Lawsuit Sparks Debate

Consensys, a blockchain software company, has sued the SEC, claiming that Ethereum (ETH) is not a security. This has raised questions about the SEC’s regulatory approach to cryptocurrencies.

Consensys’ Unrealistic Demands

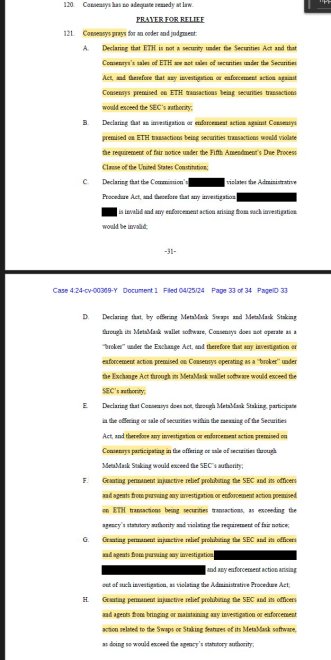

Consensys is asking the court to declare that:

- ETH is not a security.

- Any SEC investigation or enforcement related to ETH transactions being classified as securities would be unlawful.

- Any action against Consensys based on its MetaMask wallet being considered a “broker” would be outside the SEC’s authority.

- The SEC cannot pursue any investigations or enforcement actions related to MetaMask’s Staking Swap feature.

According to some crypto experts, these demands are highly unlikely to be granted.

Unclear Regulatory Framework

The SEC’s classification of cryptocurrencies has been inconsistent. Under former SEC Chair Jay Clayton, ETH was not considered a security. However, recent reports suggest that the SEC now views ETH as an “unregistered security.”

SEC’s Secrecy and Misleading Statements

The SEC has been investigating ETH’s status with “unusual secrecy” since March 2023. The agency’s Chairman, Gary Gensler, has been accused of misleading Congress about the classification of ETH.

Implications of an Adverse Ruling

An adverse ruling against Consensys would: