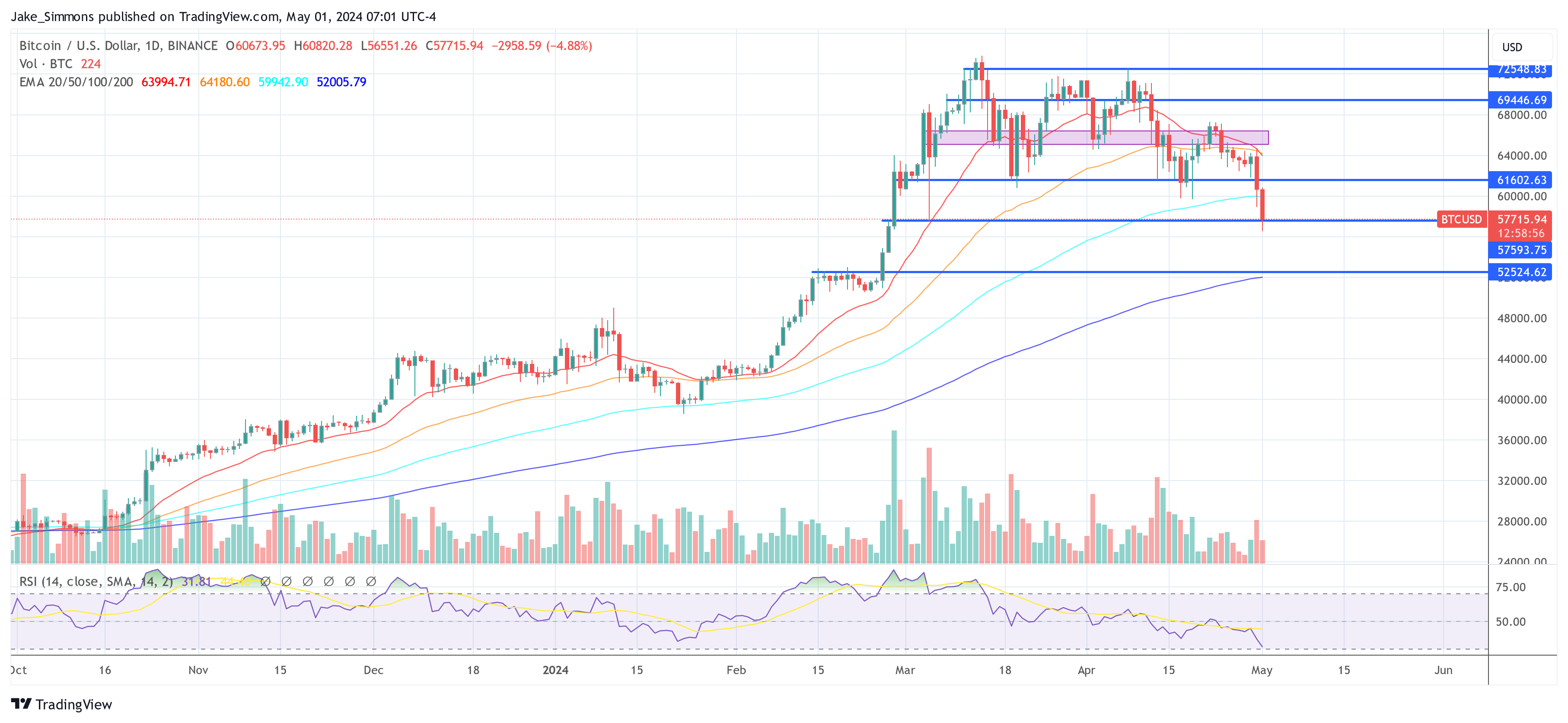

Bitcoin (BTC) has taken a hit, dropping to $56,556 on Wednesday morning in Europe. This is the lowest point since late February. The downturn is the sharpest monthly decline since November 2022, with BTC falling about 7.5% in the last 24 hours.

Reasons for the Dip

1. Anxiety Before FOMC Meeting

Investors are anxious about the Federal Open Market Committee (FOMC) meeting today, where interest rate decisions will be announced. The crypto market, especially Bitcoin, is sensitive to macroeconomic signals. Recent data shows a slowdown in GDP growth and persistent inflation, which has lowered expectations of interest rate cuts by the Federal Reserve.

2. Cyclical Correction

After a strong rally since the start of the year, the market is going through a natural correction. Before the price crash, Charles Edwards of Capriole Investments noted that Bitcoin had gone a record number of days without a significant dip.

3. Profit-Taking

Traditional finance markets and experienced investors are taking profits after substantial gains. CME Open Interest, a measure of open contracts in Bitcoin futures, has decreased rapidly. This indicates that investors are reducing their long positions and taking profits.

4. ETF Flows and Hong Kong Disappointment

Spot Bitcoin ETFs in the US have seen significant outflows, indicating a cooling investor sentiment. Grayscale Bitcoin Trust (GBTC) experienced outflows of $93.2 million. In Hong Kong, the debut of Bitcoin ETFs also fell short of expectations, with trading volumes well below the anticipated $100 million.

5. Long Liquidations

The market has seen substantial long liquidations, with a total of $451.28 million liquidated in the last 24 hours. Bitcoin-specific liquidations totaled $143.04 million, amplifying the selling pressure on BTC.