Stablecoin exchange inflows have taken a nosedive, and that’s not good news for Bitcoin.

Ethereum-Based Stablecoins: Low Exchange Deposits

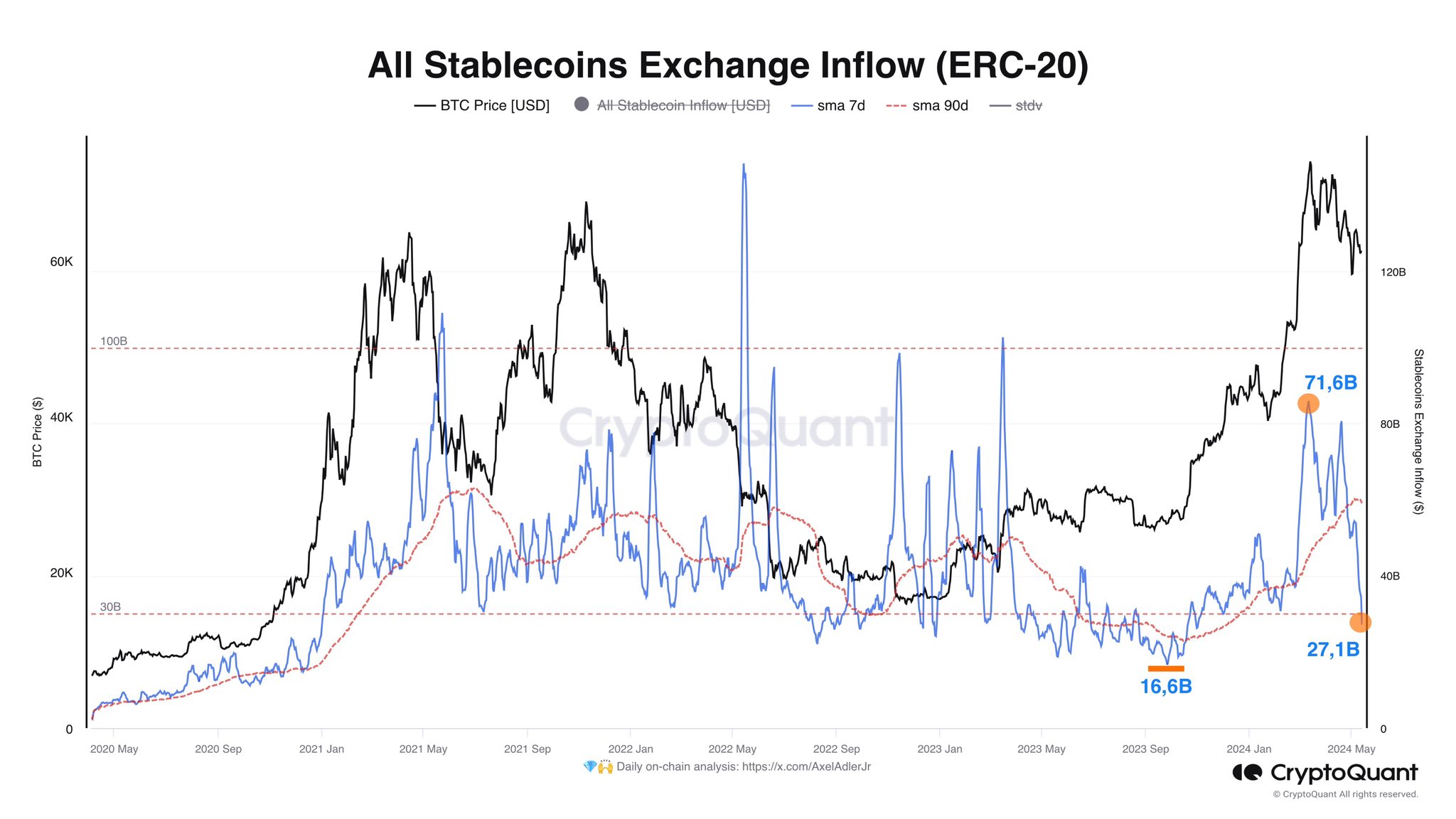

CryptoQuant’s Axel Adler Jr. noticed that Ethereum-based stablecoins are seeing fewer exchange deposits than usual. Exchange inflows track how much of a cryptocurrency is being sent to exchanges.

When inflows are high, it means people are sending coins to exchanges to trade them. For Bitcoin, this can be bearish because it suggests people are selling.

Stablecoins: Not Affected by Price, but Still Impactful

Stablecoins are different because their value is pegged to $1. So, selling them doesn’t affect their price. However, exchange inflows of stablecoins still matter.

If people are cashing out stablecoins, it means money is leaving the crypto market, which is bearish. If they’re using stablecoins to buy Bitcoin, it’s bullish.

Exchange Inflows: A Bearish Signal for Bitcoin

The chart below shows that exchange inflows for Ethereum-based stablecoins have dropped below the 90-day average. This means stablecoin holders are less interested in buying Bitcoin.

“This drop in volume is a negative signal,” says Adler.

Bitcoin Price

Despite the drop in stablecoin inflows, Bitcoin has been trying to recover. It’s currently trading above $63,000.