The Halving and Its Impact on Mining

The Bitcoin halving is an event that occurs every four years, where the reward for mining a block is cut in half. This reduces the supply of new Bitcoins entering circulation, which can impact the value of the cryptocurrency.

Mining Costs Post-Halving

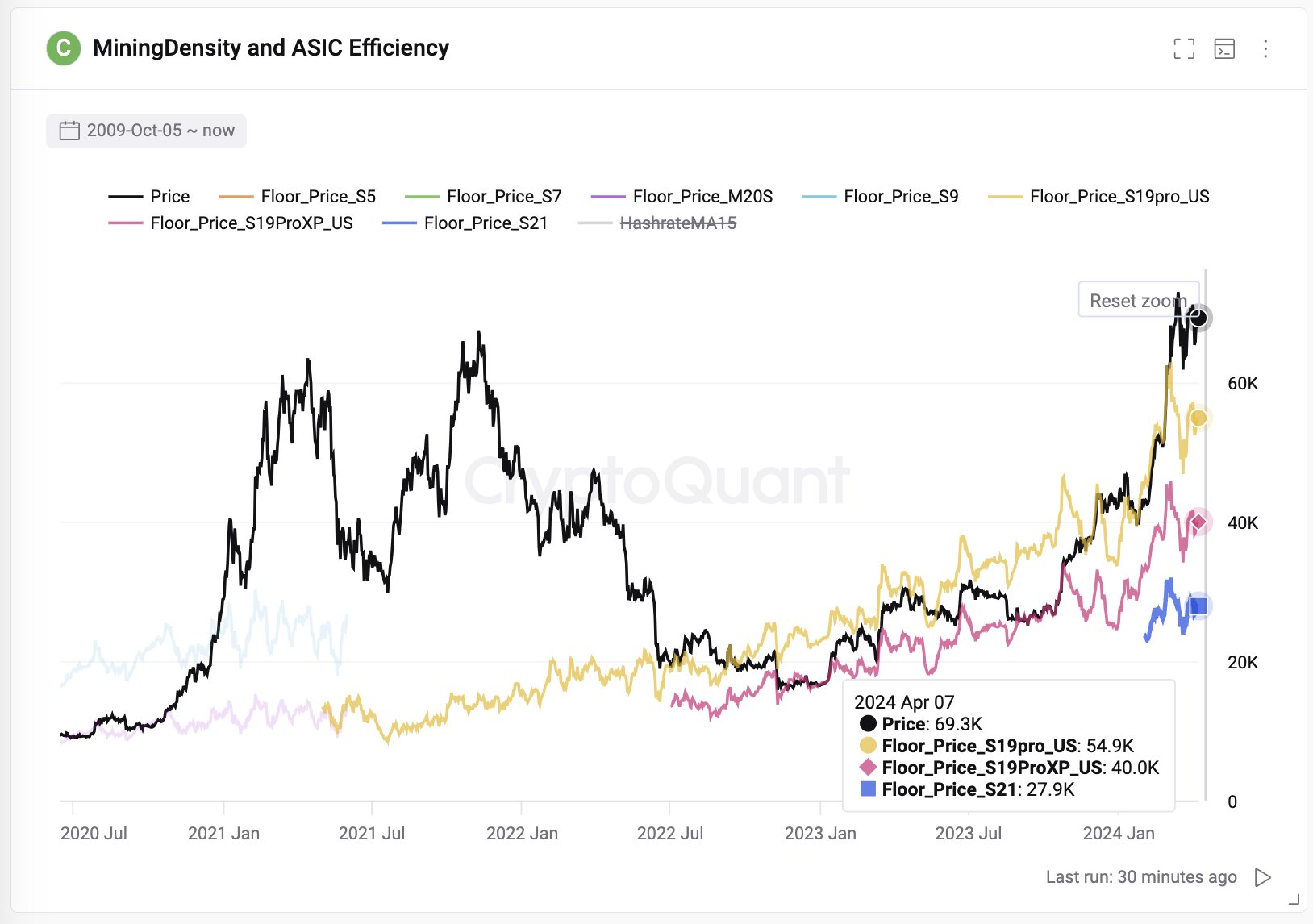

With the halving approaching, mining costs are expected to change significantly. Here’s a breakdown of the estimated floor prices for popular mining rigs:

- Antminer S19: $54,900 (currently) -> $109,800 (post-halving)

- Antminer S19 XP: $40,000 (currently) -> $80,000 (post-halving)

- Antminer S21: $27,900 (currently) -> $55,800 (post-halving)

Implications for Miners

The halving will make it more expensive for miners to operate. Those using the S19 and S19 XP rigs may face losses, while S21 miners may still remain profitable.

