Hashrate Hiccup or Miner Exodus?

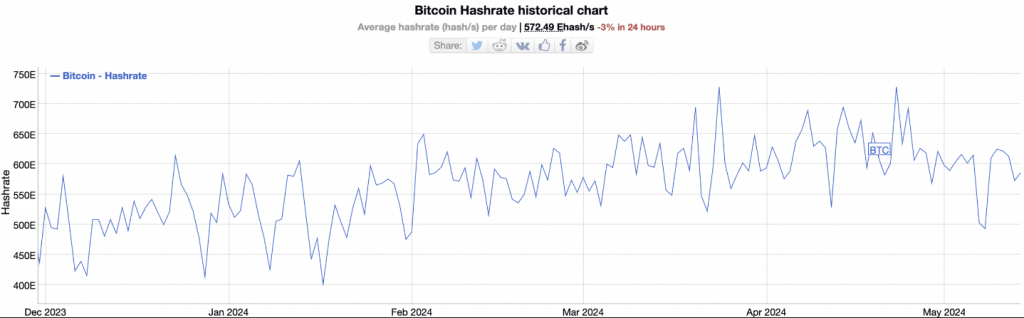

After a surge in Bitcoin’s hashrate (computational power) following the block reward halving in April, it has unexpectedly dropped by 20%. This has sparked speculation about a potential “miner capitulation,” where less efficient miners are shutting down operations due to reduced profits.

Hash Ribbons Flash Warning

Hash Ribbons, a technical indicator, has widened, indicating a decline in mining activity. This has historically coincided with price lows for Bitcoin.

Bitcoin Miners Selling Off?

The Bitcoin Miner Reserve has also decreased, suggesting miners may be selling their mined coins to cover costs or exit the market.

Undervaluation Signal or Cyclical Dip?

Some analysts interpret these signs as a bullish indicator, arguing that Hash Ribbons often point to buying opportunities. The Market Value to Realized Value (MVRV) ratio also suggests Bitcoin may be undervalued.

Not Everyone on the Capitulation Train

However, not all analysts agree. Some believe the hashrate decline could be temporary due to factors like weather events or post-halving adjustments.

Conclusion

The post-halving Bitcoin landscape is still evolving. While the hashrate decline and other signs suggest a potential buying opportunity, the situation remains fluid. Long-term investors may consider this as a possible entry point, but caution is advised.