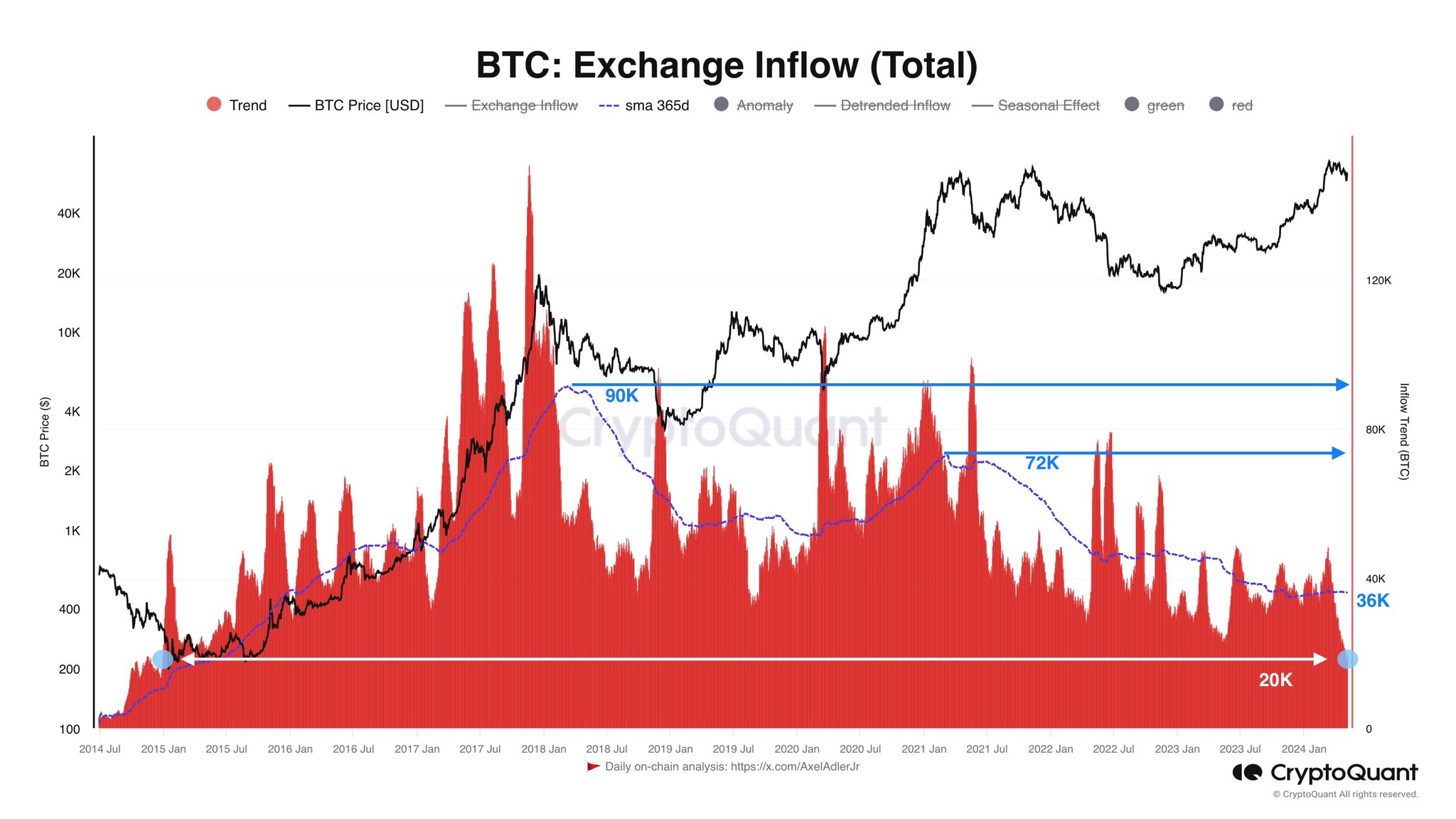

Declining Exchange Inflows

Data shows that Bitcoin exchange inflows, the amount of Bitcoin deposited into centralized exchange wallets, have been at their lowest in almost a decade. This suggests that investors are less inclined to sell their coins.

Supply-Demand Dynamics

When exchange inflows are low, it means that the supply of Bitcoin available for sale is reduced. This can create a bullish effect on the price, as demand remains high while supply is limited.

Alternative Investment Options

One possible explanation for the low inflows is the emergence of alternative investment options for Bitcoin, such as spot exchange-traded funds (ETFs). These ETFs allow investors to gain exposure to Bitcoin without having to hold the coins themselves, which may have reduced the need to deposit coins on exchanges.

Current Market Conditions

Bitcoin’s price recently surged above $65,000 but has since retreated to around $63,100. It remains to be seen whether the low exchange inflows will continue to support the price or if other factors will influence the market.