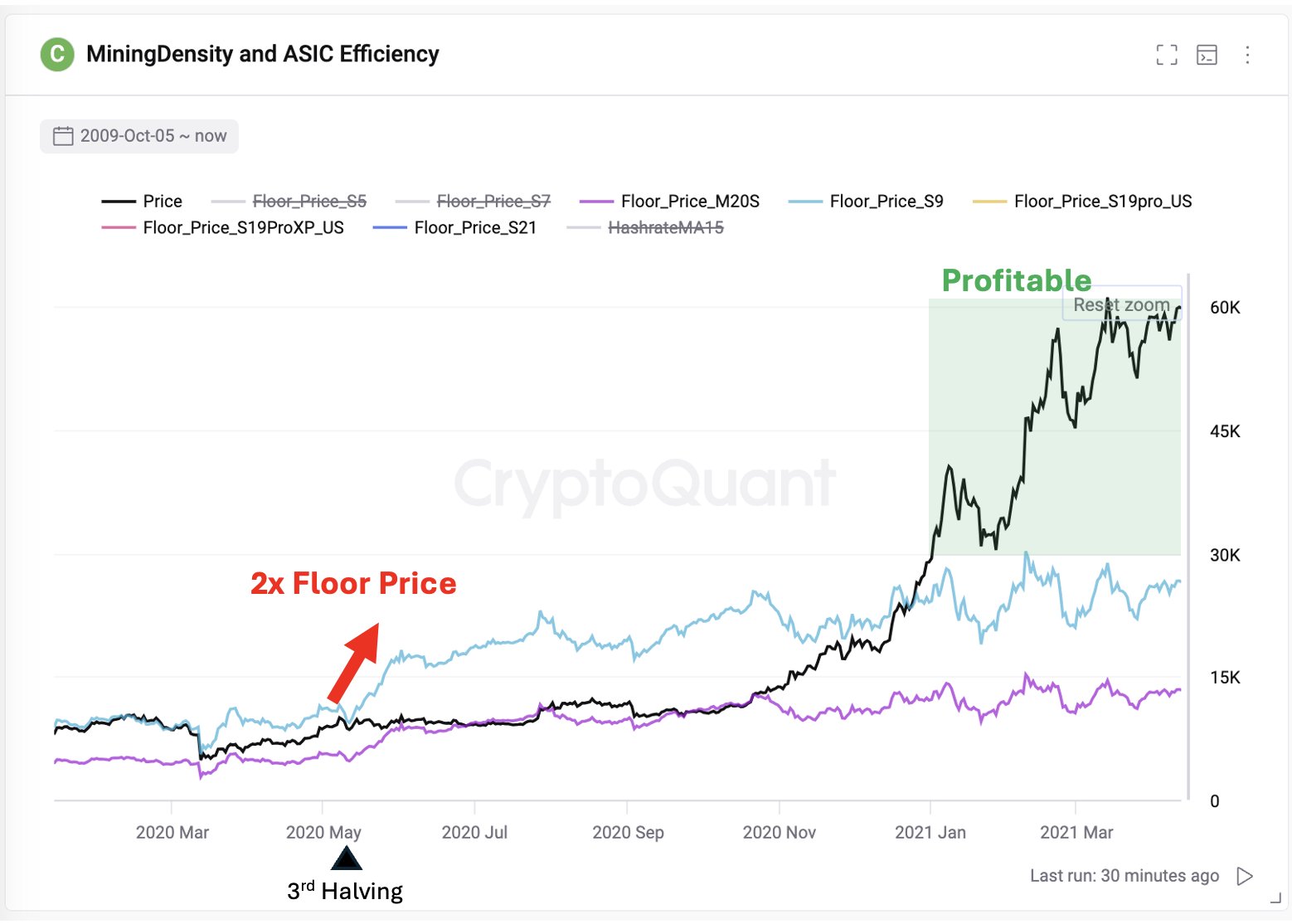

Historical Context

Similar situations have occurred in the past. After the 2020 halving, S9 miners experienced a period of unprofitability. However, the bull market eventually drove up the price of Bitcoin, offsetting the reduced rewards.

Current Market Conditions

Currently, Bitcoin is in a bull run. This means that even with the halving, miners may still be able to profit. A modest 11% increase in the price of Bitcoin from its current level would make the S19 Pro miners profitable again.

Conclusion

The Bitcoin halving will impact mining costs, but it’s not necessarily a death knell for miners. With the current bull market, it’s possible that miners can still remain profitable despite the reduced rewards.