Institutional Demand on the Rise

The launch of Spot Bitcoin ETFs has fueled institutional demand for Bitcoin. ETF issuers have been accumulating BTC, now holding a significant 4.27% of the total supply. This has created a new category of whale addresses on the Bitcoin network.

Leading ETFs Dominate

BlackRock’s IBIT and Fidelity’s FBTC ETFs are leading the pack, holding a combined 405,749 BTC. This influx of institutional money has driven Bitcoin’s price to new highs.

Temporary Price Dip

Despite the institutional support, Bitcoin recently experienced a drop to $61,000 due to tensions between Iran and Israel. However, analysts believe this dip is temporary and the cryptocurrency is recovering.

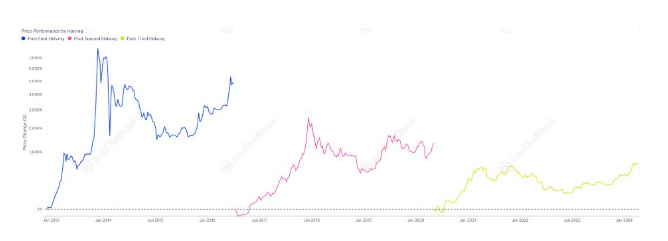

Halving Dynamics Shift

The upcoming Bitcoin halving is expected to further support price increases. Unlike previous halvings, there is now a new source of demand from the institutional sector through Spot Bitcoin ETFs. This could lead to a significant surge in Bitcoin’s price, potentially exceeding $100,000.