Price Drop Sparks Liquidations

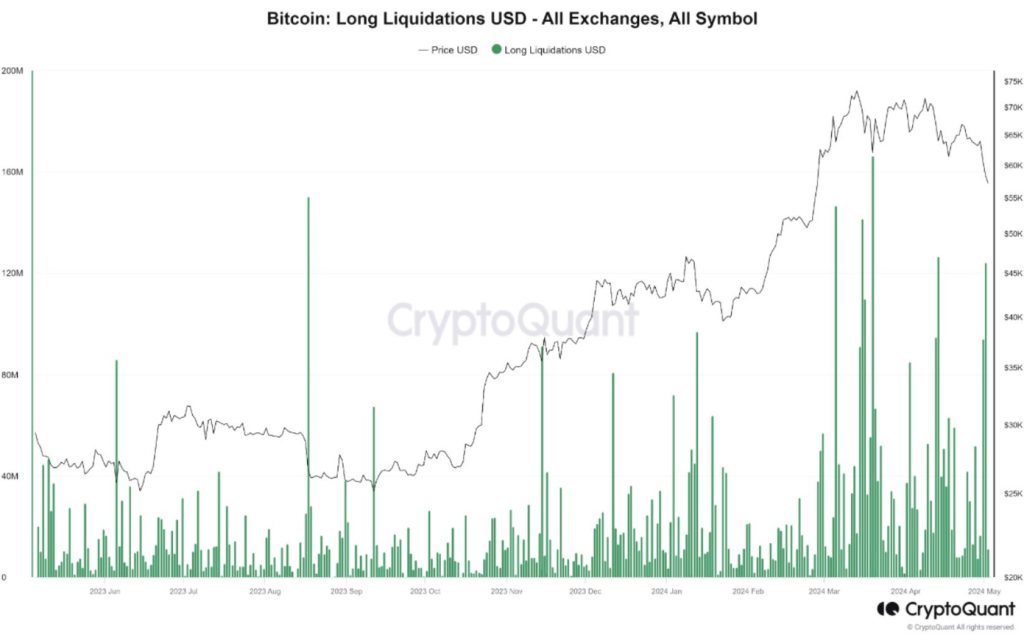

Bitcoin’s recent dip below $59,000 sent shockwaves through the market. This triggered $120 million in liquidations of futures contracts that bet on a price increase.

Not a Mass Exodus

Unlike previous selloffs, this liquidation doesn’t indicate a panicked sell-off. Investors are taking a measured approach, suggesting a short-term correction rather than a long-term bear market.

Hope for Long-Term Investors

Despite the short-term uncertainty, long-term investors have reasons to be optimistic. On-chain metrics hint at a potential future upswing. This could present a buying opportunity if a significant capitulation event occurs in the futures market.

Navigating the Volatility

Understanding market sentiment is crucial for making informed decisions. The funding rate, an indicator of sentiment, has dipped into negative territory, suggesting a stronger presence of bears. However, it’s not as extreme as during previous downturns, leaving the overall sentiment unclear.

Long-Term Story Unwritten

Bitcoin’s price drop has caused volatility, but the long-term story remains unwritten. Investors who can analyze market data and make strategic decisions are likely to profit from future moves.