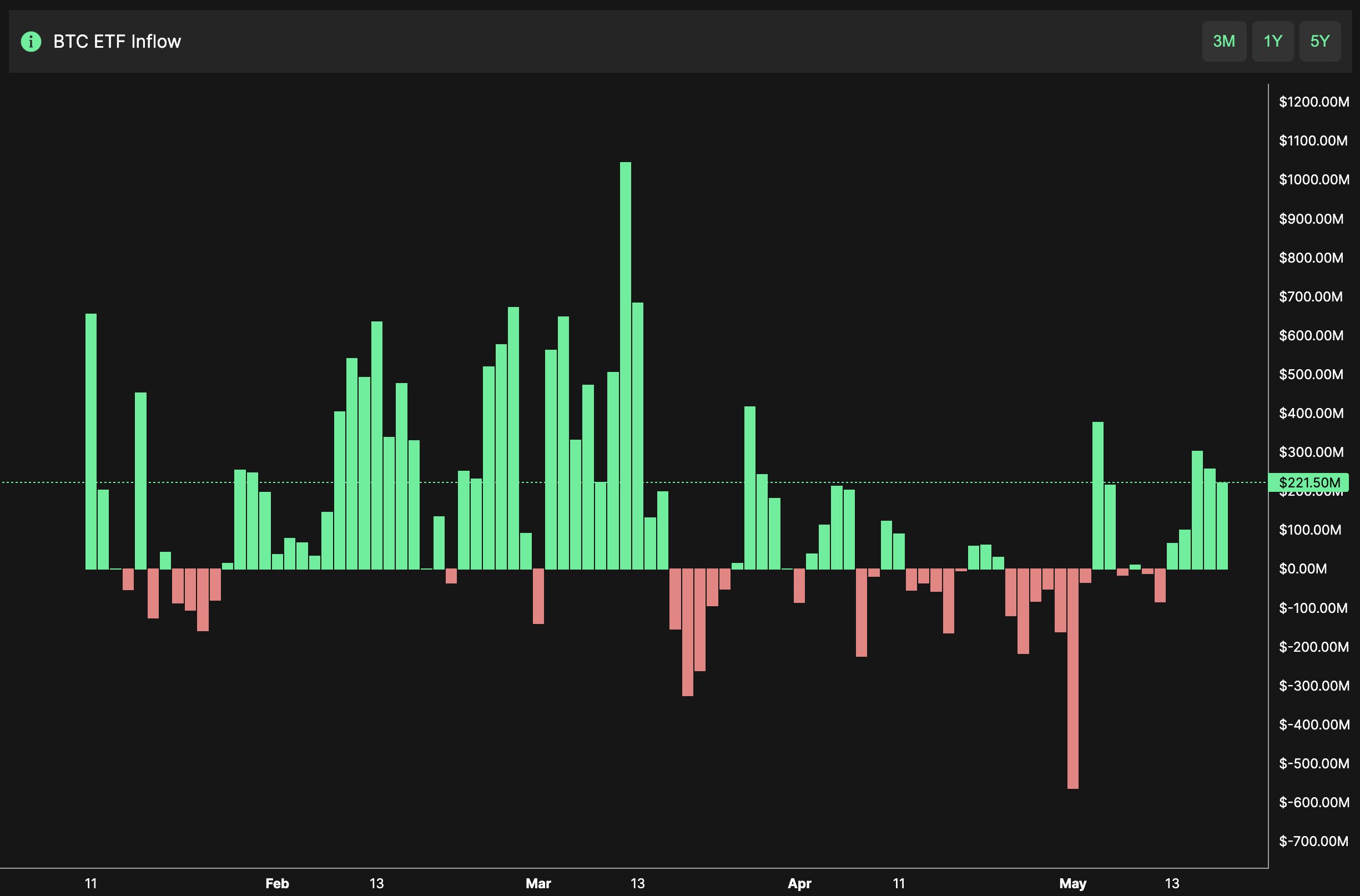

3. Crypto Liquidity

While liquidity has returned to crypto markets, the rate of inflows has not yet reached the levels seen at cycle tops. This suggests that the market is not yet in a speculative frenzy, which can provide a more stable foundation for price increases.

4. Spot Bitcoin ETF Flows

Spot Bitcoin ETFs have seen significant inflows, indicating growing acceptance and investment from institutional investors. As Bitcoin’s price rises, these inflows are expected to increase, providing a strong bullish signal for Bitcoin’s continued ascent.

These factors combined point to a sustained bull market for Bitcoin. As central banks potentially ease monetary policies and institutional interest continues to grow, the conditions are favorable for Bitcoin’s bull run to extend into the coming years.